Good morning 👋

And welcome back to work.

We’ve been building towards a prediction economy for years, but now it is fully here. The financialization of everything has already taken place, and now everybody playing the great online game wants to play with dollars and not just their attention.

Alex Danco covers this more in his latest piece, and we’re breaking it all down with our own two cents below …

Today at a glance ...

Big breakdown

The prediction economy

On Friday, Kalshi announced a massive round from Sequoia, a16z, and others. Prediction markets have been mainstream for some time now, but this definitely solidifies that.

On the back of that news, Alex Danco (one of my favorite tech writers) wrote a deeper piece on why he thinks we’re living in the prediction economy today. The piece is filled with bangers, but here are a few quotes that stuck out the most:

Meme stocks might only be a few years old, but popular culture preceded them by a decade when Home & Garden TV programming became entirely about house flipping. Large swaths of the population now buy into the idea of “making your own luck” as a more literal virtue than it used to be.

Everybody, either consciously or subconsciously, wants in on the action.

We’re in the late innings of the attention economy; we’re in the early innings of figuring out how to personally monetize on where you are personally giving your attention.

If you are spending a bulk of your day thinking about something, why are you not “betting” with that information?

At the forefront of culture and commerce, flash sales and popup stores are a revealing break from business convention where removing friction is always good. A sneaker drop is all about adding friction to the sales process. That’s why people like them: your place in line is the meaning of the product.

Friction sometimes is the product, and anticipation can equal consumption.

How early or late you are to something is now an essential component of your relationship to that thing.

I don’t think there is an industry where this is more obvious than in venture capital.

Everybody wants to say they were investors in OpenAI, Anduril, Databricks, etc. How many were actually early to these companies? Very few.

Mucker bought ~7% of Honey for $125k and put $3m total into the business. That company later sold to PayPal for ~$4b. Mucker is one of the best seed funds in the world, but that exit completely changed their perception in the world.

We’re all participating in one great online game, and your goal is to be predictive of the game, rather than predicted by the game.

If you are reading this, you are part of this game.

“Being good at the Internet” is now a highly practical and monetizable career - it used to be, too, but less legibly.

More time spent online = better odds at predicting the future of the online game

Capital follows talent which follows attention. If you pay attention to where your smartest friends are spending their time, you’ll be able to predict where the capital will go next.

Fund notes

What I’m up to

Last week had some momentum on the fundraising side:

Closed four new LPs for fund I

Met potential $3-5m anchor for fund II

Onboarded intern and have him finishing v3 of his first memo

We’re holding first close right now, and it feels like the majority of my day is wrangling together commitments from folks who have either already verbally committed or have been most aligned with the strategy.

We already have our first five investments from the fund picked out, and we have a few more in the pipeline that we’re in negotiations with.

We’ve said it before, but we’ll say it again:

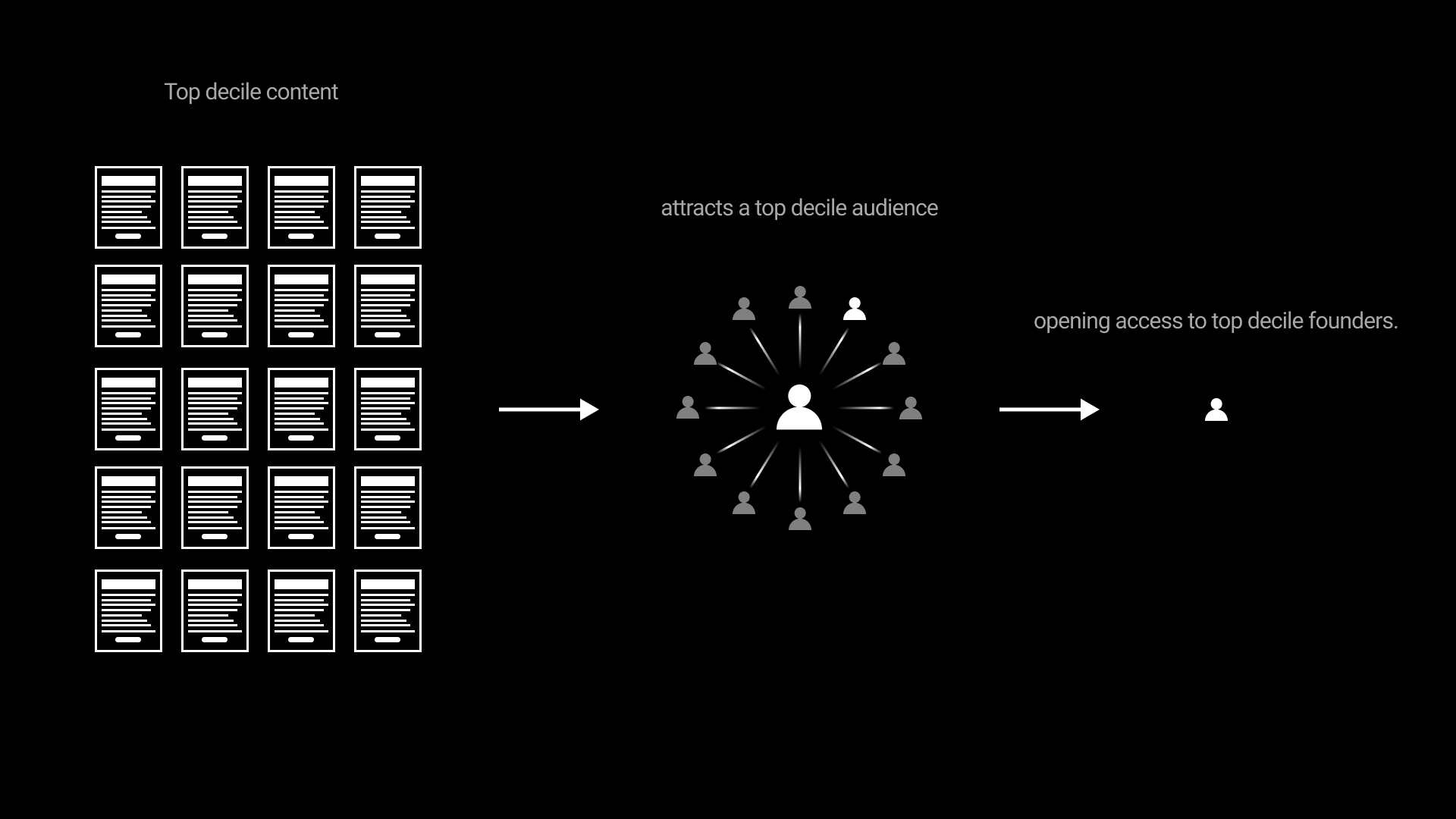

We believe media operators have unfair advantages in pre-seed and seed investing.

We’re investing more and more into this newsletter business (more on that to share very soon), and it is already directly improving our founder selection funnel.

Everybody already knows this by now, but the best founders have to choose you. If you’re a small fund like us, that means you have to bring something tangible to the table outside of capital.

For us, this newsletter acts as a differentiator, and it has already opened up founder doors that would be closed otherwise. We’re continuing to invest heavily across improved design and increased audience capture so that this asset becomes more of a wedge for Outlaw.

Strategy: Execution plan

Agent: Outlaw agent

More: Fund page

ICYMI

The best of last week

what (really) happens in the harvest period: Knowing when to sell plus thoughts on new media and investing becoming a content business

some notes on hiring venture associates: Venture hiring thoughts, the best career advice, and data on co-founder splits

consensus (investing) is for cowards: Finding conviction, what junior roles are still hiring for, and some data on founder vesting schedules

some new GTM benchmarks: Data on what "great" looks like for GTM teams, takeaways from LP meetings, and thoughts on only investing in what you know

Rabbit holes

Top Investors by Share of Early Investments in Unicorns since 2020: Ilya Strebulaev offers a chart ranking investors by share of early-stage investments (made since Jan 2020) that became unicorns (LINK)

Where AI Is Gaining Traction in Everyday Life: Menlo Ventures surveyed respondents across 5 core categories of activity and found there is still a long way to go to everyday adoption, meaning opportunities for new products to convert casual users before daily habits lock in (LINK)

Is an MBA still worth it if you want to make it in VC?: As the consensus in VC on the value of an MBA continues to waver, and the junior career options in VC shrink, the tradeoff for prospective students staring down a barrel of over $200k in debt has gotten murkier (LINK)

What a Soviet Era Pole Vaulter Can Teach Us About “Beating and Raising”: Mostly Metrics uses the example to show there’s an art and a science to consistently beating your target in public markets (and even privately with your board) (LINK)

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay Norris

(Founder @ Confluence.VC | GP @ Outlaw)

Want to start getting more emails like this?

Become a paying subscriber to get 5x more emails and unlock more subscriber-only access ...

Get your first week FREEHere's what else a paid subscription gets you:

- 5x posts / week (20x posts / month)

- 2x / month investment memos on pre-seed companies we find interesting

- Market maps on up-and-coming verticals (with company data)

- Database of 2,000+ venture capital firms with firmographic data