Good morning 👋

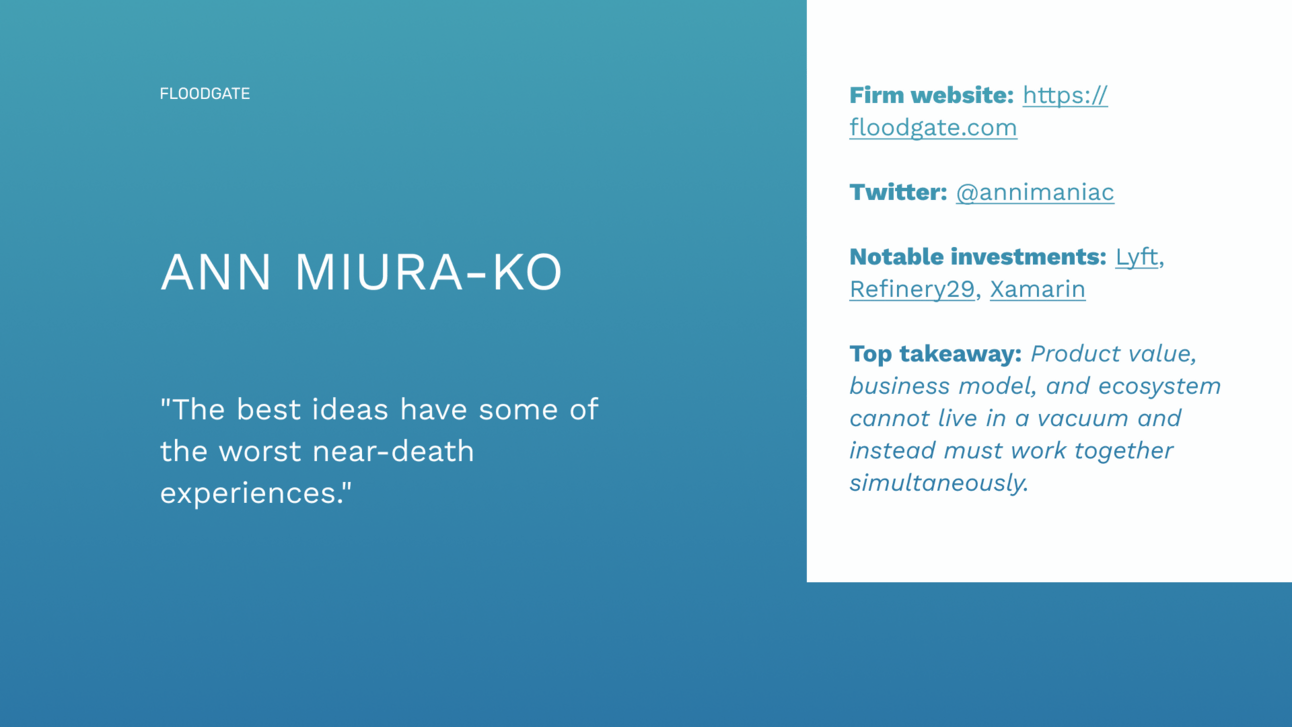

This week we studied Ann Miura-Ko (@annimaniac), Co-Founding Partner at Floodgate.

She helped started the fund back in 2008 and is responsible for investments in Lyft, Refinery29, Xamarin, and several others. She is considered one of the better pre-seed / seed investors, and she has helped build Floodgate into one of the most respected funds in the world.

Here are some of our favorite lessons, quotes, and additional reading from studying Ann.

Read the full post below, and explore all investor deep dives here.

Lessons

You cannot convince yourself to be passionate in a space. You either are or you are not.

Product value, business model, and ecosystem cannot live in a vacuum and instead must work together simultaneously. Your business is not operating at 100% efficiency if any of these three areas live in a silo.

Find technical or societal shifts that cause inflection points. Start noticing trendlines so you can better predict where the world is going.

Ideas don’t mean much. Startups only work if you can build an ecosystem around it.

Invest in people that are genetically wired differently. Some of the best teams look like an island of misfit toys to outsiders. You want to hire people that are capable of thinking outside the box.

Your business model is you company’s backbone. Pick the wrong business model, and your company is doomed from the start.

Founding teams must deeply understand both the product and the marketing around that product. Understanding one without the other equals frustration.

Technical risk is easier to predict than market risk. Timing adoption is incredibly hard.

Focus on the metrics that matter. Don’t showcase hockey stick in areas that don’t matter to the business.

Quotes

"The best ideas have some of the worst near-death experiences."

"Founders must develop insights and customers before focusing on growth."

"Features, however, aren’t the product — they’re merely enablers of value propositions: promises of how the product will drastically improve a customer’s life."

"Even if a product is valuable to one group, failing to consider the behavior of another could kill the product."

"Each industry has its own nuances. Ignore them at your own peril."

"If you run out of iterations, you don't have hope anymore."

"If a lot of people care and a lot of people care enough to pay for it, that's what a market ultimately is."

Together with the Ultimate VC Resource Library

One Place to Learn the Different Parts of Venture Capital

We started our careers in venture. After about a week, we had a realization.

We had no idea what we were doing.

Turns out, we weren’t alone.

Junior VCs don’t get training. You’re forced to figure it out on your own.

Learning the rules, tools, and players takes FOREVER to learn. That’s why we made the ultimate VC resource library to speed up the learning curve.

Reading

The #1 venture community

Join 1,831 other investors

How'd we do this week?

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.