Good morning👋

I’m writing this from a coffee shop, and a woman just ordered ice cream.

It’s 9am.

Switching gears…

Today we break down a report on VC becoming data-driven, our thoughts on the Newchip bankruptcy announcement, we share the templates we’re using to manage VAs, and we pass along our 8 favorite links since the last episode went out.

If you think we’re right, wrong, way wrong on any of the stories this week, let us know in the comment section.

P.S. We’re running this survey form to help investors tell their story to our audience.

It’s a six-question form, and we’ll share your backstory on our website and in this newsletter once you complete it. Here’s an example of what the published version will look like.

If you want to tell your story to 3,500+ VCs + venture-backed founders, take two minutes to fill in your info here.

(Note: this is only for investors, so if you don’t work in VC or growth equity, please waste your time filling this out.)

This week's episode is brought to you by … Confluence.VC Recruiting.

Let’s be honest. Hiring investors SUCKS.

You blast out a JD you copied from other online postings, get flooded with applications from unqualified candidates through LinkedIn, and you’re left filtering through a stack of trash hoping to find a gold nugget.

Hope is not a strategy, and this is not how great teams are built.

We run the investor hiring process from start-to-finish, and we help funds find, vet, and hire from the top community of venture talent. No more trash digging; gold just shows up at your door.

Let’s get into this week’s piece.

This Week in Venture

Data-driven VC landscape 🔢

Andre Retterath shared a report on data-driven innovation within venture capital last week. The results are eye-opening and will give you a better idea on how the industry is changing and how funds will need to adapt over the next decade if they want to compete.

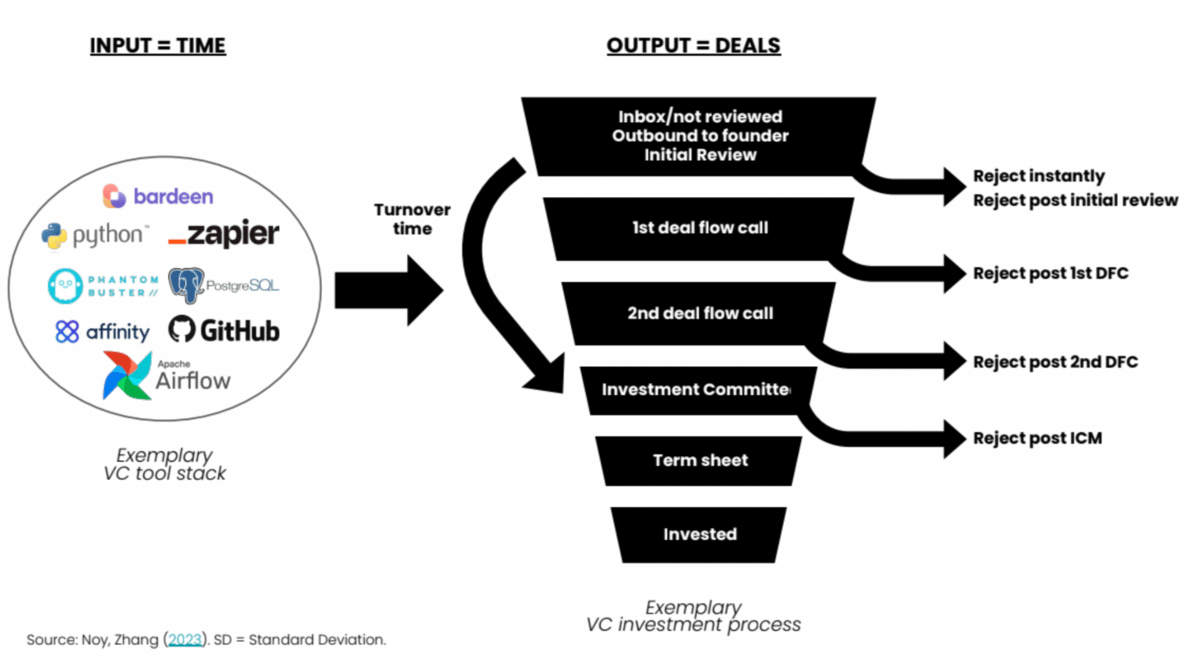

Why it matters: A lot of the info in this report confirms what we’ve seen since building out Confluence: venture is changing, and the game today is all about building more leverage.

VCs are some of the busiest information workers. They are constantly juggling too many things at once, and a lot of the work they do has no tangible output to the outside world (passing on an investment can take up hours of diligence work with nothing to show for it).

Leverage comes in many forms, but for funds, the goal is to give their people tools to 10x their output. In other words, increasing the input-to-output ratio.

The best way to do that?

Adopting a data-driven approach to building, tracking what actually matters (number of quality meetings, time to close, pass rate, etc.), and building systems to optimize those metrics.

What happens next: If you’re worried about AI coming for your job as a VC, you’re probably paranoid (for now).

The report mentions that 84% of global VC firms want to increase their efforts and resources to become more data driven, but only 1% of those same funds have dedicated teams to achieve that goal.

In other words, there’s a lot of talk with a lot less action. However, if you want to think way ahead, here’s what we think happens next.

As funds become more modernized, the org structure changes as a result.

If you’re able to scrape existing databases to make sourcing easier, there becomes less of a need to hire an army of analysts (SDRs).

If you’re able to use software to streamline operations at a fraction of the cost, there becomes less of a need to hire a team of ops people.

We’ve already seen solo GPs shake up pre-seed and seed investing by winning competitive allocations. These GPs have proven you can compete at the highest level without having to break the bank on headcount.

Software has made it easier to build more with less. People forget that applies to all industries including the industry subsidizing most of these software projects.

We expect funds to hire less people, but those that are hired will be more skilled and will come with more leverage.

If you are trying to break into venture (or stick around), you need to build a form of leverage. Don’t try to be like every other junior VC analyst or associate.

Build a community. Learn how to use no-code tools. Get really good at using Zapier. Build an online presence.

Have something to bring to the table, or you won’t have a seat at the table.

Newchip shuts down ⬇️

Newchip Accelerator filed for Chapter 11 bankruptcy in March, but last week the bankruptcy court ordered for the company to be shut down and liquidated.

The accelerator had mixed reviews, and it seems like there was a lot going on under the hood before things went south. Some of the main things that stuck out:

Pay-to-play: Newchip made startups pay to join their cohorts instead of providing capital in exchange for equity. From our understanding, the pitch was that Newchip would take money in exchange for shortening their fundraising cycle.

CEO issues and office culture: We didn’t work there, so we don’t know. That said, the Glassdoor reviews don’t paint a pretty pitcure.

Upside down org structure: Most accelerators have small teams mostly made up of partner / general partner-level folks with one or two junior people to help with sourcing companies for cohorts. Newchip hired hundreds of venture associates because these people acted as their sales team.

If you want a deeper look at what went wrong, read this piece by a former Newchip mentor.

Why it matters: Whether you liked them or hated them, Newchip was one of the larger accelerators in the world.

On their website, they claim to have helped 2,500+ companies raise over $2.25 billion since they launched. Not a small feat.

You can also question how much involvement they played in that fundraising process, but that’s a different discussion.

The real problem with the current situation stems from their structure, and who is actually on the hook here.

Remember, startups payed Newchip to join their cohort in exchange for investor intros and help with fundraising. But what happens when Newchip shuts down and isn’t able to deliver on their end of the bargain?

The startups are the ones holding the bag.

What happens next: The Newchip startups are out of luck, but that’s a given. For other startups, there are a few lessons from this:

1) Don’t pay for a curriculum on how to build a startup. There is better information already online that is free (YC’s Startup School for example).

2) Never pay somebody for the promise of investor intros. Good investors don’t put their reputation on the line by blasting out intro requests for every opportunity that comes into their orbit.

3) Always diligence your investor before deciding to do business together. Investor relationships are like marriages, and you don’t want to skip any important diligence questions before jumping into that relationship. If weird things pop up during that diligence process, you should run. There are literally thousands of other investors out there.

VC Jobs

100+ roles in VC, growth, and private equity

Finding VC jobs is hard. We try to make it a little easier.

Search for the jobs you want, and subscribe to get email alerts based on your preferences.

Want to post a role on the board? Do that here.

Links We Like

➡️ How to Pick a Career (That Actually Fits You): Long piece by Tim Urban on how to actually choose a job, project, or business that works for you

📶 How to Grow a Community to 4,500+ Paying Members With 90% Retention: How Utopia did it

🎰 Use Optionality, Don’t Hoard It: The best things in life come from reducing optionality

📖 16 Best VC Newsletters to Subscribe To: Other places to check out if you like this newsletter

📧 7 Best Newsletter Hosting Tools: What software to use if you want to start a newsletter

📊 10 Best CFO Tools: Our software picks to level up your finance teams

Have an article you like that we should include in this section? Let us know by responding to this email.

What We’re Learning

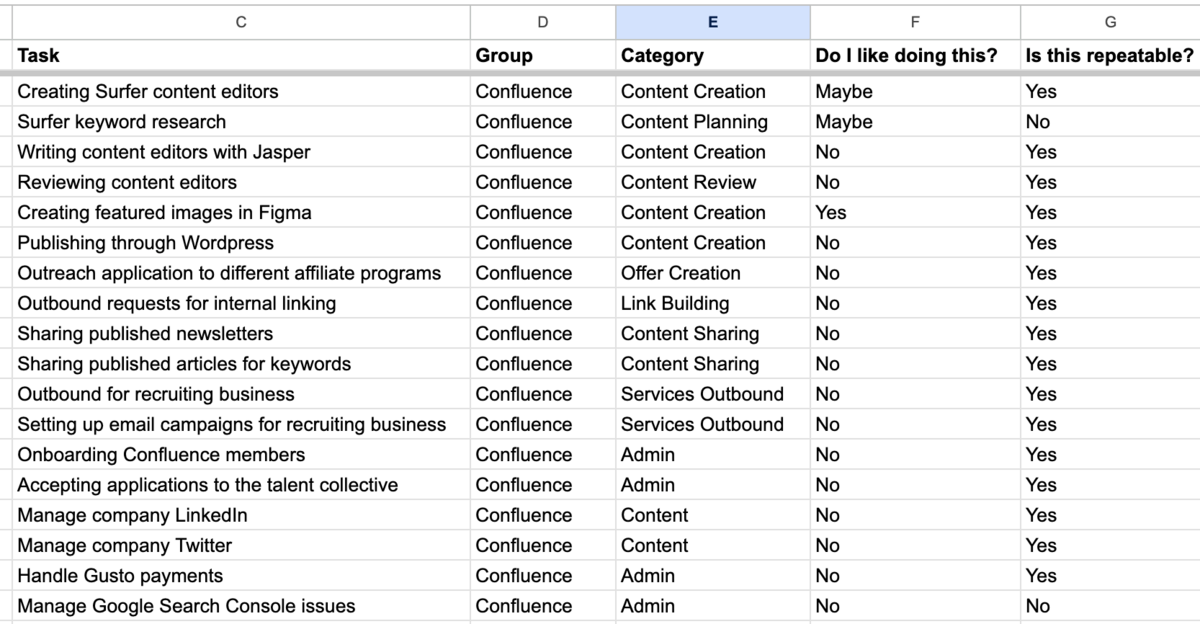

Managing VAs

Repeat after me: Doing admin work is low ROI.

The more valuable you become to your team or your business, the more valuable your time should be valued. If you’re spending your time doing things that can be delegated, you’re limiting your growth.

Enter VAs.

They are the best way to scale your output, but hiring VAs is the easy part. The hard part is training them.

We’re redesigning how we work with VAs, and we’re using this blog post and template from Rahul to do things more effectively.

If anybody has experience working with VAs and has any interest working on a guest post, we’d love to work together and share notes on our process.

Tools: Google Sheets, Upwork, Loom, Notion

Together with Brex

Expense management that doesn’t suck

Chasing down receipts, uploading to a spreadsheet, sending to another team to approve, and reimbursing your employees sounds … super fun.

Brex takes this archaic process from the Stone Ages to the modern era by giving finance teams the tools they need to operate. Dashboards, automations, integrations, and financial modeling instead of manual work that makes you want to reconsider jobs.

Member of the Week

Vishnavi Paruchuri (Investor @ NTTVC)

Want to be next weeks’ member of the week?

How'd we do this week?

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.