Good morning 👋

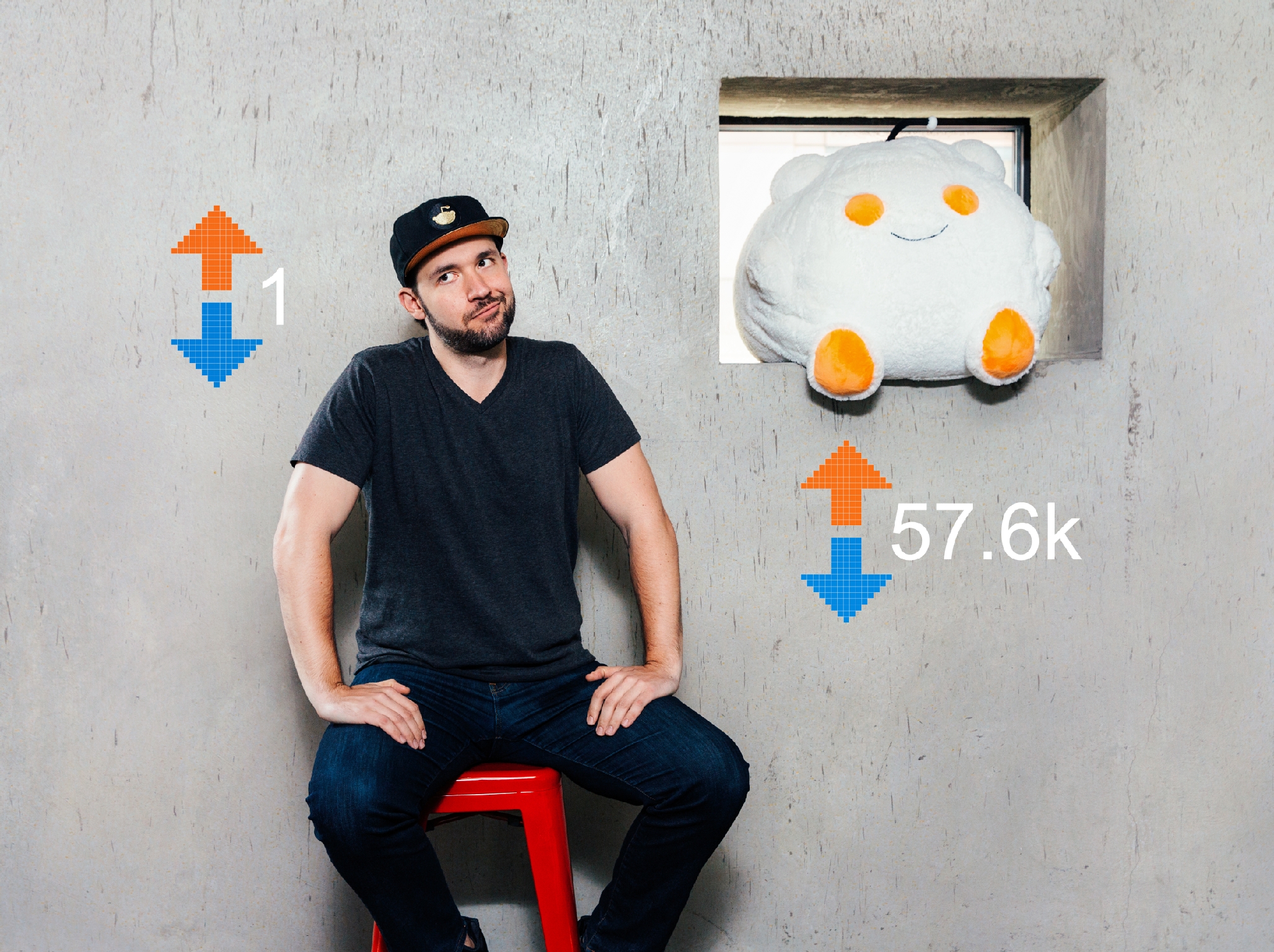

This week’s deep dive is on Alexis Ohanian (@alexisohanian), founding partner at Seven Seven Six. He’s also the founder of Reddit and former general partner at Initialized.

He’s one of the most successful operators-turned-investors of all time, and his career arc is very different than most of the other investors we have studied.

Here are 19 lessons from studying Alexis and his career.

Explore all investor deep dives here.

LESSONS

Your reputation as an investor matters more than anything else. In other words, your current reputation is a proxy for future returns.

Having people in your corner who have done this before is the ultimate competitive advantage for early-stage founders. Doing it all yourself is playing on hard mode.

Identify the most important metric(s) worth tracking to measure company success. Put this number everywhere so that decision-making revolves around optimizing it.

Process design is a superpower. Build internal systems that scale and open you up to do non-scalable work.

You get tunnel vision when you work on a problem 24/7. Seek advice from people who will tell you the hard truths about your work.

CMOs are in charge during boom times; CFOs are in charge during downturns. Especially during economic downturns, people become more aware and sensitive to where and who they support with their money.

Early-stage VC is the only profession where insider trading is legal. If you don't have a structured way to store information and identify opportunities, you have no chance at generating alpha.

Your first 100 users will determine the direction of your company. Make sure that you have done everything you can to make them happy.

You should often be asking more questions rather than giving advice. This is advice for building companies and life in general.

QUOTES

"In the early days, you should be only doing two things: writing code or talking to users."

"Most VCs don't realize that they are in the net promoter score business, and that is what matters most."

"The goal is not getting the next level of fundraising. The goal is growing the business so that that next level of fundraising can be plausible."

"If you're beholden to advertisers, it limits you so much in what you're able to build."

"Focus on the things that you can control. Work as hard as you can to improve on those things. Spend as little time as you can worrying about things you can't."

"As a mentor, it's not enough to be a complacent figure giving advice."

"Be judicious about what merits your time."

"Choose mentors, investors, advisors, who have broad vantage points and long histories of watching companies rise and fall. You want folks who have seen enough to know they’ve seen too much, and who will talk you into pushing yourself as a result."

"The most impressive communities grow by delivering more people the content they already love faster."

"If it hurts, enjoy it, because that’s what growth feels like.”

4M+ professionals read this free business newsletter.

Welcome to Morning Brew, where staying informed doesn't mean hitting snooze 😴

Every day, Morning Brew’s team of expert writers craft a newsletter packed with quick, witty, and digestible insights on top business news. We keep you in the know—and fit seamlessly into your morning routine.

Best part? It’s 100% free 💥

READING

Similar investor lessons:

REFER

Earn free stuff 🎁

You can get free gifts by telling your friends and family to sign up 👇

{{rp_personalized_text}}

Copy & paste this link: {{rp_refer_url}}

PREMIUM

Where VCs go to get lucky 📶

Every investor is chasing the same thing …

10x returns.

But what all needs to happen to make that a reality?

Short answer: some luck

Longer answer: being in the right places to attract luck

It’s application-only, and every new member is a vetted member of the VC ecosystem. Once inside, members get access to a knowledge library, member directory with 2,000+ other investors, an investor-only Slack group, and private deal flow with hundreds of decks and investment memos.

The best part?

The basic membership is free (as long as you’re approved), and the premium plan offers a 30-day free trial.

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

P.S. We recently revamped our Analyst-as-a-Service offer.