Good morning 👋

I spent five minutes trying to think of something witty to say.

I’ve got nothing. Tax Day did a number on me.

Let’s get into the news that matters.

If you think we’re right, wrong, way wrong on any of the stories this week, let us know in the comment section.

This week's episode is brought to you by … Confluence.VC Recruiting.

Let’s be honest. Hiring investors SUCKS.

You blast out a JD you copied from other online postings, get flooded with applications from unqualified candidates through LinkedIn, and you’re left filtering through a stack of trash hoping to find a gold nugget.

Hope is not a strategy, and this is not how great teams are built.

We run the investor hiring process from start-to-finish, and we help funds find, vet, and hire from the top community of venture talent. No more trash digging; gold just shows up at your door.

This Week in Venture

Expect more institutional $$$ to private equity 💸

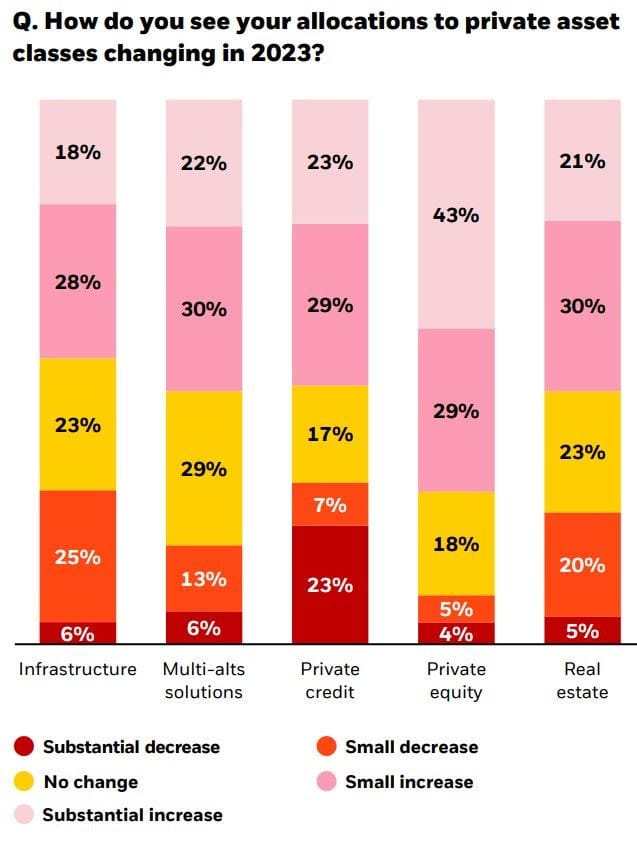

BlackRock surveyed institutional investors on how they expect capital allocation to change over the next year.

The biggest asset class winner?

Private equity.

Why it matters: Public markets are taking a beating, and the smart money can’t afford to watch returns slip away through a bear market. If you want to make money, you have to follow the money.

Institutional investors pull the strings to the entire investment landscape. Understanding what they prioritize today will give direction on where the strongest returns are expected over the next 5-10 years.

Right now, these investors are seeing the most growth opportunities in private equity, growth equity, and venture capital.

There has been a lot of talk about the changing nature of venture and whether institutions have been scared off due to poor price discipline over the past few years. This should be a small sigh of relief for those in venture as it seems that the smart money hasn’t been scared off yet.

What happens next: If you talk to funds that are fundraising right now, these results might shock you.

Raising capital is harder than any time I can remember, and institutional investors don’t seem to be in any rush to write checks.

Q1 only brought one new fintech unicorn 🦄

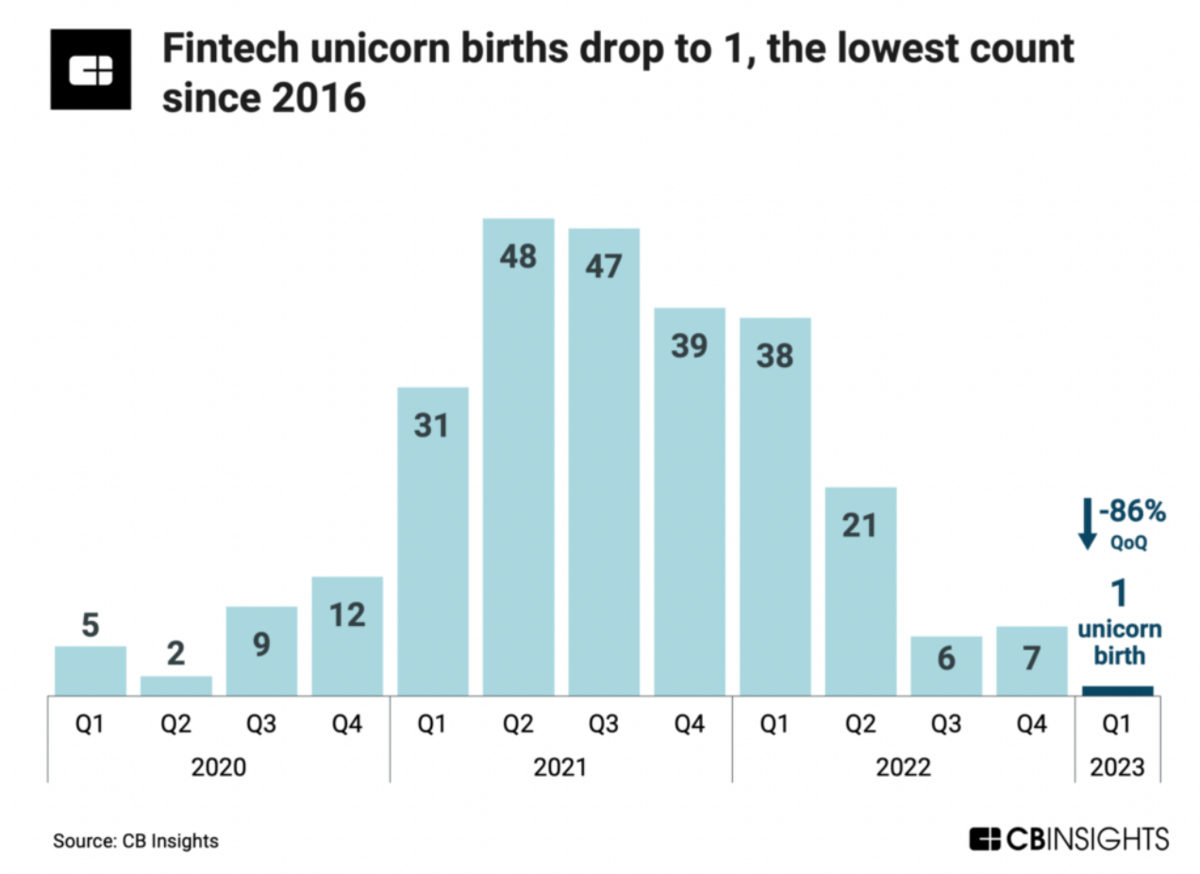

The fintech numbers are in for Q1, and they don’t look pretty.

Deal count is down, total fundraising is down if you exclude one mega-deal, and only one new fintech unicorn was minted (HNT-Malan for any of you that were curious).

Shoutout to CB Insights for the report and data referenced below.

Why it matters: Producing only one new unicorn is the sign of a larger trend: the fintech bull run is losing steam, and there are becoming fewer later-stage opportunities for investors to bid for.

Stripe raised $6.5 billion in mid-March, but if you take that deal away, total funding would have been a 12% drop from last quarter according to CB Insights.

Deal count also dipped from 1,007 in Q4 ‘22 to 983 in Q1 ‘23. The bigger dropoff comes when you zoom out and compare fintech deal count YoY (1,629 in Q1 ‘22 vs. 983 in Q1 ‘23).

On the bright side, the percentage of early-stage deals being done is up with ~72% of Q1 deals being labeled as early-stage venture.

What happens next: Late-stage fintech funding will probably continue to go through a slow period.

Less capital going towards late-stage fintech in the private markets + the fact that fintech companies are lagging in the public markets = less institutional interest in late-stage fintech opportunities.

We think there is still plenty of money to be made in fintech, and plenty of investors are still active in the space. We expect more capital to move upstream to Seed and Series A-type opportunities.

As a quick reminder: VCs are driven by large winners, and they notoriously like to remind people of those winners. When unicorn volume drops, there are less opportunities for these investors to promote their portfolio (or at least less opportunities to say “We’ve invested in {insert #} unicorns”.

LPs are evaluators of prior performance, and a slowdown in markups at the growth stage makes it harder to analyze that prior performance.

Links We Like

🎨 Midjourney AI Guide: Notion document sharing how to use Midjourney

📓 Levels Culture Handbook: How Levels has built their internal culture

🛠 Building With No-Code Tools: 5 steps to creating a web app without writing code

📈 What is Bottom Up SaaS: David Sacks gives his two cents

📧 Unconventional Email List Building: How to grow your list without going crazy

🏃♀️ Most Important Lifestyle Habits of Successful Founders: Michael Seibel of YC shares his thoughts on what he has noticed

➡️ Investor Recruiters: The 39 best recruiting firms focused on placing talent in venture, growth, and private equity roles

🚨 Cold Email Mastery: fThe best course we’ve found for people that want to solve their sales problems with better outreach

Have an article you like that we should include in this section? Let us know by responding to this email.

VC Jobs

100 roles in VC, growth, and private equity

Finding open VC roles is hard. We’ve tried to make that search process a little easier.

Search for what you’re looking for, and subscribe to get email alerts based on your preferences.

Want to post a role on the board? Do that here.

Tweet of the Week

Different way for VCs to add value

VCs love to “add value”, but this is a good example of VCs actually delivering on that.

Together with Brex

Wait … you guys manage your spend?

Obvious statement alert: managing invoices and team spend is a nightmare.

Chasing down receipts, uploading to a spreadsheet, sending to another team to approve, and reimbursing your employees sounds … super fun.

Brex takes this archaic process from the Stone Ages to the modern era by giving finance teams the tools they need to operate. Dashboards, automations, integrations, and financial modeling instead of manual work that makes you want to reconsider jobs.

Question of the Week

Good IP lawyer recs

This is a good question that will probably start coming up more often with generative AI.

If anybody has a good IP lawyer, shoot us a reply or let us know in the comments.

How'd we do this week?

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.