Sponsored by

Good morning 👋

We asked yesterday about the “software-as-a-weapon” thesis from the Slow Ventures guys, and you all answered.

The verdict? You all disagree.

I guess time will tell.

Today we’re debating over geographical returns between the US and Europe with some data.

P.S. 💰 Are you a full-time investor?

TOP STORY

Europe vs. U.S. VC: What the data really shows 🇺🇸

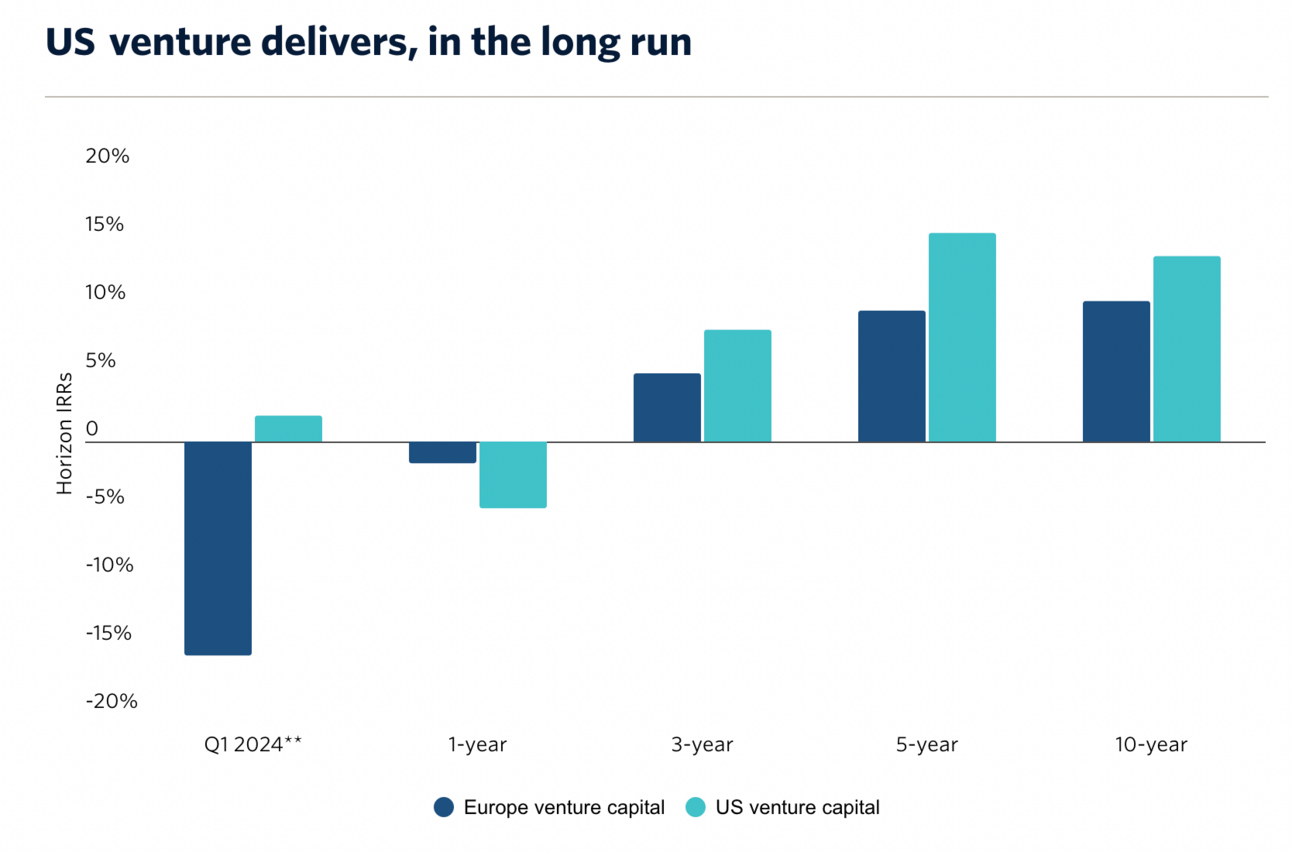

Venture capital returns are down across both Europe and the U.S., but the recent PitchBook analysis tells the real story with some more data.

On a one-year horizon, Europe’s IRR is -1.6%, outperforming the U.S., which saw -4.9%. Over five years, however, U.S. funds have delivered far better results, thanks to a larger market, stronger exit opportunities, and a faster recovery in valuations.

Why it matters: For LPs, geography plays a crucial role in shaping return profiles.

Europe’s short-term outperformance is linked to its steadier valuations and rising exit multiples, particularly post-2022 when tech stocks in the U.S. took a hit. In fact, during 2022, Europe's median exit multiple surpassed that of the U.S., reversing a decade-long trend.

The U.S. benefits from a more mature market, quicker exits (5.1 years versus 5.4 years in Europe), and historically larger exits, all of which bolster its long-term performance.

What happens next: Over a long enough time horizon, always bet on the US.

With median late-stage valuations jumping 43% in the U.S. in 2024, compared to a 2.8% decline in Europe, American funds are set to regain their edge. While Europe’s growing ecosystem and more conservative valuation approach have made it a safe bet in recent quarters, U.S. funds will likely pull ahead again as global VC markets stabilize and larger exits return to the fore.

For LPs, it’s a trade-off between Europe’s near-term stability and the U.S.’s potential for higher returns over the long haul.

Together with Vestberry

Is it possible to automate your VC portfolio reviews with AI? 🤖

Short answer: yes.

In fact, you can set up automatic weekly, monthly, or quarterly portfolio performance reviews using OpenAI along with tools like VESTBERRY, Slack, Calendly, and Gmail.

✅ Stay updated on your portfolio's performance

✅ Provide timely support to your portfolio companies

✅Give yourself (and your portfolio) more leverage

LINKS

❤️ Do You Love the Game?: If you don’t, you probably won’t beat the next person who does

🖖 The Messy Middle: Mostly Metrics says it sucks to be selling software between $50K-$100k right now

🏡 Anatomy of High-Converting Homepages: Oliver Kenyon of CRO, offers a how-to graphic

🦄 Unicorn Execs Stick Around…But Not Always for Long: Look at what this Stanford study, posted by Ilya Strebulaev reveals

🌱 List of Startups Fundraising for September: Learning VC lists entrepreneurs and startups in the midst of their fundraising endeavors

TWEET

HEADLINES

What else we’re reading

3 charts: Startup founders and VCs find more equal footing (Pitchbook)

Carbon Capture, Storage And Transformation Is Still A Popular Funding Theme (Crunchbase)

Sequoia backs Pydantic to expand beyond its open source data-validation framework (TechCrunch)

Y Combinator is being criticized after it backed an AI startup that admits it basically cloned another AI startup (TechCrunch)

The journey to fully autonomous AI agents and the venture capitalists funding them (ZDNet)

Together with 1440

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay