Say “hey” 👋 | Apply to community 👥 | Upgrade 📶 | Archive 📰 | Become an affiliate 💸 | Sponsor 📣

Good morning 👋

This week’s piece is on Erik Serrano, CEO @ Stable Asset Management.

Stable is an allocator that invests into investment firms, and Erik has been head of the ship since starting the firm 15 years ago.

I first heard of Erik last month when he went on ‘Invest Like the Best’. Everything that came out of his mouth on that podcast was gold, so I wanted to dive deeper.

Here are 21 lessons from Erik.

Explore all investor deep dives here.

LESSONS

Every investment firm has a limit to scale. Finding that limit is an expensive process.

The career risk of an asset owner forces AUM scale. Larger funds bet more on the front end (fees); smaller funds bet more on the back end (carry).

Most investors underappreciate life experiences. The more you get to know a person, the better you can underwrite them.

All hard problems go up. Resilience needs to be there or else you give up when things get hard.

Adversity at an early age is a good indicator of future success. “Chips on shoulders put chips in pockets.”

Being average is beta. You have to see things that other people don’t see yet.

Extreme variance perception is a bad thing. You have to constantly take new information into account.

Communicating is underrated. Ironically, more communication tools has created fewer great communicators.

Seeding comes from high-trust relationships. Raising a first-time fund is almost entirely reliant on the trust a person has built up until that point.

Focusing more on the strategy and less on the person is too one-dimensional. Looking at the portfolio and not looking at the business is lazy thinking.

Founders can get away with being less likable in public markets. This doesn’t fly in private markets.

Likability is a proxy for being reliable. Likability works in private markets.

Fund managers with flashier cars give up sooner during a drawdown. If you’re motivated by the wrong thing, you won’t stick around long.

Great GPs want the freedom to not think about money. Good GPs just want to make money.

Referencing is powerful. Erik’s go-to question to GPs is “What is a piece of feedback you got that surprised you?”

Changing strategies is punished. It’s okay to lose money, but you HAVE to do it the way you said you were going to.

In the investing world, LPs often buy something more than returns. “Poor people buy entertainment; wealthy people buy information.”

Together with Verified Metrics

Good investors move quickly. They don’t have time to go back and forth on data requests for new investments.

Enter Verified Metrics.

Their software keeps data rooms, models and ERP’s in sync - helping you to maintain momentum and close deals with confidence.

QUOTES

“People don’t give money to the best returners. They give money to the people they like.”

“The IP of humans is what drives an investment fund. The code drives companies.”

“Chips on the shoulders put chips in pockets.”

“You need to lose money the way you said you would lose money.”

TWEET

REFER

Earn free stuff 🎁

You can get free gifts by telling your friends and family to sign up 👇

{{rp_personalized_text}}

Copy & paste this link: {{rp_refer_url}}

READING

Similar investor lessons:

PREMIUM

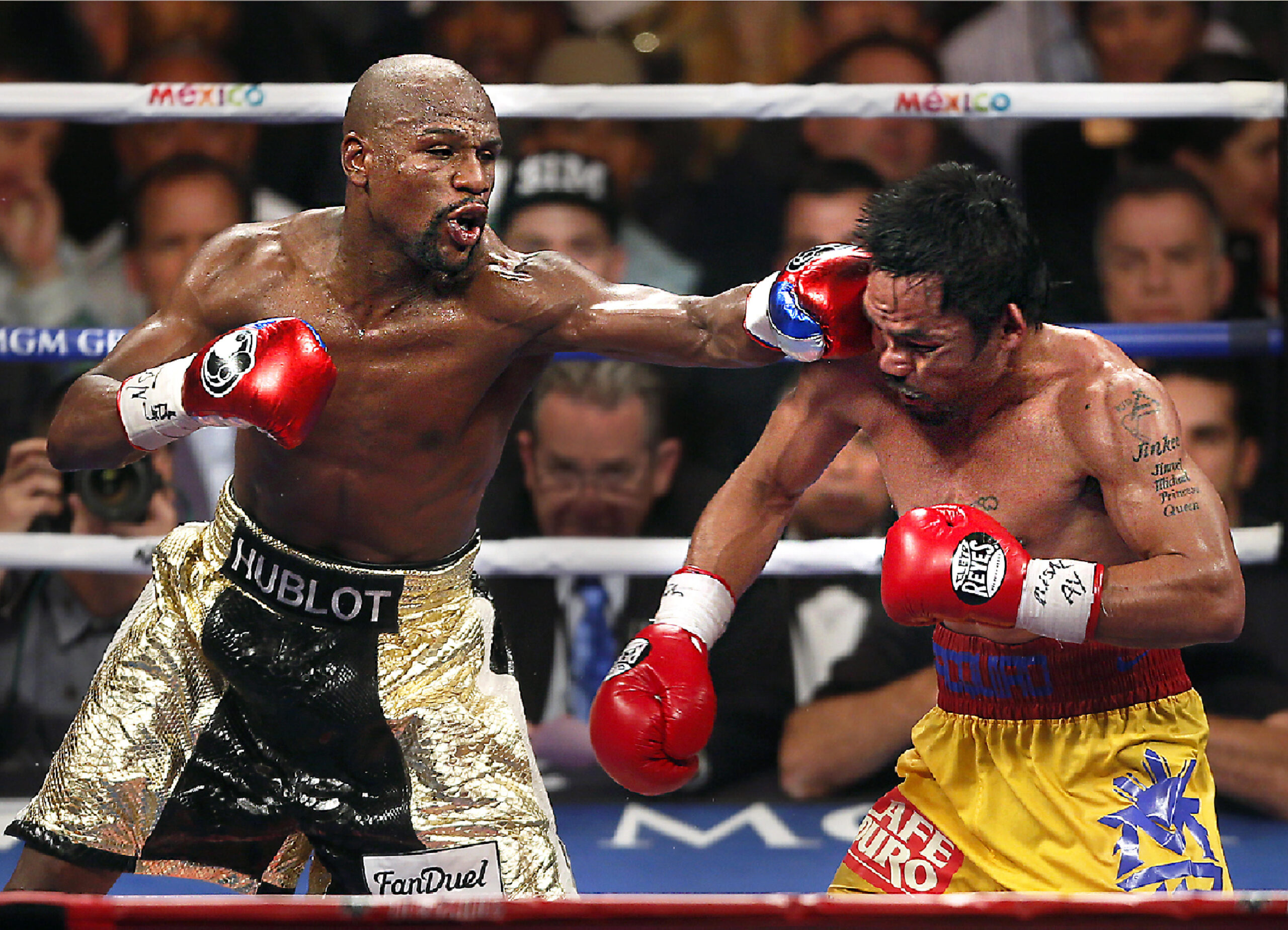

A picture is worth a thousand words 😶

Apply —> here

Spot the difference between these two career paths.

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

P.S. We’re sharing some of our best VC templates and downloads for free. Just let us know which ones you want here.