Together with

Good morning 👋

Two more days until the long weekend …

To celebrate the 4th, we have an offer to share: your first month free on any of our premium newsletter plans.

That means:

✅ Investment memos on companies backed by Sequoia, Accel, Founders Fund, and others

✅ Market maps on up-and-coming verticals (with company data)

✅ Behind-the-scenes looks at how we build and scale this business

✅ Database of 2,000+ venture capital firms

✅ Ultimate VC resource library (400+ curated resources used by the top funds in the world)

✅ Community builder playbook (everything we have learned from running a community-first business)

✅ Zero ads (ever)

And more.

We’re running this offer from now until midnight on the 4th. Check it out below if you’re interested in upgrading …

TOP

We love it when Rex shares his charts that our shaping the world - it helps us think more clearly about where things are heading.

Here are a few that stood out from his latest:

This may seem slow, but AI adoption is quite a bit faster than prior tech waves like internet and mobile. Naturally, white-collar workers are leading the charge here: 27% report frequent AI use, compared to 9% of blue-collar workers.

We’ve written before about how AI supercharges productivity, meaning companies can do more with less. This was true before AI: here’s a Coatue slide showing the decrease in # of employees per $1M of revenue over time, through the internet and PC eras:

A prior version of “10 Charts” underscored this by looking at the revenue / employee among leading AI companies like OpenAI ($1.5M / employee), Cursor ($3.3M), and Midjourney ($4.1M). But it’s not just startups that are showing impressive efficiency. AppLovin, a woefully under-appreciated business that boasts a $113B market cap, has doubled revenue / employee in recent years, surpassing $1B in revenue while trimming its headcount by 20%.

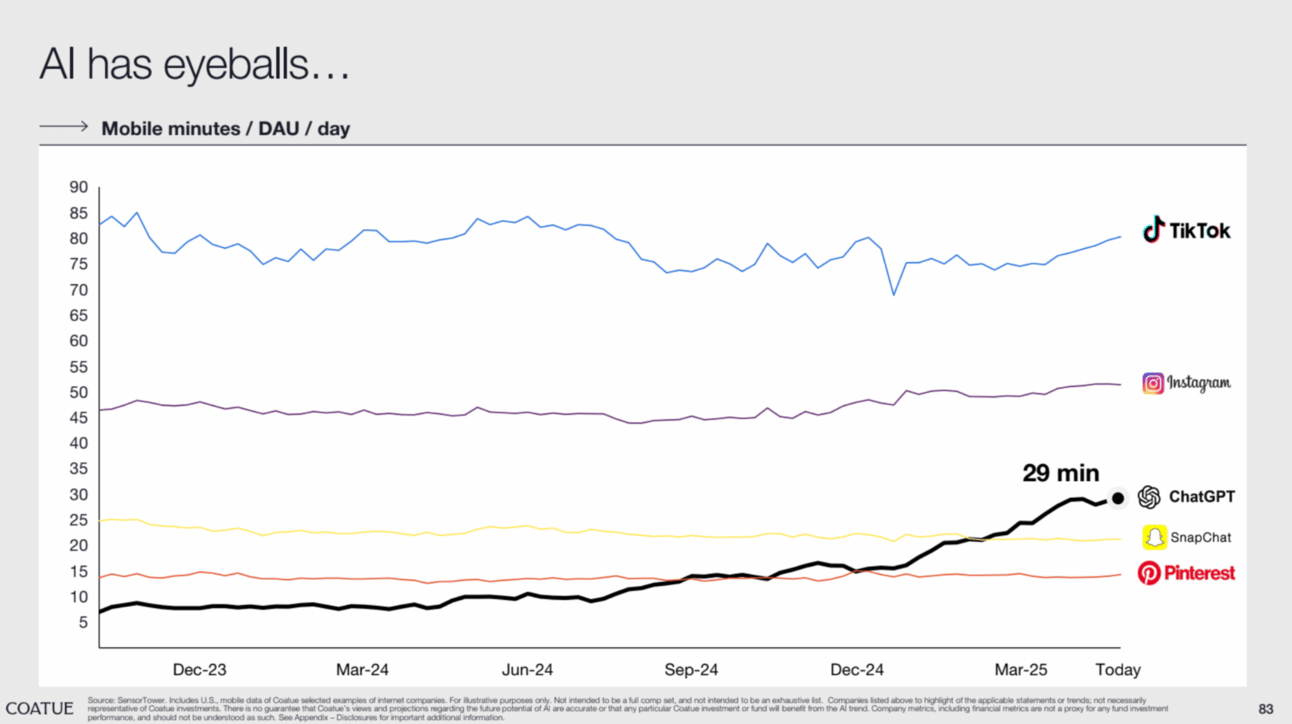

The fact that ChatGPT has higher daily engagement than Snap signals that it’s more than a Google replacement: it has created a new chat-centric category, a category equally important for answering basic queries (“Who won the big Grammys this year?”) as it is for less objective interactions (“How do I talk to my mom about her divorce?”). It is both search and social.

Together with Delve

SOC 2 that doesn’t suck

There’s a dozen compliance platforms out there - but they don’t understand YOU (at least not like Delve does).

Most give you a checklist and some APIs. All of them will upsell you on every service under the sun. None of them understand what you actually need - helping you get your enterprise deal done.

Delve gets you fully compliant with SOC 2, HIPAA, ISO 27001, and GDPR — in 15 hours or less. And their security experts will get on the Zoom call and help you close your deals. We’re not just a software platform - we’re a partner with a promise.

Need proof?

Lovable: Got SOC 2 in 20 hours

11x: Saved 143 hours and unlocked $2.3M ARR

Bland AI: Got SOC 2 and unlocked $500k ARR in 7 days

Pick the right compliance partner from the start ...

(Plus, they’ll ship you Airpods Pro on us when you get fully-compliant :)

TWEET

HEADLINES

UPGRADE

Get your first 30 days 🆓

LINKS

🥵 Should China’s 996 Work Culture be the New Normal for Startup Founders?: Periods of intense work, at least in the early stages, will always be required to be successful, but the danger lies in making it the default setting rather than a tactical choice to be used when needed

🫵 VC Job Opportunities for June: Learning VC shares a list of 23 open offers to join the venture capital world across the globe

🚨 The Long Road to Automating the SOC—Why It’s Time to Shift the Focus to Acceleration: Security Operation Centers (SOCs) are drowning in alerts that AI Agents may be able to automatically resolve and free the human analysts to do more efficient work

🔄 The Shrinking Public Markets, and Rise of Private Liquidity Loops: According to Mostly Metrics, we’ve entered a new era of capital markets, one where private is no longer a stepping stone, but a fully-built out destination

🦄 Age for Exited and Private Unicorns: Ilya Strebulaev’s data shows a trend toward longer unicorn exits with the secondary market providing liquidity without IPOs in addition to volatile public markets and steep valuation discounts discouraging going public

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

(Founder @ Confluence.VC | GP @ Outlaw)