Good morning.

I’ve spent the past few weeks obsessing over a question:

What happens to most junior investor roles when knowledge becomes commoditized?

The question applies to all knowledge workers, but in VC, what happens when it has become MUCH more effective to use ChatGPT, an agent, or software to:

Find hyper-targeted companies and automate 95% of your sourcing? (ie. Harmonic)

Research any market and know “enough to be dangerous” in ~five minutes? (ie. Deep research)

If you’re reading this and questioning what you still bring to the table, you’re probably not alone.

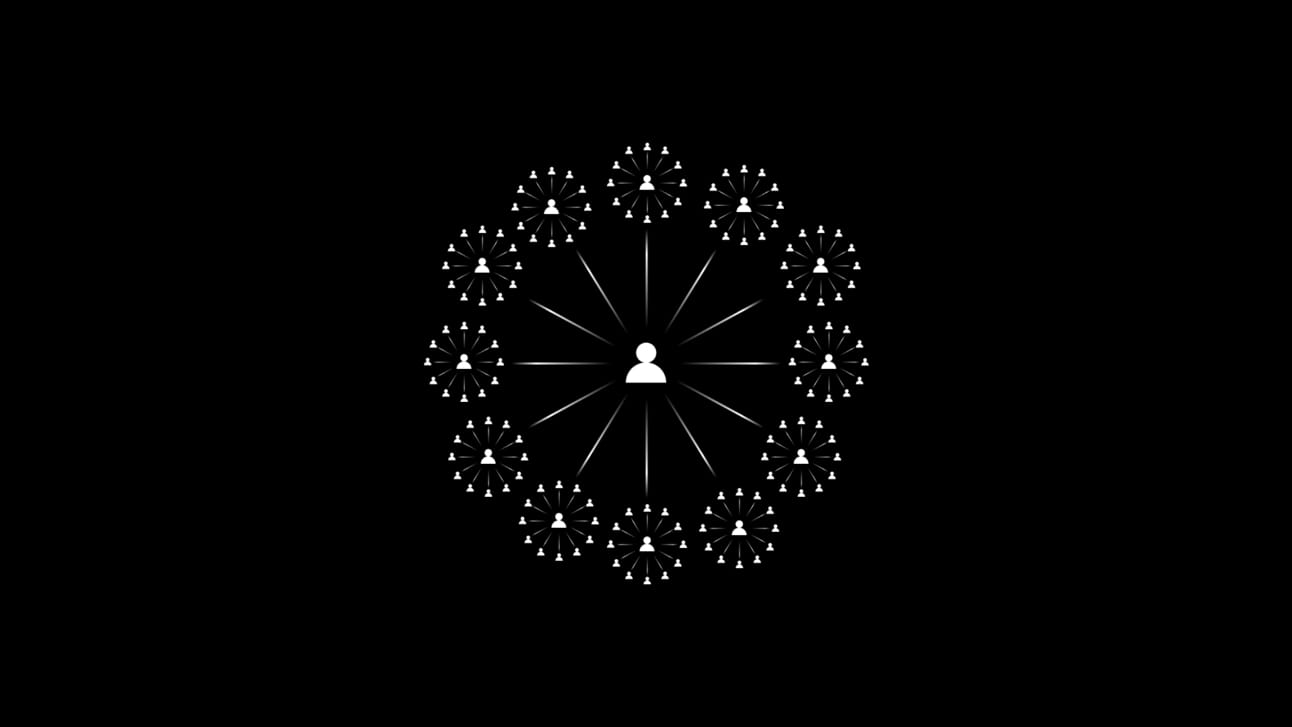

As knowledge becomes more and more commoditized, unique networks of people are one of the last sources of alpha left.

Unique networks “future-proof” a person by giving them access to opportunities, founders, customer intros, and talent. I would argue this has always been the case, but it now that knowledge is no longer a moat, I would argue bringing a network is one of the only things that matters.

The biggest firms in venture have already realized this, and they are getting ahead of it with a unique way to expand their own presence while also working with the next generation of emerging fund managers.

Here’s a 1,500-word condensed summary of how we get here, why it’s a genius move, and what happens next …

Buying networks

For those of you who don’t like reading small letters in the images above, here is the breakdown of what I’ve been seeing so far along with where I see things going:

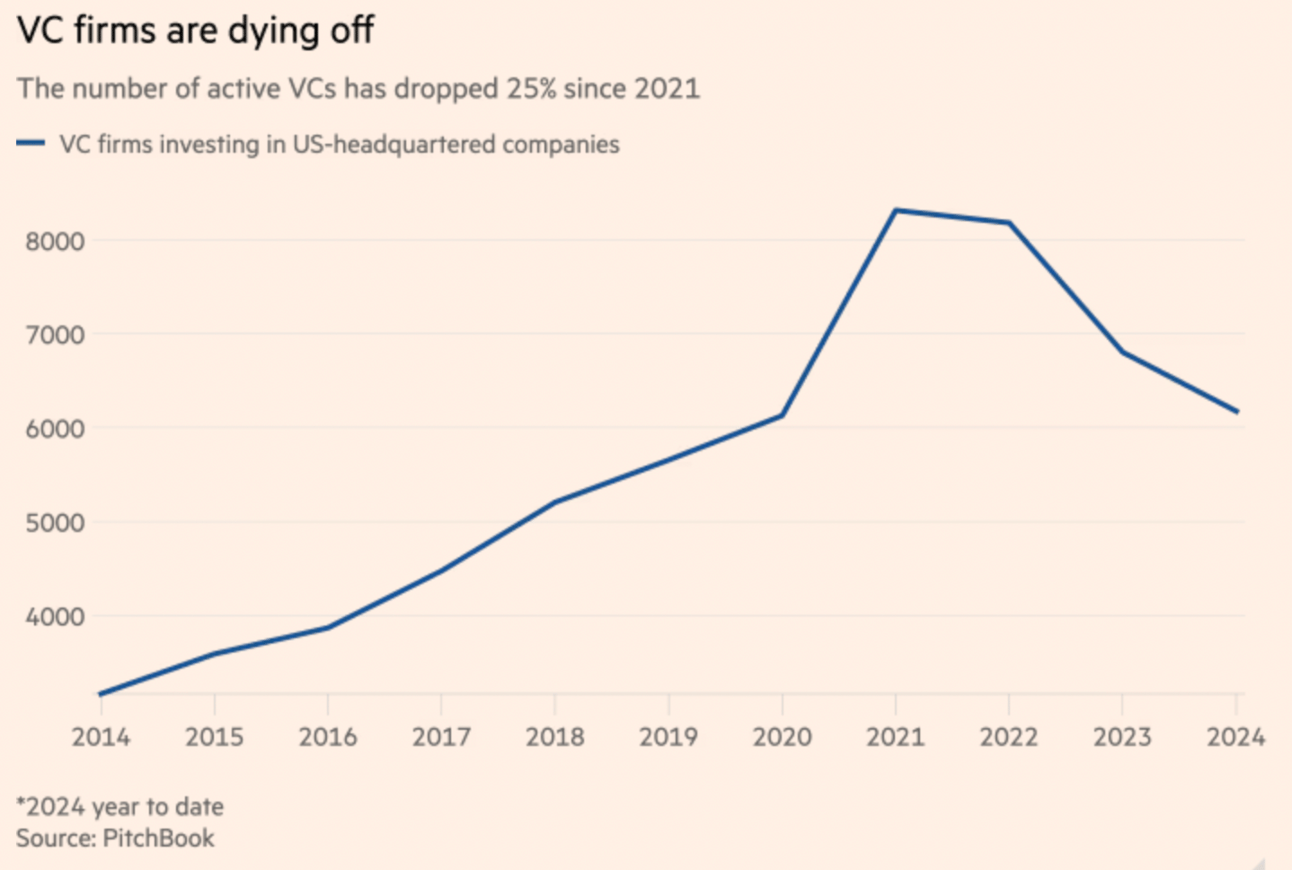

The venture hype cycle of 2020-2022 allowed for tons of bad actors / poor fund managers to attract venture dollars. A lot of bad came out of this era (low DPIs, massive loss ratios, turning the asset class to a mockery), but one of the bright spots was that a new class of GPs could win allocations into some of the most competitive rounds

This was an inflection point where a) it was getting easier to set up funds or SPVs (shoutout AngelList + Sydecar), b) there became less of an emphasis on capital alone given the amount available, and c) there became more of an emphasis on the personal brand of the lead investor. This was a defining moment where personal brand of an investor started to become as important as the overall brand of the fund. There are a million ways to build a "brand", but in this sense, the closer you were to seed-stage founders, the better your odds were to pre-empt their next round or get included when it came time for them to fundraise.

Fast forward to today, and many of these new school GPs have now become household names for the seed market. Chapter One, Essence, and Earl Grey, and others are a few examples.

As the top-performing funds rise to the top, oversubscribed funds drive up AUM, and larger AUM forces these funds to graduate to larger checks into later-stage companies. This creates a funding gap where where they used to play at the seed, and this funding gap happens every few years as the best names graduate.

Massive AUM can act more as a burden than a benefit, and it forces larger checks (10x-ing a $1m doesn't move the needle on a $1b fund). As these older funds have scaled up, they have become asset managers, and their portfolio has become concentrated around growth-stage deals with a different risk/reward profile than true venture pre-seed and seed investing.

As the old guard of venture firms have become asset managers, the game they are playing has shifted. It is no longer viable for them to scour the universe for the best seed opportunities; instead, it makes more sense for these mega funds to let others do that work so that they can curate the best opportunities from there.

But these funds still pride themselves on seeing things before they become obvious, so how do they increase seed visibility so that they can curate the best opportunities at the A? That’s the billion dollar question that all of these funds are trying to answer.

In the past, many of these funds would try to implement this by either launching a scout program or taking the Insight approach and building out an army of analysts / associates to source all day; that won’t happen as often anymore because a) knowledge has been commoditized and b) it is now well known that the best founders are choosing their investors more than their investors are choosing them. On top of that, it has become hard to justify the costs of new junior investors when the price of knowledge has shrunk to ~$20 / month (but that's a separate tangent).

So again, if you're a mega fund, and you want to pre-empt the best seed companies before they take off, how do you see everything? From our view, it’s pretty straightforward …

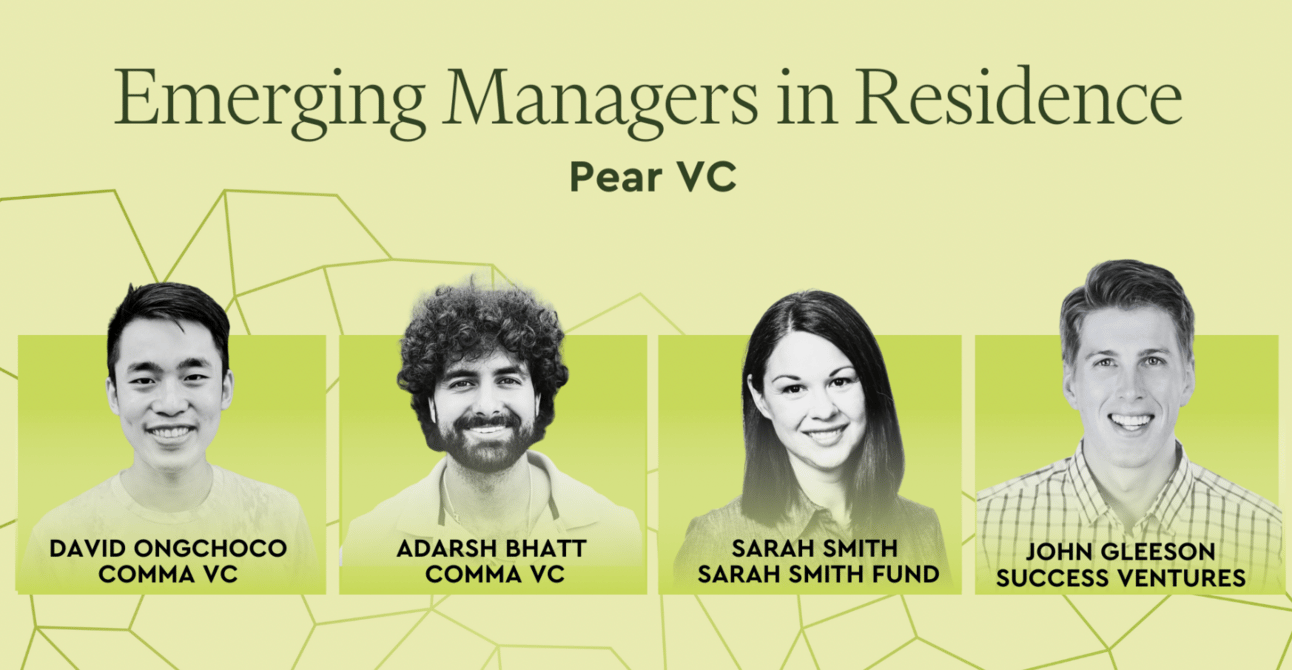

You take the fund of funds approach, and you buy networks by becoming an LP into the next-wave of seed funds. That's exactly what firms like Sequoia, a16z, Thrive, General Catalyst, Pear, and others are doing. Here's why that's brilliant:

This creates an “outsourced seed” program that lets everybody focus on what they do best. The new crop of fund managers (the GPs in this scenario) can focus on continuing to win allocations into the best early-stage companies. The megafunds (the LPs in this scenario) get visibility into those companies along with the option to write larger checks in the breakouts when they become invest-able for their own fund.

As knowledge becomes more and more commoditized, unique networks of people are one of the last sources of alpha left. Unique networks give a person access to opportunities, founders, customer intros, talent, and LPs that otherwise wouldn't be available. Having a network like this is a cheat code, and building one will put you in a category of one.

Mega funds acting as LPs to the next-wave of GPs lets them play long-term games with the right people, and it also creates a set of call options they can exercise in the future. The megafunds are buying information on the underlying portfolio, and they can double down on the breakouts if they choose to. This gives them curated visibility to the earliest stages of venture, and it creates a two-sided relationship where the smaller fund manager gets capital and the benefit of association and the larger fund gets information and downstream deal flow.

Backing the next-wave of fund managers also creates operational information advantages that the mega funds can apply to their own firms. Speaking from experience, there is a MASSIVE difference in how these two types of funds think and act. Emerging GPs pride themselves on resourcefulness, and some of this improved efficiency can be passed along through knowledge transfer to the mega funds that LP them.

A lot of smart people have written about the consolidation of venture, and I largely agree with everything they have to say. The Sequoias, Lightspeeds, and a16z's of the world will continue to bring in the bulk of the new LP capital to the asset class. But with all of this new capital, these firms have already started acting on how they can create more leverage.

Leverage can be created through capital, code, media, and labor. Companies have code, venture firms have capital, and some of them are able to help with media visibility and labor connections. Top-performing funds have massive amounts of collective leverage as each new investment compounds on their existing position.

Company leverage: code

Fund leverage: capital + media +(sometimes) labor

By seeding the next wave of world-class funds, megafunds are capturing a percentage of the leverage created through these new funds. If all funds are creating collective leverage through their own work with their portfolio, megafunds with an LP program are now are operating at a layer above that and playing long-term games that compound as their underlying GPs grow.

Collective leverage (seed fund)

Combined leverage (mega fund)

Summary

Add this all up, and there are a few things worth remembering:

Knowledge is commoditized; networks are not. If you want to make it in venture (either as an employee or as the GP), knowledge is no longer a moat. The more unique your network of founders, co-investors, and capital, the better your chances are of seeing outlier results. The best founders choose their investors - not the other way around anymore.

The old guard are competing for Series A ownership; the new guard are competing for seed allocations. More AUM forces a different portfolio approach with more growth-stage checks and fewer (if any) seed-stage checks. As older firms scale up, a new crop of managers has replaced them at the earliest stages.

Instead of competing with the new crop of the top seed funds, the old guard of funds are backing them and creating long-term games with these people. Instead of letting these new managers take all of the upside of coming in early, larger funds have started seeding them as an LP in order to get visibility into the portfolio so that they can curate the breakouts and invest larger checks from their standalone funds.

TL;DR: The winners keep winning. Megafunds will continue to win by getting more visibility and opportunities into the best early-stage opportunities by acting as an LP into a highly-curated group of emerging funds. These emerging funds keep winning by winning the support and resources of some of the most notable names in venture via bringing them on as an LP.

If anybody has additional thoughts, I’d love to talk to you.

More from me

Here’s a simple idea that I take seriously:

Media operators have unfair advantages in early-stage investing.

They have:

Content magnets that attract audiences and expand surface area

Built-in trust that compounds into authority

Curated opportunities won through that trust and authority

If the goal of venture capital is to invest into tomorrow’s best companies as early as possible, media operators have a vehicle to do that.

I realized this years ago when I started this newsletter, and I have been building on this idea ever since.

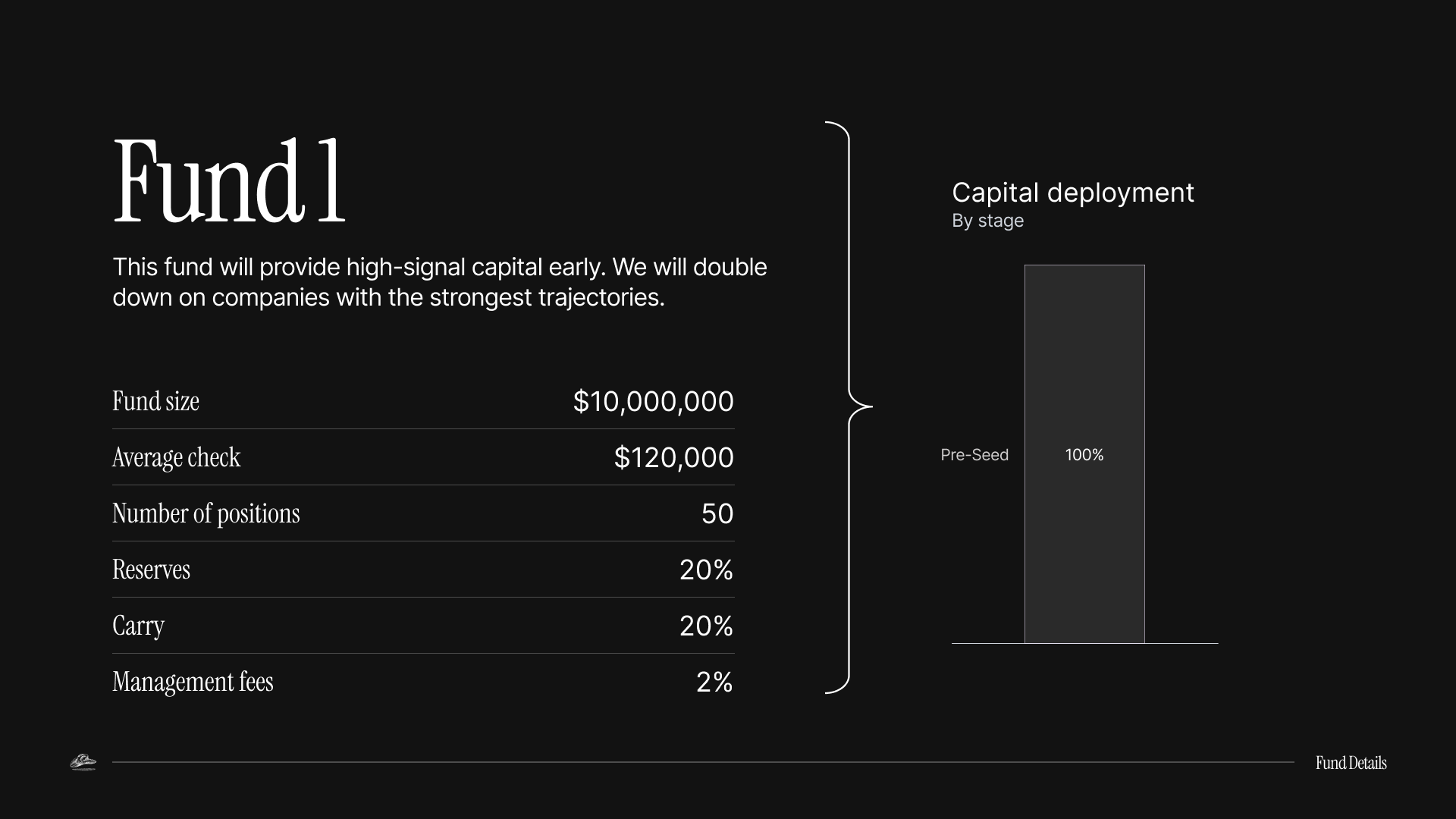

Today, I run a small investment firm that backs the best opportunities surfaced through the work of this newsletter.

The firm is called Outlaw.

More on the full thesis and execution plan can be found below:

Share Confluence.VC

Share this newsletter with your friends, or use it as a pickup line.

1 referral

Free month of Insider

5 referrals

Free month of Operator

👉 Your current referral count: {{rp_num_referrals}} 👈

Or share your personal link with others: {{rp_refer_url}}

Thanks for reading this far and giving us a little bit of your attention this week. Feel free to unsubscribe whenever this stops becoming valuable to you.

Upgrade 🤝 unlock more

Join 100's of other readers getting more exclusive content by upgrading below ...

Get your first week FREEHere's what else a paid subscription gets you:

- 5x posts / week (20x posts / month)

- 2x / month investment memos on pre-seed companies we find interesting

- Market maps on up-and-coming verticals (with company data)

- Database of 2,000+ venture capital firms with firmographic data