Good morning 👋

One more day until Friday. Also how is it October?

Let’s get into today’s piece.

P.S. 💰 Are you a full-time investor?

TOP STORY

Chipping Away at Nvidia: Cerebras’ $600M IPO Play 🧮

Cerebras Systems, an AI chipmaker from Sunnyvale, CA, is taking a swing at the public markets.

The company filed for an IPO, aiming to raise $600 million. They’re a direct competitor to Nvidia, and the company is hoping that some of the hype over their competition will translate over.

Worth noting: Cerebras reported a $66 million net loss on $104 million in revenue for the first half of 2024.

The company also warned that it got a “significant majority” (more than 80%) of its sales from one customer, G42, an AI company in the United Arab Emirates. It also said it had identified “material weaknesses” in its financial reporting protocols.

The company has received more than $400 million in VC backing, including investments from big names like Coatue, Sam Altman, and Benchmark.

Why it matters: For years, investors looking to cash in on the AI boom had limited options: Nvidia or the FAANG gang. With Cerebras knocking on Nasdaq’s door, this IPO represents a fresh opportunity for those who missed the AI train the first time.

What happens next: The public listing will give a temperature check on the AI sector and the overall market. The IPO window has largely been shut for the past three years, and this will be one of the few venture-backed public offerings that have materialized since 2021.

Our quick read is that having 80% of your revenue coming from one customer is a huge risk for any company, and we’re willing to bet that investors are not going to love that fact.

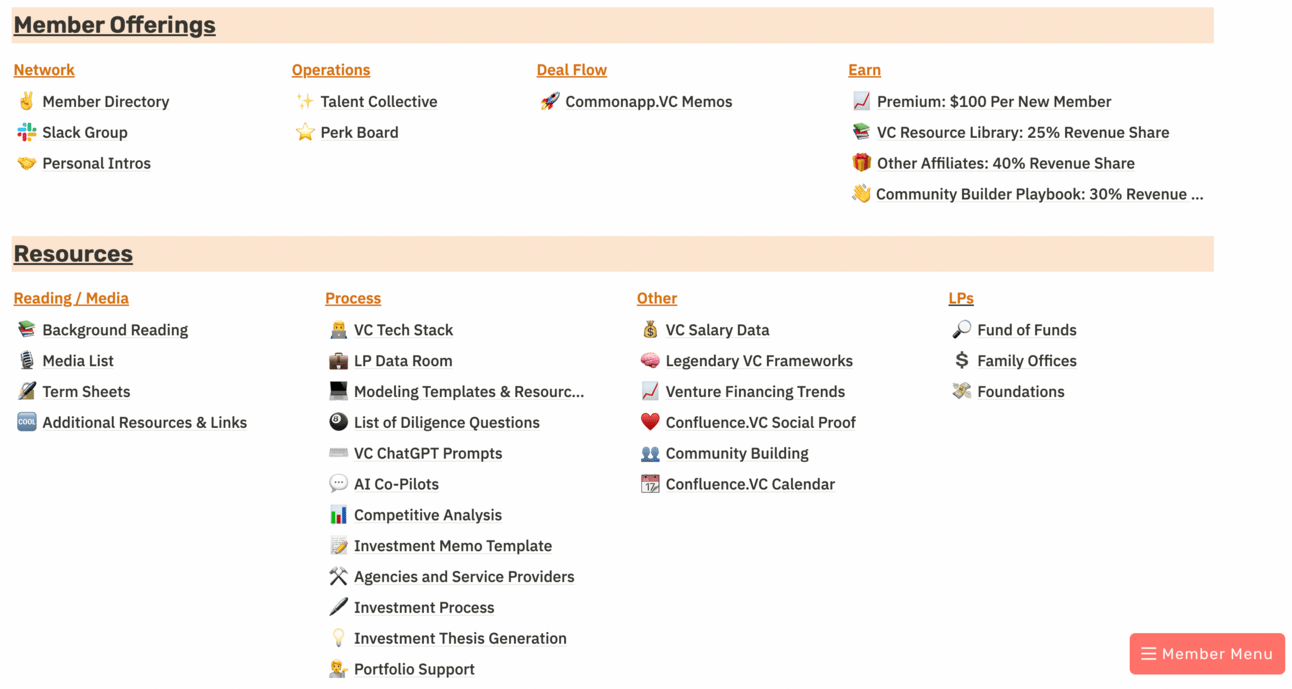

COMMUNITY

What do investors from a16z, Bessemer, Founders Fund, and Insight have in common?

They’ve all joined this private investor community.

Join 2,225 investors already inside by applying below …

LINKS

♟️ The Life-Changing Benefits of Being Boring: The strategy game is what gets the win

❤️ When To Do What You Love: Paul Graham believes if you want to do great work, the complicated question of whether or not to work on what interests you the most becomes simple

🧠 For a More Creative Brain Follow These 5 Steps: James Clear outlines the 5-step approach that should help demystify the creative process and illuminate the path to more innovating thinking

👍 How to Create a Co-Founder Agreement: VC Corner lists the key components that every co-founder agreement should include

📗 The Marketing Playbook for the 1%: Never run out of growth ideas again

TWEET

REFER

Earn free stuff 🎁

You can get free gifts by telling your friends and family to sign up 👇

{{rp_personalized_text}}

Copy & paste this link: {{rp_refer_url}}

HEADLINES

What else we’re reading 📰

Life sciences VCs beat generalists in backing IPO- and M&A-bound companies (Pitchbook)

GV, Salesforce Ventures Top Corporate Venture In Leading Investments (Crunchbase)

The Rise of VaaS: How AI Is Redefining SaaS Pricing Models (Crunchbase)

Joe Schorge, Managing Partner of Isomer Capital, on secondaries trends in venture capital (Ion)

Venture Capital Pioneer Vinod Khosla Says AI Will Deliver Broad Deflation (WSJ)

Sponsor Confluence.VC Weekly

Got a B2B biz? 📥

Join dozens of high-growth companies partnering with us to reach some of the most sought-after people in tech and finance.

15,000 subscribers

73% of audience makes over $100k / year

65% of audience between 25-44

90% of audience based in US

(Media kit available upon request)

POLL

Would you consider yourself a specialist investor or a generalist investor?

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

RESULTS

Here are the results from our poll question in Friday’s piece:

If you were an LP in charge of investing in venture capital funds, where is the bulk of your capital going?

🟩🟩🟩🟩🟩🟩 🇺🇸 USA (14)

🟨🟨🟨⬜️⬜️⬜️ 🇪🇺 Europe (9)

🟨🟨🟨⬜️⬜️⬜️ 🌎 Somewhere else (7)

30 Votes