Good morning 👋

And welcome back to work.

We asked on Friday how many of you are using management fees to hire engineers. The results were a little different than what we were expecting (results at the bottom).

Today we’re covering opportunity funds, why they got popular, why they’re currently unpopular, and what we think happens next.

Let’s get into it.

P.S. 💰 Are you a full-time investor AND do you want to get paid more?

Today’s highlights

What’s next with opportunity funds

The 2024 state of crypto

The absurdity of being cheap when hiring

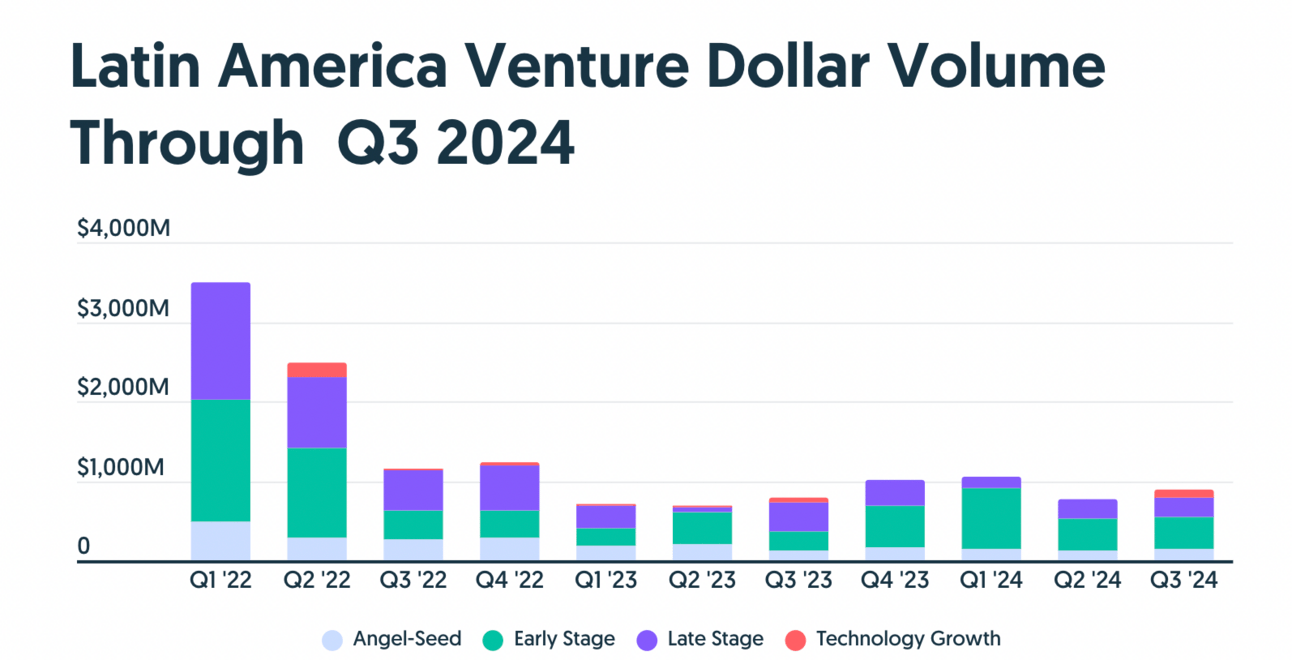

Chart of the day: Nobody wants to invest in LatAm anymore

TOP

VCs are changing the rules on opportunity funds 📏

Opportunity funds were designed during the bull market as an easy way for LPs to double down on their winners in a venture portfolio. If VC math holds, ~10% of holdings will account for ~90% of returns; opportunity funds offered a way for LPs to put more capital towards the top-performing 10% of companies in a given portfolio.

That was all good and well during the bull market, but things have changed, and LP stances towards continuation funds have changed too.

Startup valuations are still largely inflated, the IPO market is frozen, LPs are still waiting for distributions, and VCs are either scaling back or shifting their continuation fund strategies.

CRV, for instance, is returning over half of its $500 million opportunity fund, citing unsustainable valuations. Others, like Lightspeed, are still raising billions but focusing on secondary stakes and turnaround plays rather than traditional follow-on investments.

The old playbook of pouring cash into maturing companies is being rewritten in real time.

Why it matters:

IPO pathways are closing: With IPO markets stalling, opportunity funds that rely on growth-stage companies going public are no longer a safe bet. This forces VCs to rethink their late-stage strategies.

Valuations are still too high: Many startups are overvalued and overcapitalized, making follow-on investments riskier with diminished upside. LPs are starting to balk at throwing more cash at inflated companies.

LPs are pushing back: LPs no longer feel compelled to invest in opportunity funds, especially if their GPs don’t offer differentiated strategies. The old pressure to invest in both early-stage and opportunity funds is fading, and LPs are taking control.

What happens next:

VCs will likely continue to reduce their reliance on opportunity funds or reinvent them to suit the current market.

We could see firms that used to follow the playbook of investing in growth-stage companies shift to more niche or secondary opportunities. The rise of secondary stakes, LP liquidity solutions, and even distressed asset plays will become more mainstream.

However, firms that double down on trend-driven sectors like AI and deep tech could carve out success with opportunity funds—if they can convince LPs that those bets are worth the risk. Ultimately, this is a period of experimentation, where some GPs will thrive by reimagining what opportunity funds can do, while others will scrap the model entirely.

LPs have all of the control in today’s fundraising market, and they will have the final say.

COMMUNITY

VC-Cheat-Codes-as-a-Service (VCCaaS)

If you’re serious about making a name for yourself in venture, you’re going to need some help.

That’s why we built this business (especially our private investor community).

It’s application-only for full-time investors so it remains high signal, and approved members get access to our full VC playbook we’ve built over the past four years.

That includes:

The full VC resource library (Basic members)

Thousands of investment memos (Premium members)

Member directory (Premium members)

Private Slack group (Premium members)

Member matchmaking (Premium members)

LINKS

🔮 AI in VC—Outlook for 2025: Data-Driven VC shares what they see coming

Ⳬ State of Crypto 2024—All-Time Highs, Stablecoins Fit, Swing States, More: a16z Crypto’s report covers crypto’s rise as a hot policy topic, recent tech improvements to blockchain networks, and trends across builders and users

⌗ The Beginner’s Guide to Databases: Here is a breakdown of the three major categories of databases and what they do

🥀 Why WeWork Died: Lessons from the plight of a $47B tech startup landlord

TWEET

HEADLINES

Acrew Capital hits five years, raises $700M (TechCrunch)

Former OpenAI CTO is reportedly raising for a new startup (TechCrunch)

Defense-tech boom spawns wave of new European GPs (Pitchbook)

Harvard’s endowment returns lag Columbia, Brown (Pitchbook)

CHART

MEME

POLL

Are you currently investing out of an opportunity fund?

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

RESULTS

Here are the results from our poll question in yesterday’s piece:

For VCs: do you have an engineer as part of your team?

🟨⬜️⬜️⬜️⬜️⬜️ Yes - just one (2)

🟩🟩🟩🟩🟩🟩 Yes - more than one (7)

🟨🟨🟨⬜️⬜️⬜️ Nope (4)

13 Votes