What’s up 👋

It’s Clay.

I’m back in Austin and it’s 106 degrees. Reminder: a tan is earned, not given.

Here’s what happened in venture over the past week.

If you think we’re right, wrong, or way wrong on any of the stories this week, let us know in the comment section at the bottom of this email.

This week's episode is brought to you by … Confluence.VC Recruiting.

Hiring VCs is no fun.

Actually, it’s a nightmare.

We run the investor hiring process from start-to-finish, and we help funds find, vet, and hire from the top community of venture talent.

Let’s get into this week’s piece.

This Week in Venture

beehiiv raises their Series A 🐝

beehiiv raised a $12.5m Series A led by Lightspeed last week.

We usually don’t cover financing events like this, but we’re doing it for their team because beehiiv is the best product we use.

Why it matters: Substack re-opened people’s eyes to how big the newsletter industry is. beehiiv just made it more clear with a best-in-class product and customer experience.

The company has only been around for 18 months. Here’s what they’ve accomplished in that time frame:

Thousands of newsletters hosted on the platform

Currently sending ¼ billion emails per month on behalf of their writers

Used by some of the biggest newsletters in the world including The Boston Globe, Milk Road, Cult of Mac, TheFutureParty, Overtime Sports, Exec Sum, Superhuman

$4m annual revenue run rate through subscriptions

Projecting $12m annual revenue run rate by EOY to include other revenue lines

42% CMGR

$0 spend on paid acquisition over the first 12 months

What happens next: beehiiv’s next act is to become a major player in the advertising industry.

Newsletter advertising has some of the best ROAS of any marketing channel, but brands have a hard time finding niche publishers and figuring out ways to work with them without sacrificing quality. As somebody that has dealt with brand sponsorships over the past three years of writing this newsletters, I can comfortably say that going back-and-forth with sponsors is one of my least favorite parts of the job.

Luckily, beehiiv has a plan to fix that and bring in more money for brands and writers using beehiiv.

They have already launched a two-sided marketplace through their Ad Network, and we are guessing that this will become a bigger emphasis for the company going forward. We have used this (actually have an advertising request in our inbox right now), and it’s a game changer for small content teams that don’t have the bandwidth to do outbound ad sales all day long. (Here’s a shameless plug for our partner page in case any of you are looking to advertise with Confluence.)

Our luck started multiplying the more we shared on the internet. We think that email is the most valuable form of follower, but we recommend you create on the channel that feels most natural to you.

If you’re thinking about starting a newsletter, you’re crazy if you don’t go with beehiiv.

Read more: beehiiv Review, beehiiv Feature Breakdowns

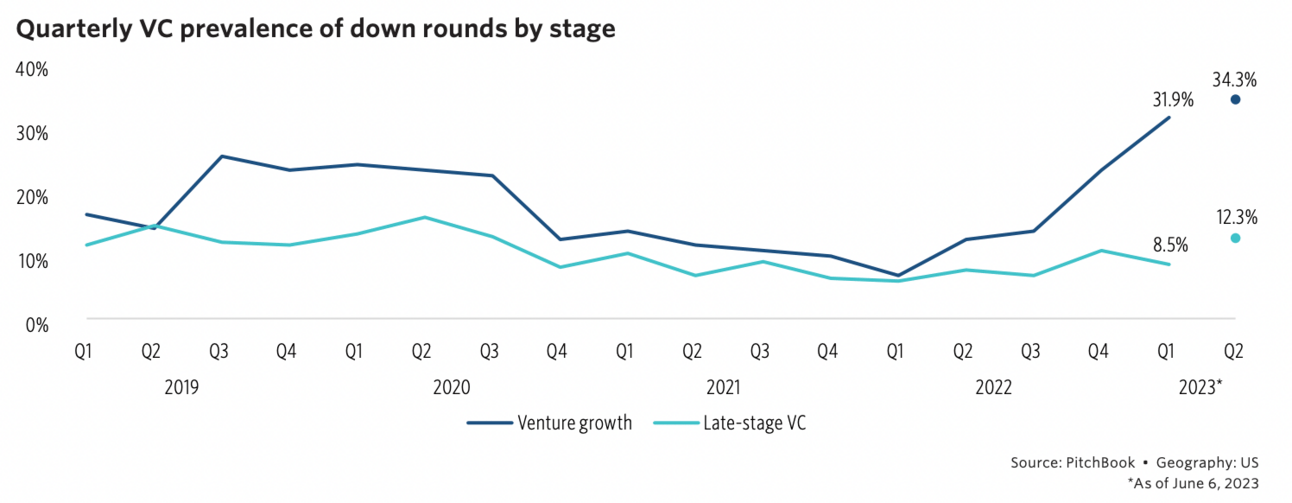

Series C + D companies are hurting 🤕

Pitchbook released their US VC outlook for the second half of the year.

The results weren’t pretty.

According to their research, Series C + D companies are in the most trouble, and these companies will be forced into the most down rounds over the next six months. The capital supply isn’t there anymore, and now the demand side of the equation is being forced to change

Why it matters: Price sensitivity has returned, hype investing is over, and founders are having to justify their latest 2019-2021 valuations. If they aren’t able to do that, investors dictate the fundraise.

Down rounds suck for everybody involved.

Founders are diluted. Employees are diluted. ESOP become worth less. Investors lose interest in the company because momentum has slowed down.

Down rounds hurt at the earliest stages, but the ramifications are larger at the growth stages. That’s what’s happening right now for a lot of Series B, C, and D companies that aren’t able to grow into their valuations.

Maybe that means downsizing. Maybe it means a down round. Maybe it means starting over with a new management team. All of these options are on the table, and they’re being used more aggressively by investors on the cap table.

What happens next: All of capital markets are hurting right now, but some parts are hurting more than others. Late stage venture is hurting more than others, and there will be spillover effects as all of this takes place.

If you’re an investor, it’s time to be more aggressive with terms and pricing. If a company raised at a massive valuations two years ago and can’t justify that, you’re not doing them any favors by extending a lifeline through a bridge round. These businesses need a reset and a return to normal pricing. It hurts in the short-run, but it’s the right thing to do over the long-run.

If you’re a founder at a Seed or Series A company, you should be thinking through your future fundraising plans today. There is no benefit to accepting a larger valuation today if you aren’t able to justify it in 18-24 months. If you need help on valuation trends, Cooley puts together good data on what they are seeing.

If you’re an employee at a venture-backed company, you should start thinking through a backup plan. Not to be all doom-and-gloom, but you don’t want to have your name added to this list.

Links We Like

🏰 The New New Moats: Jerry Chen from Greylock details why systems intelligence are the next defensible business model

🔦 Programmatic SEO 101: How Failory gets tens of thousands of search visitors every month

🧠 50 Ideas That Shaped My Thinking: David Perell’s ideas

🥇 EarlyUserGrowth.com: How some of the best companies got their first users

⨏ The Age of Average: The downsides of blending ideas and trying to fit in

💡 Lessons from Albert Wenger: 10 lessons and six quotes from the managing partner at USV

🧾 VC Checklist Guide: 74 Items Investors will expect in a data room

Have an article you like that we should include in this section? Let us know by responding to this email or sharing a link in this Slack channel.

What We’re Learning

Cleaning up the landing page

We spent some time over the weekend auditing our landing page. It wasn’t up-to-par with what we wanted, so we made some changes.

It’s become harder to compress our message as we’ve expanded the number of offerings. Our old landing page tried to simplify everything down, but we have lost a number of first-time visitors because we didn’t do a good job of explaining the different ways we could help them.

If you check our page now, it includes the same message above the fold, but we’ve sectioned off different areas below the fold.

Now the landing page gives more detail on what Confluence members get access to, it showcases our digital products, job board, talent collective, and some of the most popular content from our blog, and it has an email capture form at the bottom of the page.

We’re curious to get your feedback so shoot us a note or comment at the bottom if there is anything you love or hate about the new design.

Tools: Wordpress

VC Jobs

127 roles in VC and growth equity

Finding VC jobs is hard. We try to make it a little easier.

Search for the jobs you want, and subscribe to get email alerts based on your preferences.

Want to stay up-to-date on these roles? Sign up here.

Want to post a role on the board? Do that here.

Tweet of the Week

Stop complicating it

Free money propping up startups made for a lot of bad business advice. Keep it simple, return to the fundamentals, avoid people obsessed with overcomplicating it.

Member of the Week

David Endler (General Partner @ Runtime Ventures)

How'd we do this week?

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.