Good morning 👋

David Sacks (@DavidSacks) is a former member of the PayPal Mafia and the founding partner of Craft Ventures. He is one of the legendary operators and investors of Silicon Valley, and he has become more of a public voice through being a host on the All-In podcast.

Distilling all of his shared wisdom down to 25 lessons was a challenge, and realistically we could have shared 100 more.

Here are some of our favorite takeaways from studying David and his career.

Explore all investor deep dives here.

LESSONS

Leave your time unstructured so you can fill it with what is most important today. A busy calendar leaves a cluttered mind.

High-margin software businesses have made us bad at operational efficiency. This was said five years ago, and it couldn’t be more true today.

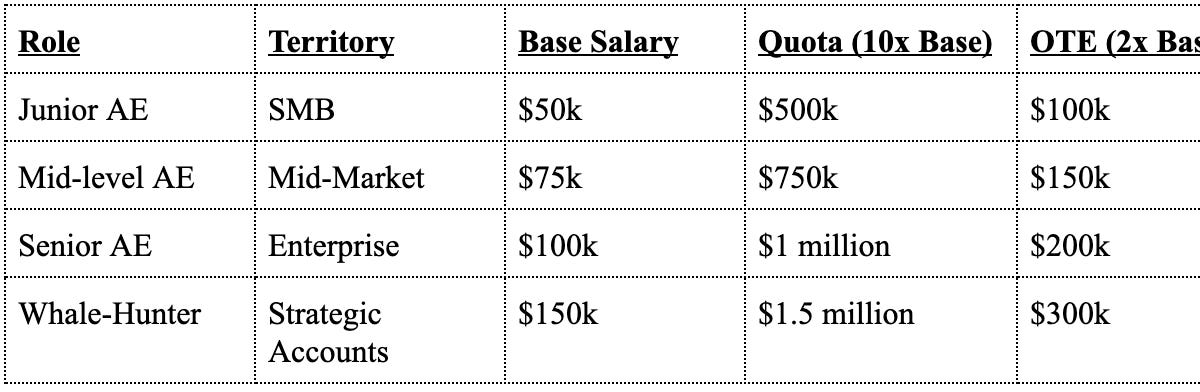

Spend more time on pricing. Most companies underprice their offering, and this results in a death spiral of long sales cycles and terrible CAC:LTV ratios.

Focus on a few killer features for the most desperate customer segment. Solve for the most painful problems before expanding the feature set to more niche ones.

In times of crisis, acknowledge the problem, lay out a plan and required sacrifices, and inspire that the job can be done. Ben Horowitz talks about this too. There is a time for peacetime CEOs, and there is a time for wartime CEOs.

During good times, people are willing to buy vitamins. During a downturn, people shift to buy painkillers.

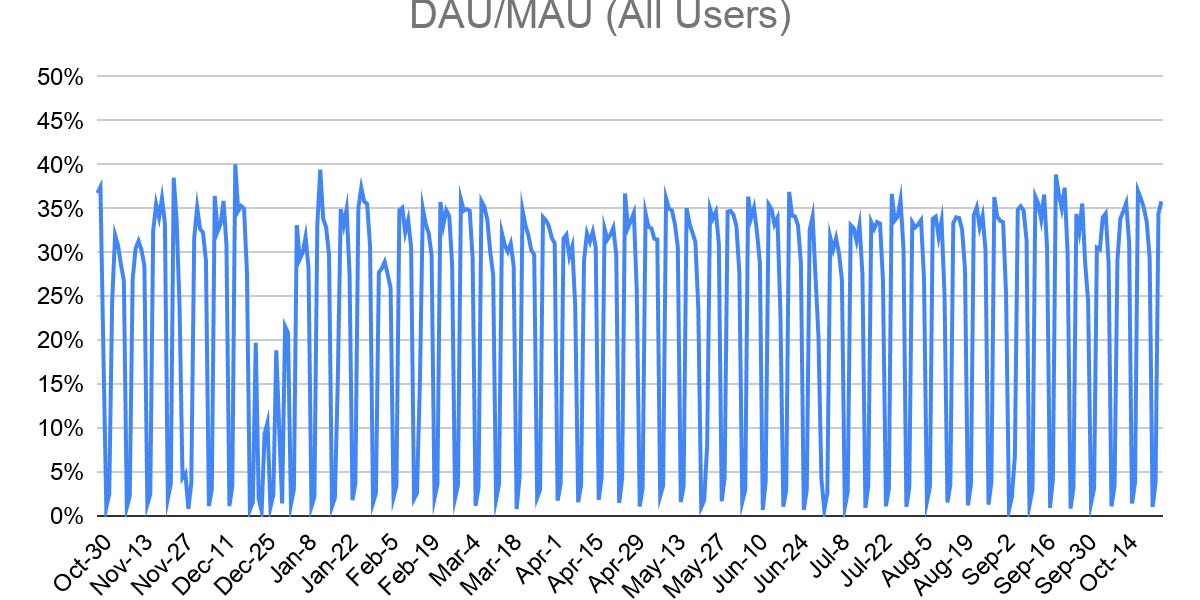

Logo churn is inevitable. Aim for expansion from the accounts that stay with you that exceeds, in dollar terms, the churn from the customers that you’re losing.

Good revenue retention starts at 100%. 130% and above is industry leading.

Founders need to be aggressive enough to set and hit large goals. They should be humble enough to seek out and listen to good advice.

Define the category so that you can shape category requirements to position yourself and de-position competitors. David believes most software markets are still winner-take-most.

New entrants = validation. People don’t try to copy things that don’t work.

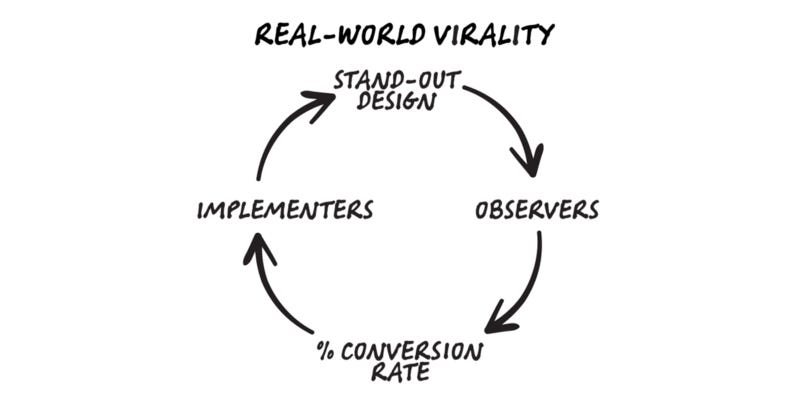

You can’t buy some forms of marketing; you have to earn it. This can be done through brand, messaging, press, influencers, content — anything that defines what the business is.

Start with a product hook to grab users and a distribution trick to find them, pay attention to the organic use of the product to discover the market insight, then lean into that insight to build the company. Startup marketing distilled down to a sentence.

Obsess over engagement and removing friction. There are very few companies that nail these two pieces and don’t ultimately win in the end.

QUOTES

"Ironically, the better the startup is doing, the more chaos there is."

"You have to be comfortable with ambiguity. If you're the type who likes to very carefully weigh 99% of the data before you make a decision, you're not cut out to run a start-up."

"Growth solves many problems at startups; unit economics is not one of them."

"Trying to re-engineer the unit economics or culture of a business that is already operating at massive scale is brutally hard. Searching for the scalable model when you’re already at scale is a contradiction in terms."

"The low end of the market is usually the most under-served part."

"Investors increasingly scrutinize burn and margins during downturns."

"Psychologically speaking, you’re better off burning the boats, so to speak, and saying that failure is not an option, it’s not acceptable, and we will do whatever we have to do to survive and persevere."

"When you start to glorify doing things that don’t scale, you end up with a startup that doesn’t scale, which is kind of the opposite of the whole point."

"The category leader wins the easy sales — the order taking — while also-rans must sell hard to win every deal."

“No one cares about your features. You have to talk about the larger problem that you're solving and how the world will be different if what you're doing works. Explain the change that you're bringing about in the world and why that's important.”

“Everyone is running around with their hair on fire but they’re afraid that their innovation gets copied. If you’re not moving fast enough, you’re on a bit of hamster wheel. If you’re not moving fast enough, you’re running in place.”

TOGETHER WITH THE ULTIMATE VC RESOURCE LIBRARY

We started our careers in venture. After about a week, we had a realization.

We had no idea what we were doing.

Turns out, we weren’t alone.

Junior VCs don’t get training. You’re forced to figure it out on your own.

Learning the rules, tools, and players takes FOREVER to learn. That’s why we made the ultimate VC resource library to speed up the learning curve.

READING

Similar investor lessons:

PREMIUM

The #1 private venture community 📶

By this point you already know that making it as an investor is hard.

If you want to win, you need some sort of edge.

But how do you get that edge?

That’s a question we can’t answer, but here are a few examples we’ve noticed after studying hundreds of investors:

Better knowledge: Knowledge is power, and learning the ins and outs of the venture game gives you a leg up on other investors.

Better network: Ideally you want deals to come to you instead of constantly having to chase them down.

Better access to capital: Being able to call other investor friends and bring more money to the table is a cheat code.

Better access to talent: You’re only as good as the people you work with.

Knowing that, we built our private investor community to give members each of those.

It’s application-only, and every new member is a vetted member of the VC ecosystem. Once inside, members get access to a knowledge library, member directory with 1,900+ other investors, an investor-only Slack group, and private deal flow with hundreds of decks and investment memos.

The best part? The basic membership is free (as long as you’re approved), and the premium plan offers a 30-day free trial.

REFER

Earn free stuff 🎁

You can get free gifts by telling your friends and family to sign up 👇

{{rp_personalized_text}}

Copy & paste this link: {{rp_refer_url}}

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

P.S. We’re sharing some of our best VC templates and downloads for free. Just let us know which ones you want here.