Good morning 👋

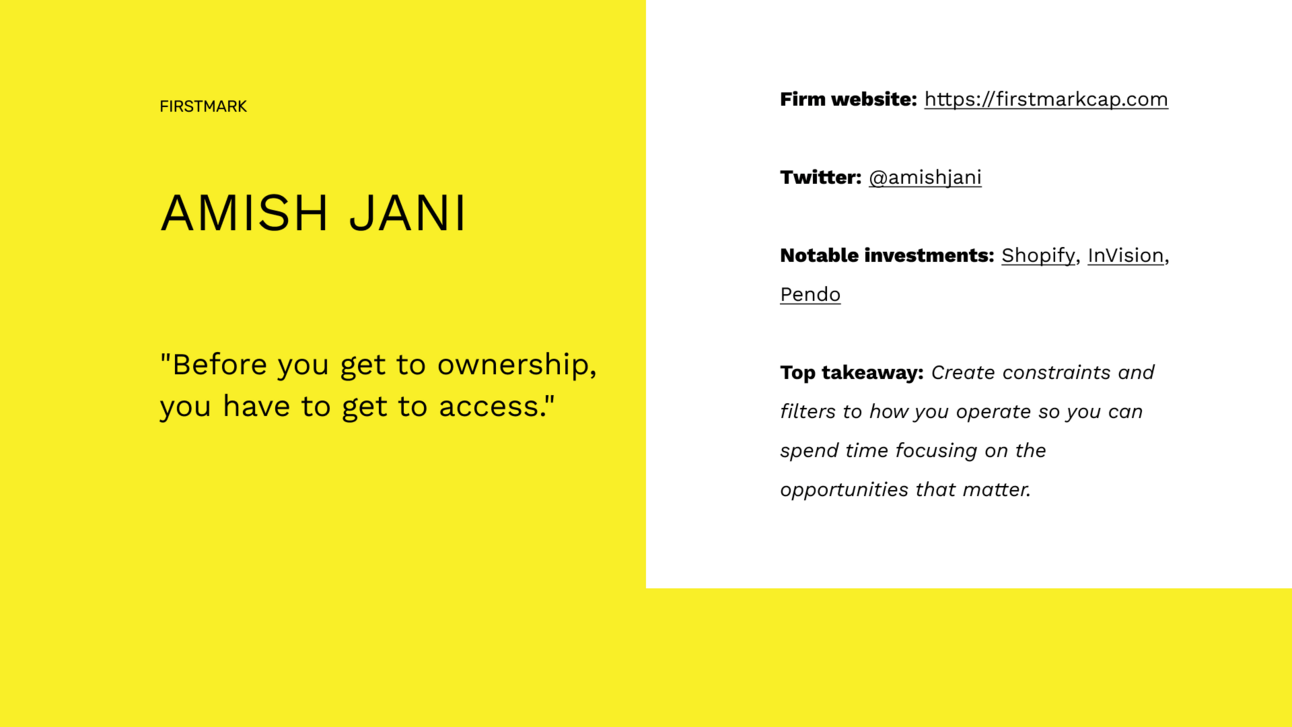

This week’s deep dive is on Amish Jani, founder and partner at FirstMark.

He is based in New York, and FirstMark has become one of the elite funds based in the Big Apple.

Amish relatively reserved, and he doesn’t do as many media appearances as some of the other investors we have profiled. When he does talk, people listen.

Here are some of our favorite lessons, quotes, and additional reading from studying Amish.

Read the full post below, and explore all investor deep dives here.

Lessons

Bad markets set a state of constraints. This creates an environment of separation for certain companies.

Everybody knows that entrepreneurship is the driver of economic upside. Creating more access to capital and opportunities will continue to be an overarching theme as long as leaders pursue economic growth.

VC math only works if your ownership works. The odds say that 50% of your portfolio will return nothing. To make up for these losses, you need significant ownership in your winners.

If you become the lead or largest shareholder, your decision to follow on becomes more scrutinized. Nobody cares if a smaller check follows on, but there is signalling risk when the lead doesn’t exercise pro rata.

Understand what drives economics for your fund. This is a different answer for different fund sizes. The more time you spend focusing on the drivers that matter, the better odds you outperform.

Identify why entrepreneurs are solving the problem. This will filter out opportunists from those that have conviction around the issue. This should be one of the first exercises you do when evaluating a company.

Your personal risk profile is a byproduct of your first market cycle. Those that start their career in bull markets have a different perspective than those who start during a downturn.

No VC will ever admit they are not writing checks. It’s literally their job to constantly be looking for deals, and LPs are paying them a management fee to do so. Behind closed doors, the story is often different than what it portrayed.

Quotes

"Whatever your strategy is, be clear about it because it prevents you from wasting time on the noise."

"Before you get to ownership, you have to get to access."

“Venture investments are about evidencing enough ROI to overcome inertia.”

Together with the Ultimate VC Resource Library

One Place to Learn the Different Parts of Venture Capital

We started our careers in venture. After about a week, we had a realization.

We had no idea what we were doing.

Turns out, we weren’t alone.

Junior VCs don’t get training. You’re forced to figure it out on your own.

Learning the rules, tools, and players takes FOREVER to learn. That’s why we made the ultimate VC resource library to speed up the learning curve.

Reading

How'd we do this week?

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.