How do the best early-stage VCs actually find deals in 2025?

That’s the question we’re all thinking through, and we went deep to find out the answer.

This guide is based on dozens of firsthand investor reviews, Reddit threads, Slack leaks, public playbooks, and private posts from the people actually doing the work: solo GPs, emerging managers, platform teams, and fund associates sourcing deals every day.

What emerged is a clear picture of the evolving VC sourcing stack — what’s working, what’s overhyped (and overpriced), and how investors are customizing their workflows based on firm size, thesis, and budget.

Whether you’re a solo capitalist trying to get ahead of the curve or a multi-stage fund rethinking your CRM, this breakdown will help you identify the right tools for your sourcing strategy.

P.S. We’re taking the next few weeks off.

I need some time to rest and execute on other things, and I figured late July / August is the best time of the year to do that.

I have a few emails queued up to tease more of what I’m up to next, so stay tuned for those.

TOP

Top sourcing tools for early-stage investors in 2025 👇

Harmonic

Category: Real-time startup signal intelligence

Best for: Funds that rely on outbound sourcing and thesis-driven discovery

Pricing: Custom pricing (mid-to-enterprise range, often $10K+/year)

Harmonic is the closest thing venture has to a startup Bloomberg Terminal.

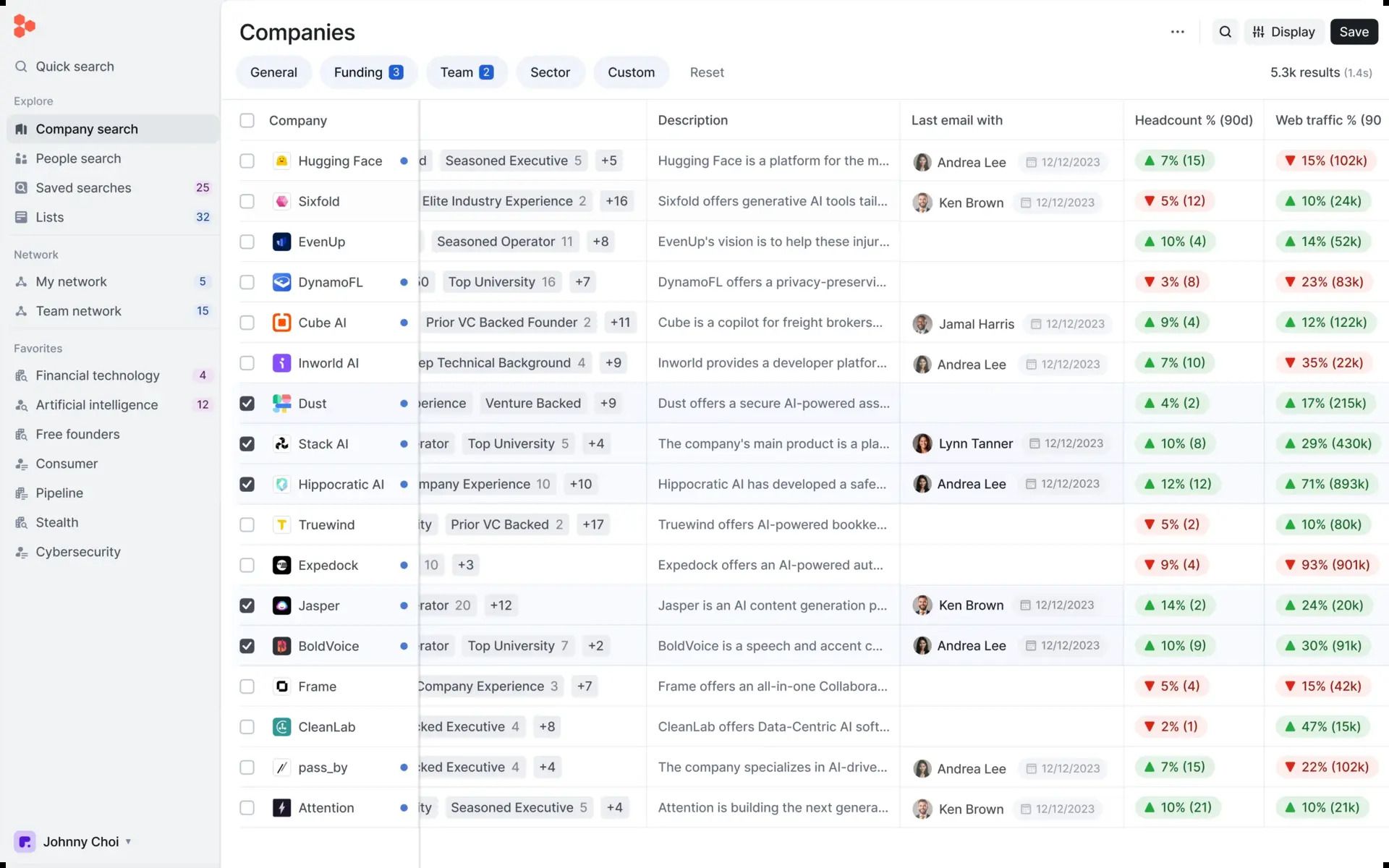

It tracks early-stage activity across 30M+ companies and 190M+ professionals, pulling in data from hiring boards, social profiles, product changes, and traction signals as well as integrating your teams’ network to surface promising companies — often before they raise a dollar or show up in the news.

What sets Harmonic apart is its depth of company-level signal intelligence. You can build filters like “first-time founders hiring engineers in industrial automation” or “AI startups with recent web traffic surges,” and Harmonic will surface relevant companies in real time. Many top funds run these workflows in tandem with CRMs like Affinity or internal platforms like Q (NGP Capital’s custom OS).

Beyond search, Harmonic powers outbound pipelines and systematizes research and evaluation with its new agent, Scout. You can deploy its Chrome extension for on-the-fly research, ingest bulk data into your internal stack, or build scoring models around hiring velocity and founder backgrounds. Firms like NEA, Pear, and Insight Partners rely on it as the backbone of their sourcing stack.

Pros

Real-time startup momentum data (headcount, hiring, web activity, founder info)

Highly customizable filters for verticals, geography, signals

Supports large-scale outbound workflows and pipeline generation

Cons

Requires analyst time to most effectively interpret data

Mid-to-high price point for lean teams

Harmonic is built for firms that treat sourcing like infrastructure. If you’re serious about identifying startups before the market does — and want structured, filterable data to power your outbound engine — it’s the most robust tool available.

Clay

Category: Data enrichment, outbound automation

Best for: Solo GPs, lean teams doing proactive sourcing

Pricing: ~$149–349/month

Clay is one of the most powerful tools in the modern VC sourcing stack and also one of the least VC-native. Originally designed for sales teams, Clay has quickly been adopted by investors who want to automate research, build prospecting lists, and reach founders before they’re on TechCrunch.

It’s essentially an API-connected spreadsheet on steroids. Users can feed Clay a list of companies, people, or keywords (or generate them with built-in sources like Google Maps, Product Hunt, or LinkedIn), and then enrich that data using dozens of integrations—LinkedIn, Clearbit, Crunchbase, Twitter, company websites, and more.

But what makes Clay stand out is how investors are using it creatively.

Take Sergey Plotnikov of Untapped Capital, who replaced his analyst workflow entirely with Clay. In one example, he built a pipeline of HVAC companies in North Carolina using:

Google Maps → to identify businesses

Clay + LinkedIn/Twitter enrichment → to pull owner data

Zapier → to auto-send cold emails or trigger LinkedIn messages

Airtable + Clay AI agents → to summarize founder bios

Other investors use Clay to monitor job changes (e.g., “left Stripe in the last 30 days”), track hackathon winners, or auto-generate deal memos based on scraped websites. And now, with embedded AI agents, you can even summarize founder backgrounds or predict industry fit automatically.

Pros

Incredibly flexible and powerful once set up

Lets lean teams act like they have a full analyst bench

Integrates with CRM tools (Airtable, HubSpot, Notion)

Supports advanced filtering, enrichment, and outreach flows

Cons

Not plug-and-play — setup takes technical skill or templates

Potentially overkill if you aren’t doing large-scale outbound

You’re on your own for compliance and email deliverability

Requires regular heavy maintenance to avoid messy results

Crunchbase + PitchBook

Category: Startup databases & market intelligence

Best for: Competitive mapping, verifying funding rounds, building founder lists

Pricing:

Crunchbase: Starts at $79/month

PitchBook: Enterprise only, typically $10K+/year*

These two are the backbone of traditional startup research, and while they’re no longer sufficient on their own, most investors still rely on them for validation and context.

Crunchbase is often used at the very top of the funnel: scanning new funding rounds, checking for founder contact info, and quickly sizing up company activity. It’s fast, relatively cheap, and has enough depth to support outbound targeting.

PitchBook, on the other hand, is built for deeper analysis: you get private market comparables, cap table breakdowns, valuation history, and exit data.

Pros

Reliable structured data for company, investor, and funding info

Crunchbase is budget-friendly and quick to scan

PitchBook offers institutional-grade insights and exportable reports

Cons

Crunchbase data can be stale or incomplete, especially for pre-seed or stealth

PitchBook is prohibitively expensive for smaller teams

Pitchbook’s coverage at pre-Series A stages is patchy at best

Neither tool captures truly early activity (before funding is public)

Most investors treat Crunchbase as a daily scanner and PitchBook as a research vault. If you’re a solo GP or lean fund, Crunchbase + LinkedIn might be enough. For platform teams or firms running heavy diligence, PitchBook is a necessary (but costly) upgrade.

LinkedIn Sales Navigator

Category: Social prospecting

Best for: Associates, solo GPs, anyone doing proactive outbound

Pricing: ~$99+/month

LinkedIn Sales Navigator remains one of the most valuable tools for finding early-stage founders, especially those operating in stealth.

It lets investors run advanced searches using filters like job title, company, location, and tenure. Popular strategies include tracking titles like “Founder” at stealth startups, or filtering for people who recently left top companies (e.g., Stripe, OpenAI, Google) to predict who might be working on their next venture. Some investors set up saved searches or alerts that trigger whenever someone in their second-degree network starts something new.

It’s also widely used to surface mutual connections for warm intros, reach out to operators-turned-founders, or create outbound lists for sectors of interest (e.g., all product leads at Series B AI startups).

Pros

Real-time, user-generated data — founders update profiles before funding news drops

Enables direct sourcing without needing a massive scout network

Relatively affordable and widely understood

Cons

High manual effort — requires crafting thoughtful filters and reviewing noisy results

Limited messaging volume unless you’re connected

Can become overwhelming without a clear search strategy

UI is not as advanced as some of the other options presented in this article

Sales Nav is helpful for anyone running outbound or trying to get visibility into stealth or pre-launch founders. It’s not flashy, but when paired with smart filters and regular monitoring, it consistently surfaces investable signals ahead of the crowd.

Affinity

Category: Relationship intelligence CRM

Best for: Multi-partner firms, platform teams, institutional seed or Series A funds

Pricing: Starting around $2,000/user/year (annual contracts only)

Affinity is one of the most widely used CRMs in venture, built specifically for investors who need to manage high-volume deal flow and internal network visibility.

Unlike general-purpose tools like Salesforce or HubSpot, Affinity automatically syncs with your email and calendar to track every conversation with founders, LPs, and co-investors. It also enriches contact records with external data from Harmonic, Crunchbase, PitchBook, and other sources, making it easier to stay updated on a startup’s latest raise or team change.

Think of it as your fund’s institutional memory: every email thread, meeting, and intro is logged and searchable, regardless of who on your team had the interaction.

Firms like Susa Ventures and Craft Ventures rely on Affinity to streamline their pipeline and maintain context across the team. “We like [Affinity] because it automatically pulls in data from Crunchbase and tracks recent emails and meetings between us and companies we’re talking to,” says Leo Polovets of Susa.

Craft, meanwhile, pipes inbound leads from tools like Harmonic directly into Affinity, where associates can claim and manage them.

Where Affinity really shines is in relationship mapping. The platform reveals who at your firm knows a given founder, how recently you’ve connected, and how strong the relationship is, helping turn cold outreach into warm intros and giving your team an edge in competitive deals.

Pros

Automatically syncs with your inbox and calendar (no manual entry)

Built-in integrations with Crunchbase and external data sources

Visual pipeline views, Kanban boards, and reporting tools

Ideal for tracking touchpoints across a growing team

Cons

Expensive — pricing starts at $2K/user/year and scales quickly

Performance can lag with large datasets or slow team adoption

If even one partner refuses to use it, the value drops

Not well-suited for solo GPs or lean teams with basic CRM needs

Sourcing product is insufficient for most venture teams

Cabal

Category: Network activation & founder support

Best for: Seed funds, platform teams, operator-led firms

Pricing: Free tier available; pricing scales with usage

Cabal isn’t a sourcing tool in the traditional sense, but it has become a quiet driver of referral deal flow by helping VCs actually follow through on their promise to be helpful.

The platform connects founders and their supporters (investors, advisors, operators) in a shared workspace. Founders can post specific “asks”, from warm intros to hiring needs, while Cabal helps investors track, fulfill, and log contributions. For VCs, it becomes a lightweight operating system for founder relationships, making it easier to support your portfolio and signal your value to others.

And that matters for sourcing. Helpful investors get talked about. Founders make referrals. Strong signal leads to stronger inbound.

Pros

Turns value-add into a repeatable, visible system

Encourages LPs, angels, and partners to surface intros

Lightweight and well-designed; doesn’t add bloat to your stack

Cons

Only works if founders and investors actively use it

Impact on sourcing is indirect — relationship compounding vs. pipeline filling

Less useful for cold outbound or net-new discovery

Cabal helps investors turn goodwill into momentum. If you’re building a fund around founder relationships, intros, and network leverage, it’s one of the best tools to stay top-of-mind and quietly at the top of the referral list.

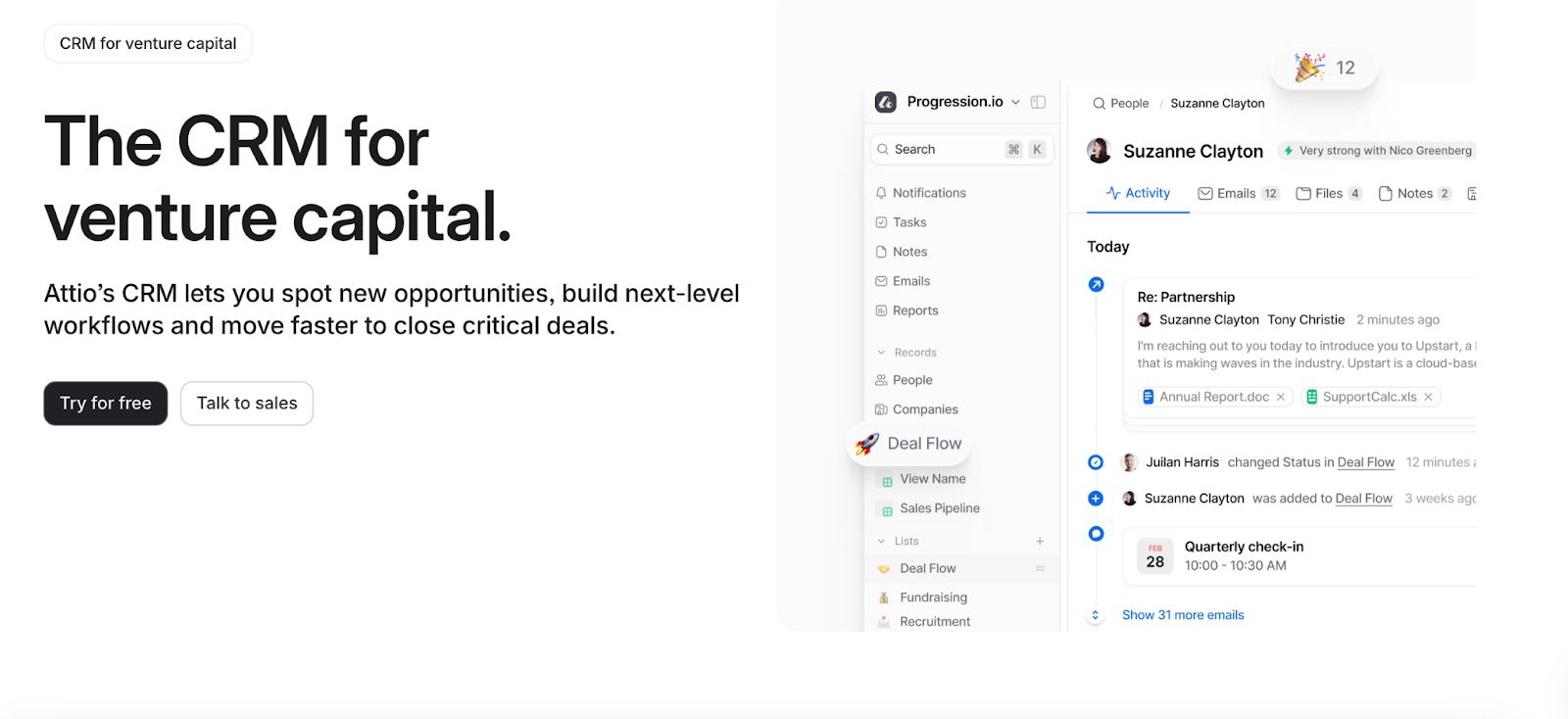

Attio / Folk

Category: Lightweight CRMs for investor workflows

Best for: Solo GPs, emerging managers, or small teams with <3 people

Pricing: ~$10–30/user/month

Both of these are lightweight, modern CRMs built for small VC teams. These tools offer 80% of Affinity’s functionality at a fraction of the price, ideal for solo capitalists or emerging managers managing sub-100 deal pipelines.

Attio auto-syncs with your inbox and calendar, then lets you build customizable pipelines with clean UX and real-time collaboration.

Folk focuses on intuitive tagging, contact enrichment, and flexible relationship views.

Both are built with small teams in mind, and both have growing adoption among lean VCs who need better than a spreadsheet but don’t want the overhead of a heavyweight CRM.

Pros

Affordable and fast to implement

Easy to customize for your firm’s workflow

Built specifically for relationship-driven teams (not salespeople)

Cons

Lacks some of Affinity’s network intelligence or integrations

No native analytics or reporting for more complex use cases

Support and stability can vary (especially with rapid product changes)

If you're running a lean shop and want to upgrade from Notion or Google Sheets, Attio and Folk are smart, modern options. They're fast, flexible, and built for exactly the kind of investor who’s doing most of their own sourcing and needs their CRM to keep up.

Slack & Discord Groups

Category: Community-based sourcing

Best for: Pre-seed and seed investors, sector specialists, and GPs with deep founder networks

Pricing: Free (invite required for most groups)

Some of the best early-stage deals in 2025 are being casually mentioned in private Slack and Discord groups before they ever hit a CRM.

Whether it’s a university alumni group, an operator collective, or a niche founder channel (think: “AI Infra Builders” or “Fintech Product Leads”), these invite-only communities are high-signal environments where new projects, soft-launches, and fundraising plans are shared organically.

Many investors set keyword alerts (e.g., “raising,” “cofounder,” “stealth”) and monitor channels for early signals. Others simply stay active — offering help, sharing insights, and earning trust that converts into deal flow later.

Pros

Direct access to under-the-radar founders before they fundraise

Relationship-driven, not reliant on outbound or databases

Works across sectors and geographies if you’re plugged in

Cons

Time-intensive; you need to show up and add value consistently

No structure—finding deals can be like looking for needles in haystacks

Access is everything: most high-value groups are invite-only

Slack and Discord are powerful ecosystems. If you're investing at the earliest stages and want to meet founders before they fundraise, embedding in the right communities is one of the most overlooked advantages in modern VC sourcing.

Airtable + Zapier (Custom Stacks)

Category: DIY dealflow management and automation

Best for: Technical solo GPs, lean teams, and funds that want full control

Pricing:

Airtable: Free–$24/month/user

Zapier: Free–$50+/month depending on usage*

For investors who want maximum flexibility without committing to a full-featured CRM, Airtable + Zapier offers a customizable, low-cost alternative. You can design your own CRM, track your pipeline, build founder dossiers, and even automate entire workflows, without writing code.

Many solo GPs and emerging managers use Airtable as their central deal dashboard and then connect it to Typeform, Gmail, Slack, or Notion via Zapier. For example:

A founder submits a pitch → auto-logged in Airtable

A deal moves to “Meeting” stage → Zapier creates a Slack thread + calendar event

Weekly digest of “deals in progress” sent to the team automatically

Here’s how Ben Tossell of Ben’s Bites has set his up:

Some GPs even plug in GPT-4 via API to auto-summarize inbound decks or scrape founder bios.

Pros

Total flexibility, design your stack around your exact process

Low cost compared to SaaS CRMs

Integrates with everything: email, Notion, Slack, LinkedIn, etc.

Cons

No out-of-the-box investor workflows; you have to build it

Can get messy without process discipline

Breaks easily if automations aren't well maintained

If you like building systems and want full ownership over your pipeline, Airtable + Zapier is one of the most powerful and scalable setups available. It’s not for everyone, but for GPs who are product-minded or data-driven, it turns your sourcing workflow into a competitive edge.

What Makes a Great Sourcing Tool

The most effective investors in 2025 have structured workflows that combine visibility, velocity, and relationships. They define what “good fit” looks like, set up smart filters, track activity across channels, and stay consistent in how they engage founders.

Great sourcing systems tend to share a few traits:

They surface early signals—like founder job changes, hiring spikes, and quiet launches—before those companies show up in headlines.

They match the team’s workflow, not the other way around. Tools are integrated into daily habits, making follow-ups, triage, and tracking seamless.

They make room for both data and relationships. Whether through Slack groups, warm intros, or advisory networks, human context stays central to how deals are sourced and evaluated.

They prioritize iteration. Teams track what channels are working, adjust their criteria, and refine the tools they use to stay sharp over time.

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

(Founder @ Confluence.VC | GP @ Outlaw)