Good morning 👋

I met Tony Kim a few months back, and he has already become somebody who has opened new doors and bounced new ideas around my head.

He works on the investment team of Cisco’s venture arm, and he underwrites for both financial and strategic returns.

This has given him a pretty unique lens into the M&A world (something that we’ve found most other venture investors are completely unaware of), and we wanted to hear more of his thoughts.

Here’s his latest piece of writing about the what else should go on behind-the-scenes of a clean M&A process …

TOP

I could use some help.

I’m building a free 5-day email course that packages up the most important things I have learned in venture over the past ~decade.

It is completely unfiltered, and the goal is to help readers cut through the noise, see things clearly, and start using better frameworks to make better decisions for themselves.

What name do you like the best?

TOP

The 10-Step M&A Exit Playbook

Exiting a startup is hard.

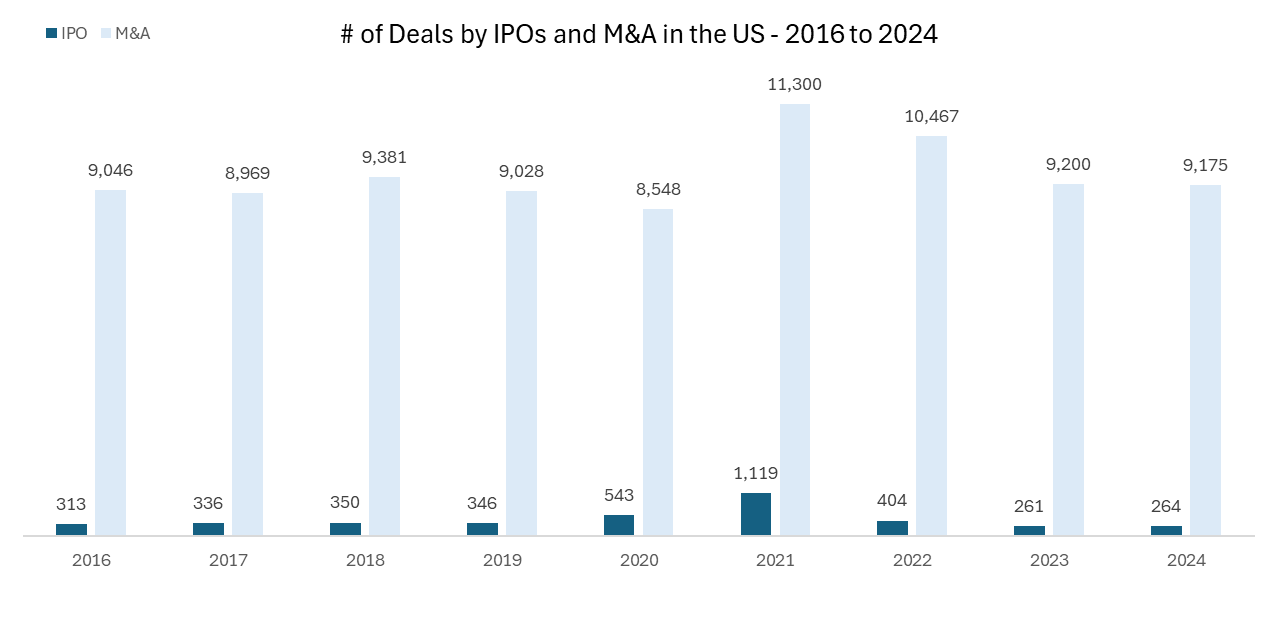

Fewer than 10% of startups ever achieve any kind of successful exit. And among those exits, the vast majority are acquisitions rather than public offerings¹. With such steep odds for success, founders need every edge to navigate the journey toward a liquidity event.

In today’s market, with IPO windows mostly stalled due to macroeconomic factors, more and more startups have been opting for M&A as their go-to exit strategy.

Understanding the Exit Landscape: IPO vs. M&A

Exiting via IPO is rare compared to M&A. In recent years, acquisitions have overwhelmingly dominated startup exits. For example, by 2021, M&A accounted for >90% of exits, and in the downturn of 2022 to 2024, this gap widened further as venture-backed companies saw over 34 acquisitions for every 1 IPO in 2024².

Positioning your company for a strategic M&A exit has therefore become essential. When executed well, M&A can provide greater rewards not just for investors but also for founders and employees.

However, preparing for an M&A exit isn’t something to do at the last minute. It involves deliberate steps taken well ahead of time to make your startup attractive to potential buyers. From understanding what acquirers are looking for, to building the right relationships, to getting your financial and legal house in order, thoughtful preparation can make the difference between an average and a great exit.

How do Large Companies Typically Evaluate Acquisitions?

Many large corporations typically evaluate M&A opportunities through internal corporate development or corporate finance functions, while also receiving inbound deal flow from investment bankers.

While banker-led deals occasionally lead to meaningful transactions, many corporations prefer acquiring companies they’ve already been working with, whether through partnerships, vendor relationships, or commercial engagements.

Broadly speaking, large acquirers tend to evaluate M&A opportunities through two lenses: Acqui-hire and Product acquisitions.

Acqui-hires, or tuck-ins, often involve early-stage companies that are just beginning to generate revenue. These deals are typically driven by the value of the technology, IP, and team. Valuation factors may include employee count, location, roles, seniority, and recent fundraising activity.

Product acquisitions typically involve more mature companies with established revenue. These acquisitions are often driven by strategic goals such as horizontal or vertical expansion and are evaluated within the acquirer’s broader financial planning process. Valuation here depends more on internal financial forecasting and metrics such as revenue growth, customer acquisition, and business model scalability.

Navigating the Buyer’s Decision Process

The corporate development and finance team works closely with Business Unit (BU) Leads to scout the market landscape and discuss companies that they’d like to double-click on.

Initial engagement typically starts with a 30-minute to 1-hour meeting between corporate development and the startup. The purpose is to understand the company’s business and what it aims to achieve. Notes, impressions from the meeting, and often PowerPoint decks, typically requested by the corporate development team, are then shared with the BU to gauge whether there is further interest.

If the BU shows further interest, the next step is a detailed tech diligence session for the BU to dive deeper into the product and business. Depending on the session, a follow-up tech or GTM diligence session may be scheduled.

Once the BU indicates a desire to move forward, the acquirer usually considers a few key questions:

Is it better to buy, build, or partner?

Does the BU have the budget to onboard all employees?

How much synergy could realistically be realized from the acquisition?

What are the potential downsides, including impact on existing customers and partners?

Will the deal require broader internal approvals depending on the transaction size?

It is important to note that BU engagement could cool down for many reasons: shifting priorities, OpEx constraints (one of the top reasons deals fall through), leadership changes, or internal restructuring. Consistency and persistence are key as a result. Founders should identify who the true decision makers are (often BU-level stakeholders), as they often have the final say.

When it comes to diligence, founders should be fully prepared going into the diligence meeting to answer any technical questions. In my experience, the startups that come best prepared often bring slides that lay out a joint vision, roadmap, and GTM plan. These materials show how both companies could work together long-term. Beyond the financials and the products, it’s often the founder’s broader vision that persuades buyers to move forward.

Simple Internal Buyer Flowchart

10-Step M&A Exit Playbook for Startups

While not all startups are prime candidates for acquisition, there are ways to increase the likelihood of a favorable outcome.

Identify Likely Buyers — Research and map out the companies that might want to buy a company like yours. Watch who’s actively making acquisitions in your space. Understanding the acquisition priorities of companies helps you tailor your positioning. Knowing who’s buying and what they are looking for is crucial to getting on an acquirer’s radar. For example, if a giant like Google is willing to pay $32BN to acquire a cloud security startup like Wiz in 2025, that signals what they value³. Monitor industry news, PitchBook or Crunchbase reports, and investor insights to stay informed on who your top suitors could be.

Build Relationships Early — Don’t wait until you are ready to sell to start networking with potential acquirers. Identify product managers, partnership leads, or corporate development folks at those target acquiring companies and look for opportunities to connect. Cultivate genuine relationships by sharing insights or asking for advice. The goal is to put your startup on their radar long before any acquisition talk begins, so when the time comes, there is already familiarity and trust. Many acquisitions begin with informal chats or investments/partnerships long before formal M&A talks. For example, data protection giant Veeam had a long relationship with a startup called Alcion (investing in its Seed round and leading its Series A round) before eventually acquiring them and naming Alcion’s CEO as Veeam’s CTO as part of the deal⁴. These early connections build trust and give potential buyers internal champions who know your value.

Get Your House in Order — Familiarize yourself with the diligence process and build a well-organized data room to be an attractive acquisition target. Keep all your financials, cap table, legal documents, and key metrics organized and up to date. Clean up your cap table, ensure your financial statements are accurate, and resolve any outstanding legal, regulatory, or compliance issues. Keep all key documents (corporate records, IP assignments, customer contracts, employee agreements, privacy policies, etc.) neatly indexed in a tidy data room or folder. Acquirers love to see a well-run operation with no ugly surprises, which also gives them confidence in pursuing the deal. For more details on how to organize your data room, refer to the chart below.

Focus on Strategic Value — Position your startup as the missing puzzle piece for a bigger player. Highlight the strategic value a buyer would gain. Maybe you’ve built a coveted piece of technology, accumulated a strong user base, or assembled a world-class team in a cutting-edge field. Remember that strategic fit can often trump size or revenue when it comes to acquisitions. For example, WhatsApp had only 55 employees when Facebook bought it for $19BN⁵, and Instagram’s 13-person team was acquired for $1BN⁶ due to their explosive user growth and product-market fit. Likewise, in 2025, Meta is paying nearly $15BN for a 49% stake in Scale AI to secure its advanced AI data modeling capabilities⁷. Big companies will be more willing to pay a higher premium if your product fills an important gap for them. Make it clear how you expand their portfolio or solve a problem they can’t easily solve internally.

Demonstrate Growth and Traction — Show that your business is not only strategically interesting, but also on a solid upward trajectory. Acquirers will dive into your KPIs — growth rate, retention/churn, revenue trends, gross margins, CAC vs. LTV, etc. Be prepared with clean data and charts that tell a story of momentum. Strong, predictable growth is the single biggest driver of a tech company’s valuation, so highlight your key traction metrics. If you have a clear path to profitability (or at least improving unit economics), point that out as well. The goal is to prove to buyers that acquiring you will add fuel to their engine, not a hole in their pocket.

Be Realistic and Time Your Exit Wisely — In the startup world, timing can be everything. While it’s great to be ambitious with the “go big or go home” mentality, you also need to be pragmatic about exit opportunities. Market conditions can change drastically. For example, the IPO window was practically closed between 2022 and 2024 due to macroeconomic factors. Keep an eye on your runway and growth trajectory, and be willing to seriously consider acquisition offers when they arise. Sometimes an early offer that feels small can actually be the smart move if the alternative is raising in a down-round. The key here is also to evaluate offers in context: what’s the competitive environment? Are there multiple interested bidders? How is your sector’s exit climate? Also, align with your investors and board on expectations — if everyone is on the same page about what a “good” exit looks like, you can move quickly when an opportunity arises. Timing matters as selling too late can slash your valuation, whereas a well-timed exit during an upswing can reward everyone. Plan ahead for various scenarios so that if an M&A opportunity knocks, you are ready to seize it.

Craft a Compelling Acquisition Story — Be ready to articulate why a combination with your company would be powerful. This often means preparing a deck illustrating what the ‘marriage’ would look like for potential buyers as discussions get serious. Outline a clear joint roadmap: How would your product and team fit into the acquirer’s organization? How could a merger accelerate their growth or expand their market? Paint a picture of the combined future, for instance, how your technology could be plugged into their distribution channel to create a new revenue stream. Founders who present a convincing vision of integration (complete with a high-level 12-to-24-month plan and go-to-market strategy) give acquirers extra confidence. Beyond the usual financials and product demo, show that you’ve thought through the synergy. Often it’s this forward-looking narrative that persuades a hesitant buyer to commit.

Leverage Advisors and Mentors — Don’t go through an acquisition process alone. Surround yourself with a few experienced allies who’ve been down this road. A savvy M&A attorney is essential to help with due diligence and deal terms, ensuring you don’t overlook liabilities or leave money on the table. An investment banker can help create competitive dynamics and guide valuation discussions (especially for larger deals), though for smaller transactions, you might rely on your network. Equally important are mentors or board members who have sold companies before. They can coach you on how to handle sensitive negotiations, maintain focus during the exhaustive due diligence process, and avoid common pitfalls. Advisors can also discreetly shop your company to multiple prospects to get the best outcome. Think of it like assembling your personal deal task force to maximize your chances of a smooth, successful exit.

Boost Your Visibility in the Market — An often-overlooked step to attract acquisition interest is simply making sure your startup gets noticed. It’s easier for a big company to buy you if they’ve heard of you. Pursue press coverage, speak at industry conferences, publish thought leadership, and engage in communities where your target acquirers are paying attention. Showing up on industry “top startup” lists or being known as a leader in your niche (e.g., open-source projects or developer communities) can put you on the map. Strategic acquirers frequently track innovative up-and-comers through news and events. By building your brand and credibility publicly, you increase the likelihood that when their corp dev team is scouting, your startup’s name is already on their list.

Be Patient and Persistent — Successfully selling your company can take time. It’s common for initial buyer interest to heat up and cool down due to shifting priorities or budget cycles on the acquirer’s side. Don’t be discouraged by a few false starts. Keep improving your business and maintain polite periodic contact with potential buyers. Consistency can eventually pay off when their needs align with your timing. Importantly, don’t let the M&A quest distract you from running the company. A deal isn’t done until the money’s in the bank. By staying patient and continuing to execute well, you put yourself in the best position to capitalize when the right opportunity comes knocking. Remember, you want to sell on a high note, not out of desperation, so keep your startup healthy and growing while those M&A conversations percolate.

Source — The Ultimate Startup Data Room Checklist: What to Include in 2025⁸

Ultimately, positioning your tech startup for a successful M&A exit is all about preparation and strategy. By understanding the market dynamics and buyer landscape, nurturing key relationships, keeping your operations airtight, and articulating the strategic value of your business, you make it easy for an acquirer to say “yes.” While luck and timing certainly play a role in any startup outcome, you have control over how attractive your company appears to potential buyers. Treat the possibility of acquisition as an integral part of your business planning, and you’ll be ready to capitalize when opportunity comes knocking.

In today’s environment, an acquisition can often be the golden reward for all your hard work, providing liquidity for founders and investors and a promising home for the product or technology you’ve built. With the above playbook, you’ll be proactively steering your company toward that successful outcome, rather than leaving it to chance.

Reach Tony: LinkedIn profile

Sources

SVB: Startup Exit Strategies — Types of Startup Exit Strategies

PitchBook — M&A vs. IPO volume analysis

Crunchbase News — 2025’s Billion-Dollar Startup Exits

Business Insider — Early WhatsApp Team Size at Acquisition

Reuters — Meta’s $15B Stake in Scale AI

Papermark — Startup Data Room Checklist

Additional Resources for Founders

Crunchbase News — Startup Valuation Factors

Carta — Cap Table Template

Salesforce / Slack Deal Deck — Summary Slides PDF

Microsoft / Activision Proxy Deck — SEC Filing Example

HPE / Juniper Investor Deck — Acquisition Slide Deck (PDF)

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

(Founder @ Confluence.VC | GP @ Outlaw)

/pai