Good morning 👋

Miami and Omaha.

Arguably two of the most different cities in the US. Visit both in week, and you’ll think you’re in a different countries.

One had an F1 event over the weekend. The other had an investment conference.

Guess which one we’re covering.

(The F1 race looked *great* too.)

This week's episode is brought to you by … Confluence.VC Recruiting.

Let’s be honest. Hiring investors SUCKS.

You blast out a JD you copied from other online postings, get flooded with applications from unqualified candidates through LinkedIn, and you’re left filtering through a stack of trash hoping to find a gold nugget.

Hope is not a strategy, and this is not how great teams are built.

We run the investor hiring process from start-to-finish, and we help funds find, vet, and hire from the top community of venture talent. No more trash digging; gold just shows up at your door.

Let’s get into this week’s piece.

This Week in Venture

Woodstock for capitalists takeaways 🧠

Berkshire Hathaway held its annual meeting in Omaha over the weekend.

Tens of thousands of people fly in every year to hear Warren Buffett and Charlie Munger give their two cents on the current state of the world and where we are going from here.

Why it matters: There is a lot of doomer news floating around, and in case you’ve been living under a rock, investing isn’t easy anymore.

Buffett and Munger have lived through more market cycles than just about anybody, and there’s a reason people turn to them when they don’t know what to do.

Here are some of the main takeaways they both mentioned during the event. Let us know in the comments if you disagree with anything here.

The dollar is NOT losing its reserve status. This is contrary to popular belief nowadays.

Banking issues will continue; depositors won’t lose their money. The government and FDIC have made it clear that they will do whatever is necessary to maintain trust in the system even if that system is showing cracks.

Sometimes diversification is “de-worsification”. Spreading yourself too thin does nothing good, and this applies to investing as well. Munger argues you should find less opportunities where you have more conviction.

America is still worth betting on. Buffett made the majority of his wealth betting on the future of the United States. That country today looks very different than it did 50 years ago, but Buffett still believes the US will prosper looking ahead.

Value investing opportunity comes from other people doing stupid things. The two also believe that more people are making more stupid mistakes today. This means there should be more opportunities in the coming years for those looking to buy value at a discount.

Humans > AI. Both see AI changing every industry (notably more robotics being used in industrial fields), but it won’t replace human ability any time soon.

What happens next: We wish we knew.

Every year this event is a good reminder that:

The media is designed to sell fear, and things are rarely as bad as they tell you to believe.

You’re not as smart as you think you are.

The best investors have the longest time horizon.

VCs predict the future 🔮

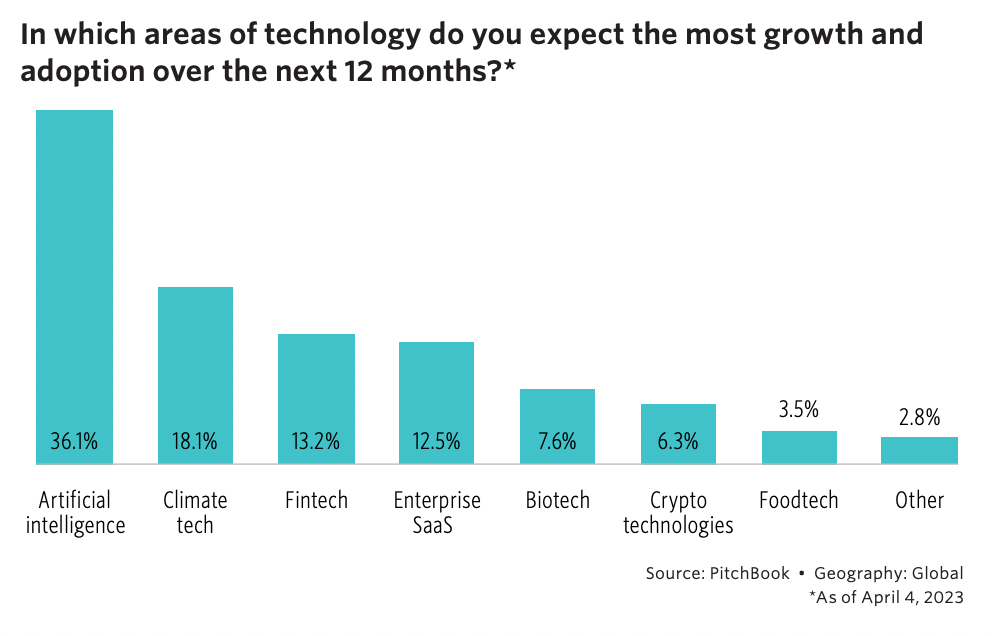

Pitchbook released its bi-annual tech survey last week, and the results are in.

If you’re betting on the future and want to follow the advice from other people that do it for a living, bet on AI, climate, fintech, SaaS, and biotech.

Why it matters: For anybody working within venture, none of this should be news.

ChatGPT and generative AI are here to stay, and there are potential use cases for nearly every business. Adoption has already happened at the beginning of the adoption curve, and now we wait for the laggards to catch on.

Climate is benefiting from regulatory and consumer demand shifts. We wrote a few weeks back about funding drying up within climate tech, so we’ll see if the sentiment changes.

Fintech remains popular even though fintech companies are flopping in public markets. We’ll see if that changes sentiment too.

Enterprise SaaS is proven, and we’re most bullish on this type of business. SaaS multiples are down, but subscription revenue will never go out of style.

What happens next: Some of the best investors follow a simple strategy of avoiding competition. If you want to be contrarian, you’ll have to find a different area of expertise outside of the ones mentioned above.

General interest brings dollars, and dollars brings competition. Competition is good for companies fundraising and terrible for investors trying to get allocation; you’re left bidding up based on hype and FOMO, and an inflated entry price makes it harder to achieve venture-like returns.

We think there are going to be winners coming out of the generative AI and climate 2.0 booms.

We also think there are going to be a lot of dollars burned on fire chasing those winners.

Links We Like

📶 Meritech Public SaaS Comparables Table: One of the better datasets we’ve played around with for benchmarking

📈 Bootstrapping to 2m+ Users With Zero Employees: Great case study on how to scale without hiring staff

🤮 The Worst Part About Media Businesses: What they don’t tell you

< Fewer, But Better Is The Secret: F-O-C-U-S

⚕️ Levels Updates: Levels does millions in revenue and shares all of their investor updates publicly

🏰 Building a VC Firm That Lasts Centuries: The partners at Bessemer share what has worked for them

🎯 Commonapp.VC: Where companies go to boost their odds of raising from investors

Have an article you like that we should include in this section? Let us know by responding to this email.

What We’re Learning

Software feature breakdowns for beehiiv + takeaways on how to structure a high-ROI referral program

We use beehiiv to power our newsletter. We’ve been pretty vocal about how much we like their product.

They run an ELITE partner program where customers can make money promoting the product, so we figured why not get paid doing something you’re already doing for free.

If you’re using Substack or another newsletter tool, we think you’re making a mistake. The videos in this playlist will walk though why.

As partners, we’re learning a lot about how to structure a referral program. If you’re thinking about building any sort of affiliate program for your product or service, here are some of our top takeaways:

Provide an income calculator on your affiliate signup page. Make it easy for people to quantify how much they can earn as an affiliate partner, and you’ll be rewarded with more applications to start spreading the word.

Make the upside worth it for the affiliate. If you want people to pitch your business, give them a reason to. Offering credits is way less desirable than offering cash, and if you you’re offering cash, make sure it’s enough to justify it. (Most affiliate programs we’ve seen hand over 20-30% to the affiliate; beehiiv shares 50% over the first 12 months.)

Recurring commission > one-time commission. The best partners are long-term partners, and structuring commissions to be recurring instead of one time encourages long-term relationships with the right partners. This isn’t the right affiliate model for most services, but it makes more sense for subscription businesses.

Provide a public leaderboard. People like to compare themselves to others. Affiliate leaderboards take advantage of this and reward those that are most active as affiliates.

Make it as easy as possible to share by providing different content ideas for affiliates. Different buyers have different buying processes. If you’re running an affiliate program, it’s up to you to understand the buyer journey for your ideal customer and build content to navigate that journey. Some ideas that beehiiv shares with its partners includes:

Benchmarks / industry data

Platform comparisons between competitors

Onboarding / how-to info on beehiiv

Growth tips and strategies for newsletter writers

Proof through case studies and testimonials

Tools: beehiiv

Related reading: 7 Best Newsletter Hosting Tools in 2023

Tweet of the Week

What happens next

History doesn’t repeat, but often rhymes.

This is what happened the last time we had a financial crisis similar to the one we’re dealing with now.

Do with this information as you please.

Together with Brex

Wait … you guys manage your spend?

Obvious statement alert: managing invoices and team spend is a nightmare.

Chasing down receipts, uploading to a spreadsheet, sending to another team to approve, and reimbursing your employees sounds … super fun.

Brex takes this archaic process from the Stone Ages to the modern era by giving finance teams the tools they need to operate. Dashboards, automations, integrations, and financial modeling instead of manual work that makes you want to reconsider jobs.

Member of the Week

Bernardt Vogel (Investor @ VU Venture Partners)

Want to be featured next week?

How'd we do this week?

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.