Good morning and happy early Easter 👋

We got good feedback on the last one of these, so we’re going to start covering the news.

The goal of these newsletters is simple: aggregate the news, cover what actually matters, and give our two cents on each of the biggest venture stories over the past week.

If you think we’re right, wrong, way wrong on any of the stories this week, let us know in the comment section.

This week's episode is brought to you by … Confluence.VC Recruiting.

Let’s be honest. Hiring investors SUCKS.

You blast out a JD you copied from other online postings, get flooded with applications from unqualified candidates through LinkedIn, and you’re left filtering through a stack of trash hoping to find a gold nugget.

Hope is not a strategy, and this is not how great teams are built.

We run the investor hiring process from start-to-finish, and we help funds find, vet, and hire from the top community of venture talent. No more trash digging; gold just shows up at your door.

Let’s get into this week’s piece.

This Week in Venture

Climate tech funding falls off a cliff 📉

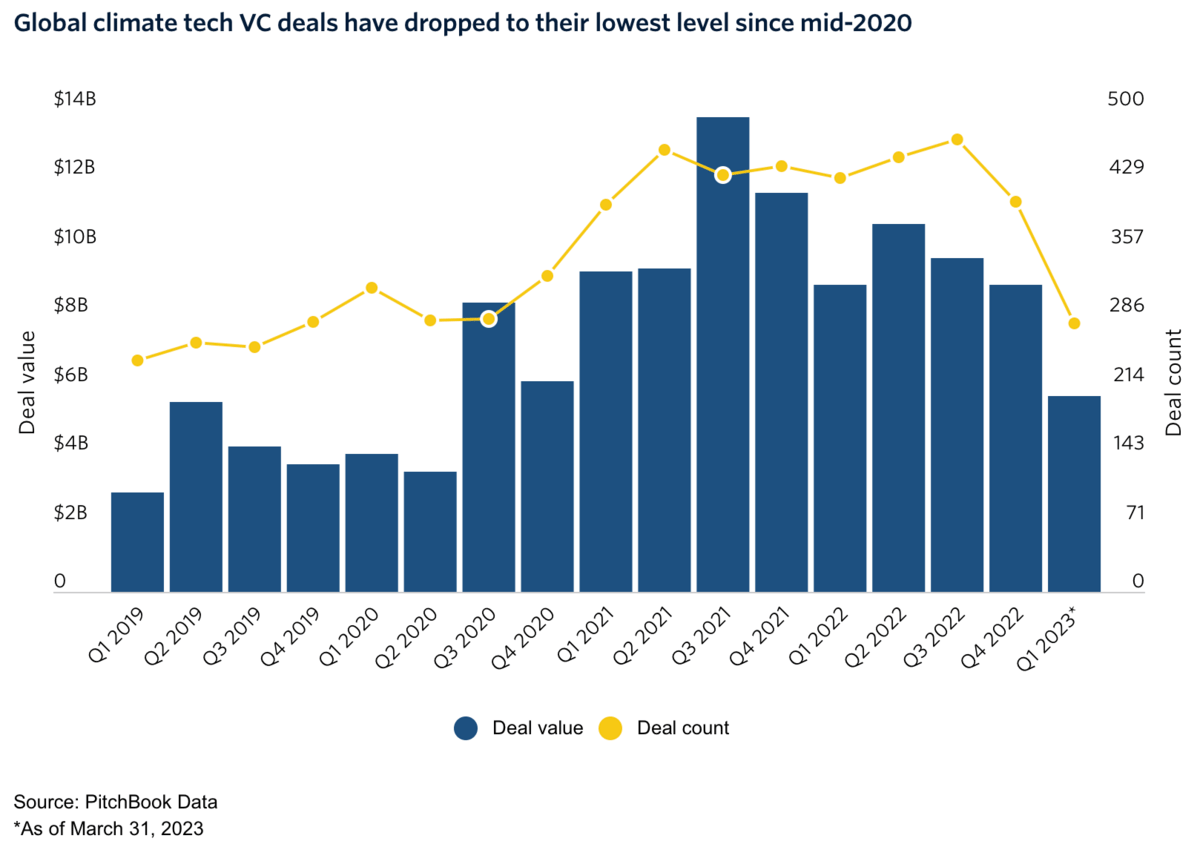

The climate tech boom looks to be coming to an end.

Just a year ago, roughly 25% of venture funding went into climate deals. Fast forward to today, and climate funding is now at a three-year low with no signs to reverse the trend.

Why it matters: According to Pitchbook, there were 6,826 climate-focused private funds over the past two years. Many of these funds operate within a four year investment period, and there are 2-3 years left to deploy that capital.

If deal pacing is slowing (which is definitely is according to the chart above), then funds can either sit on committed capital or chase non-existent deals. Limited partners (especially those that have not invested within climate tech funds before) will want to see how their money is being spent, and if no progress is being made, they will start to have more questions.

What happens next: Climate tech has been one of the few funding bright spots when the rest of the market has been down over the past year. Despite this, a lot of seasoned investors squirm when they hear “climate tech” because of what happened last time there was a funding boom in the space.

Climate Tech 1.0 was largely a failure and resulted in billions of dollars being burned on fire. People cite different reasons for why this happened, but the main reasons were that funding during this period focused on capital-intensive sectors with poor unit economics combined with investors misjudging how long it would take these companies to develop and scale.

If you talk to climate tech investors today, they will tell you that it is different this time, and investors have learned from prior mistakes.

Capital is already committed to these funds for now, but if deal making continues to be slow, LPs will have to decide if they want to keep their capital parked in these types of funds.

Not a good time to be an insurtech company 🙃

Insurtech companies are HURTING in the public markets right now.

Companies like Clover Health, Doma, Hippo, and Lemonade caught the public eye (and Robinhood day traders) during the bull run. Now they are trading down ~75% YTD as a group.

Why it matters: Insurtech is captured under the “fintech” umbrella, and the majority of funds you talk to will still tell you they are still investing in this category. From a high-level, it’s hard to argue against why.

Financial services are outdated, and consumers want a better experience. That’s what these companies promised.

These companies have figured out the consumer experience side, but they haven’t figured out the business side, and their stock performance indicates that.

Public markets don’t affect VCs, but at the same time, they do. If a category of companies doesn’t perform in the public markets, it changes risk appetite for that sake category of investors in the private markets.

If you were an early-stage VC investing in insurance companies right now, you’d want a company’s valuation to reflect reality. The illiquidity premium shouldn’t exist, and according to public market comps, investors are actually paying a premium to hold onto securities they should get at a discount.

What happens next: We don’t expect VC funding to slow down towards insurtech companies. Too many fintech funds have already raised money, and 515 insurtech companies raised VC dollars last year according to Pitchbook.

There are still good companies out there, but smart VCs will start to question what the exit opportunity can and should look like. If public markets don’t have any appetite for insurtech companies, expect more M&A activity between these types of companies and major carriers that want to improve their customer experience.

Italy bans ChatGPT 🚫

Italy joined a list of countries that have banned ChatGPT.

The country’s data protection authority raised flags around a lack of age verification and how the company is storing Italian citizen data, and the ban went into effect earlier this week.

OpenAI has three weeks to lay out a solution, or else they’ll face a $22 million fine from the Italian government.

Why it matters: “If it’s free, you are the product” is conventional wisdom in the tech world, and the rest of the world is starting to wake up to this as countries and business leaders are starting to push for a development pause of sophisticated AI projects.

Business leaders are worried about the potential power of this type of technology. Government leaders are worried about the effect on their citizens.

In one scenario, leaders only have to worry about data privacy risks. In another scenario, they have to worry about a lack of available white collar jobs due to ChatGPT.

What happens next: Business and government will be forced to take a side for or against generative AI, and which side they choose will be driven by incentives.

If you believe that ChatGPT and other similar generative AI companies can increase productivity while ALSO positively affecting the lives of employees and citizens, you will support it. If you don’t believe that generative can deliver on both of those fronts, you should be against it.

We believe this type of technology will eventually impact millions of white collar jobs, but the speed at which this impact will take place has been overexaggerated.

Large companies would need to move fast in order for millions of white collar jobs to disappear overnight, and everybody knows that isn’t the case. Bureaucratic decision-making will make generative AI complementary to many roles before it comes a serious threat at replacing them.

If leaders want to encourage technology adoption while also looking out for their people, they should invest more into up-skilling and giving workers and citizens the tools they need to adapt.

Links We Like

😖 The Difficulty Ratio: How SaaS companies justify the work needed to close a new deal

📈 Product-Led Marketing Playbook: How to get users for $0 CAC

🔮 Lessons Learned From 3,000 SaaS Companies: Patrick Campbell of Profitwell covers his biggest takeaways

👷♂️ Site Structure for Service Businesses: How to set up a service website to maximize conversions and revenue

🤷♂️ The Upside and Downside Case for ChatGPT: Understand both cases before assuming what the future will look like

🗞 Richard Patey launched a course on the business of newsletters

Have an article you like that we should include in this section? Let us know by responding to this email.

What We’re Learning

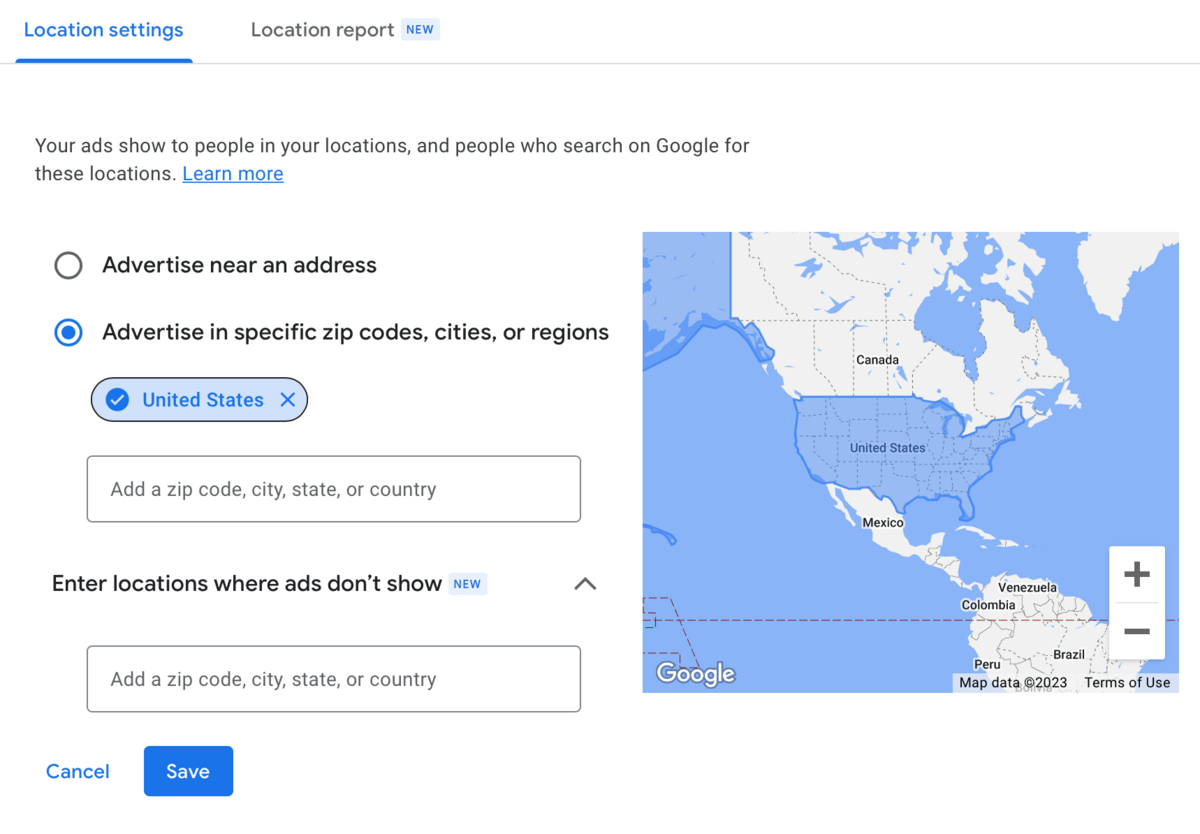

Running location-specific Google Ad campaigns

We’ve relied on word-of-mouth and this newsletter for growth, but we started to use Google Ads to pour fuel on the fire. Running an effective ad campaign is a game that you can continually optimize.

One idea we’re playing around with is running hyper-targeted ads based on location. The ads we’re testing are for our recruitment service, and firms we are targeting with this campaign are those that are currently hiring.

To test this, we’re doing the extra step of finding the funds’ HQ location and including that zip code in our targeting location for the campaign.

If anybody has experience running Google Ads and has other ideas of how to optimize CPC, let us know in the comments below.

Tools: Google Ads

Tweet of the Week

Declining American values

This is a depressing reality in America. We were already becoming a society that slowly values nothing outside of money, but that has accelerated rapidly since 2019.

Why do you think this is happening, and why do you think it has picked up steam over the past 3-4 years?

Together with Brex

Wait … you guys manage your spend?

Obvious statement alert: managing invoices and team spend is a nightmare.

Chasing down receipts, uploading to a spreadsheet, sending to another team to approve, and reimbursing your employees sounds … super fun.

Brex takes this archaic process from the Stone Ages to the modern era by giving finance teams the tools they need to operate. Dashboards, automations, integrations, and financial modeling instead of manual work that makes you want to reconsider jobs.

Question of the Week

Good IP lawyer recs

This is a good question that will probably start coming up more often with generative AI.

If anybody has a good IP lawyer, shoot us a reply or let us know in the comments.

How'd we do this week?

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.