Good morning 👋

The Last Money guys + Sydecar teamed up to put together some SPV data (read the full report here).

We’re here to break it all down for you and explain how the trends affect the decision-making for SPV leads going forward.

Let’s get into it.

P.S. 💰 Are you a full-time investor AND do you want to get paid more?

Today’s highlights

SPV trends and data from the Last Money guys

Compressed economic theories from Jack Butcher

Fixing the “messy inbox” problem with AI

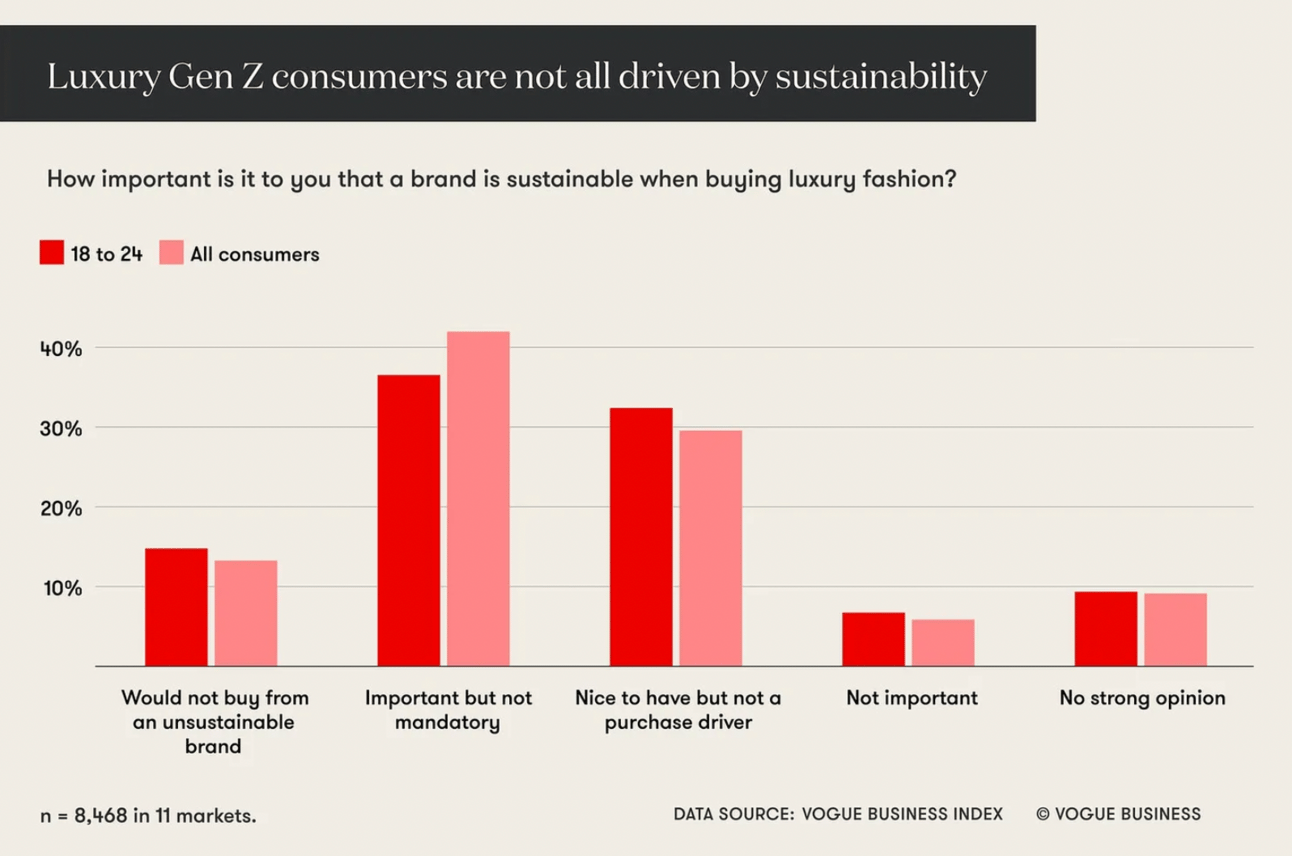

Chart: GenZ doesn’t care about sustainability

TOP

SPV trends (Q3) 📊

The Last Money guys did a huge deep dive on SPV data over the last quarter, and the results were interesting.

They analyzed a total of 833 SPVS. Here’s the high-level snap shot:

% that charged carry | 40% |

|---|---|

Average management fee | 2.86% |

Management fee range | .2% - 20% |

And here’s the quick breakdown of what stages are warranting management fees:

Stage | Percentage that charge management fees |

|---|---|

Pre-Seed | 25.21% |

Seed | 36.43% |

Series A | 37.10% |

Series B | 49.30% |

Series C | 40.91% |

Series D | 61.90% |

Series E | 75% |

Bridge Rounds | 41.18% |

Why it matters: The syndicate market has fluctuated a lot over the past few years, but it finally seems like things are stabilizing a bit.

The main takeaways from this report are that:

LPs are increasingly excited about later-stage companies with proven models

Tier-1 backing (e.g., Sequoia, a16z) is the strongest signal to LPs

Shorter liquidity timelines > unknown payback periods

As liquidity for $1B+ companies becomes more available, early investors are left with a choice: either adapt to later stage deals or continue to struggle to hit allocation goals for earlier stage deals.

What happens next: Many fund managers start as syndicate leads to prove their ability to win deals, so we’re always monitoring this group of people.

As the data suggests, it’s becoming harder to survive as an early-stage syndicate lead, and LP preferences are forcing investors to shop for allocations downstream with larger and more established companies.

We expect for this trend to continue, and we do not expect for it to reverse until the early stage venture market becomes more lucrative than the growth market. In our view, that will be at least a few more quarters as there are still plenty of proven businesses trading at a discount in the $300m - $1b valuation range compared to the number of pre-seed and seed companies trading at a discount with far lower revenue numbers.

P.S. Want to see the companies we’re going in on?

Search Partners

Hiring new analysts, associates, principals, or partners in the US? 📌

Hire A players from the #1 venture capital community in the world.

🔎 Explore a talent base of 2,250+ vetted candidates

🤝 Our team sets up 10+ intros for you

☑️ Don’t pay until we finish the job and find the right hire for you

🔄 60-day money-back guarantee

LINKS

🔎 Compressed Economic Theories: Jack Butcher helps you think more clearly

📈 Why Lifetime Value is Relevant Again in Software: Tomasz Tunguz is not a fan of lifetime value (LTV) in startups but for public software companies in these sparser economies, it becomes an important determinant of whether & when to invest more in growth

📢 When Are You Ready to go Public?: Mostly Metrics shares benchmarks for operators

🛣️ Who You Are vs. What You Can Control: Overcoming Bias believes it is a mistake for startups to pursue many different unrelated innovative deviations from standard practices

🔢 VC SPV Trends Data → Q3, 2024: The full data set and inspiration for today’s piece

TWEET

HEADLINES

AI nabs better deal terms than the rest of VC (Pitchbook)

Five Red Flags Hanging Over Venture Capital (The Information)

Our favorite startups from Pear VC’s invitational demo day (TechCrunch)

Here’s the full list of 39 US AI startups that have raised $100M or more in 2024 (TechCrunch)

CHART

Sponsor Confluence.VC Weekly

Got a B2B biz? 📥

Join dozens of high-growth companies partnering with us to reach 15k of some of the most sought-after people in tech and finance.

73% of audience makes over $100k / year

65% of audience between 25-44

90% of audience based in US

(Media kit available upon request)

RECS

The Product-Led Geek: Learn how to scale your B2B software company with product-led growth and product-led sales

Creator Spotlight: Your guide to building an audience with social media and newsletters with creator deep-dives every Friday.

SCALE: Weekly insights directly from the world's best growth-stage founders and investors

POLL

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

RESULTS

Here are the results from our poll question in yesterday’s piece:

What's the best VC podcast?

🟨🟨🟨🟨⬜️⬜️ All In (4)

🟩🟩🟩🟩🟩🟩 The Twenty Minute VC (5)

🟨🟨🟨⬜️⬜️⬜️ a16z Podcast (3)

⬜️⬜️⬜️⬜️⬜️⬜️ Consumer VC (0)

⬜️⬜️⬜️⬜️⬜️⬜️ The Syndicate (0)

🟨🟨⬜️⬜️⬜️⬜️ The Full Ratchet (2)

🟨🟨⬜️⬜️⬜️⬜️ Bring back the Confluence.VC pod (2)

16 Votes