Good morning 👋

This week’s deep dive is on Bill Gurley (@bgurley). Bill is the legendary General Partner at Benchmark, a position he has held for the last 20+ years.

He is responsible for their Uber investment, and he is widely considered one of the best VCs to have ever lived.

Here are 17 of our favorite takeaways from studying Bill and his investment philosophy.

Explore all investor deep dives here.

LESSONS

If you are going to focus on one thing, focus on conversion rates. You can spend all of your money getting people to check out your offer, but if nobody converts, that means your offer sucks.

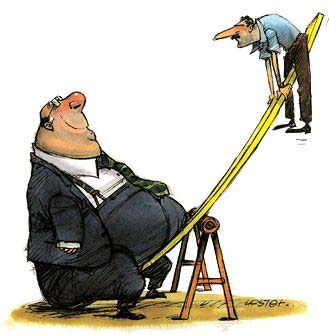

Expansion isn’t always a good thing. Especially on the investing side, we have seen more and more funds build out international expansion while Benchmark has stayed consistent. During the bull run, people thought they were dumb for leaving money on the table; during the current bear market, people saw their brilliance for not copying what everybody else was doing.

Acknowledge luck. People who acknowledge the role of luck in life are as a rule far more humble and less susceptible to mistakes caused by hubris.

If you can’t learn from your mistakes, you can’t make it as an investor. Investing is a game that should get easier with age, but that only applies if you are able to learn from the errors you made when you were younger.

The problem with more dollars in private markets: more VCs = more venture-backed competitors = more cutthroat behavior = suppressed returns for companies and shareholders.

Truly great products are bought, not sold. If you want to look for companies with this phenomenon, look at their top-line revenue and compare it to their marketing budget.

A true marketplace needs a natural pull on both the consumer and supplier side of the market. Missing one side of this equation equals no marketplace.

When evaluating marketplace businesses, high volume + a modest rake = the perfect formula for an organic marketplace with sustainable growth. High rakes add friction for consumers and force suppliers to look elsewhere.

There is a nonlinear relationship between the simplicity of the system you are trying to understand and your ability to make bets that can generate alpha. The simplest system that one can work at understanding is an individual company.

QUOTES

“Being ‘right’ doesn’t lead to superior performance if the consensus forecast is also right.”

"It is imperative to understand ways in which a smaller private company can gain the upper hand on a large incumbent. One of the most successful ways to do this is to change the rules of the game in such a way that the incumbent would need to abandon or destroy its core business in order to lay chase to your strategy."

“If you can’t sell, venture capital is not a good industry to be in.”

“The collective venture community needs to get its head around the new reality as fast as possible. The more people see what’s really going on, the quicker that will happen.”

“The number-one risk of being outside the Valley was always, ‘Can I get the executive talent?’ You could always get programmers. You could always get customer support people. Now, with hybrid, maybe you can get the executive talent, too.”

“Pick a profession in which you have a deep, personal interest. There’s nothing that’s going to make you be more successful than if you love doing what you’re doing because you’re going to work harder than anybody else because it’s going to feel like work. It’s going to feel like fun.”

“All the great investors I’ve ever studied have felt macroeconomics is one of the silliest wastes of time possible.”

“The minute you set a very hard rule, you might be setting yourself up for a mistake. And venture, I have found, is a world where that happens frequently.”

Together with the Ultimate VC Resource Library

Your cheat code to learning the VC game 📶

We started our careers in venture. After about a week, we had a realization.

We had no idea what we were doing.

Turns out, we weren’t alone.

Junior VCs don’t get training. You’re forced to figure it out on your own.

Learning the rules, tools, and players takes FOREVER to learn. That’s why we made the ultimate VC resource library to speed up the learning curve.

READING

PREMIUM

The venture community that pays for itself 💲

Everyone’s experienced membership regret. That feeling when you see money leave your account knowing it could have been better spent? 🤮 Horrible.

What if there was a community that could pay for itself by connecting you overnight with thousands of other venture and growth equity investors?

Confluence.VC does just that. It’s application-only, and every new member is a vetted member of the VC ecosystem. Once inside, members get access to a knowledge library, member directory, Slack group, and private deal flow with hundreds of investment memos.

The best part? The basic membership is free (as long as you’re approved), and the premium plan offers a 30-day free trial.

Sooo … what are you waiting for?

How'd we do this week?

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

P.S. We’re running our fourth annual VC comp survey.

If you work full-time in venture, growth equity, or private equity, this is a chance to let us know how you’re compensated, and we’ll let you know if you’re over / underpaid.