Good morning 👋

There was drama in the startup world last week when it came out that Carta was probably allegedly using inside info from their cap table product to pitch investors to sell their shares using another one of their products.

In this week’s piece, we’ll break down what happened, why it matters, what we think happens next, plus the best of what we found last week.

TL;DR:

NEWS

CartaX calls it quits 🛑

Last week, Carta announced it would be exiting its secondaries exchange business.

For those who missed the news, here’s how it played out last week.

Timeline:

January 5: Linear CEO Karri Saarinen posted on X that one of his angel investors received an email from a Carta employee, pitching a sale of their shares.

January 6: Henry Ward (Carta’s CEO) admitted the company messed up.

January 8: Carta announced it would be getting out of secondary stock trading.

Why it matters:

Everybody knows Carta as the cap table management software. CartaX was their moonshot project meant to make the company even more powerful.

The original vision was to become the "Nasdaq for private markets".

The high-level plan was to:

Capture cap table information (who is in each deal) through Carta

Use that data to track which companies are appreciating in value and which investors are seeing paper gains

Use that information to create a secondaries marketplace for investors to create liquidity for themselves

But the project never caught on as they had hoped, and founders started to see right through the conflict of interest. (There is signaling risk every time shares trade hands, so founders generally are not big fans of secondary sales.)

According to Ward, CartaX was generating around $3 million in annual revenue, less than 1% of its annual revenue of about $373 million.

What happens next:

Carta evaporated a lot of goodwill last week.

We think their $8.5 billion valuation will take a hit (both from the reduced growth projections without CartaX along with the assumed loss of business in their core business as companies look for alternative vendors.

But we also think that there needs to be a better solution for LPs to get liquidity without riding an investment through an IPO or acquisition. It looks like that will have to wait, and we’re stuck with other existing options for now.

LINKS

👀 How to break into VC: Ryan Hoover gives the best answer we’ve seen

🍷 The Puritans of Venture Capital: What changes when venture stops becoming a cottage industry?

🔮 10 VC predictions: A partner makes his predictions about the future of VC

👉 Private communities vs. memberships: Greg Eisenberg breaks it down

✉️ Permanent Equity’s Annual Letter: How to think about last year and the year ahead

🤝 How to negotiate like an MD: The latest from @privateinequity

REFER

Earn free stuff 🎁

You can get free gifts by telling your friends and family to sign up 👇

{{rp_personalized_text}}

Copy & paste this link: {{rp_refer_url}}

JOBS

Finding your next role in venture 📌

Featured venture jobs

Greycroft is looking for an associate in LA

Energy Impact Ventures is looking for an investor in NY

Forum Ventures is looking for an analyst in NY

Mucker is looking for a senior associate in Chicago

Capital Factory is looking for an IR coordinator in Austin

P.S. 👉 If you’re hiring investors …

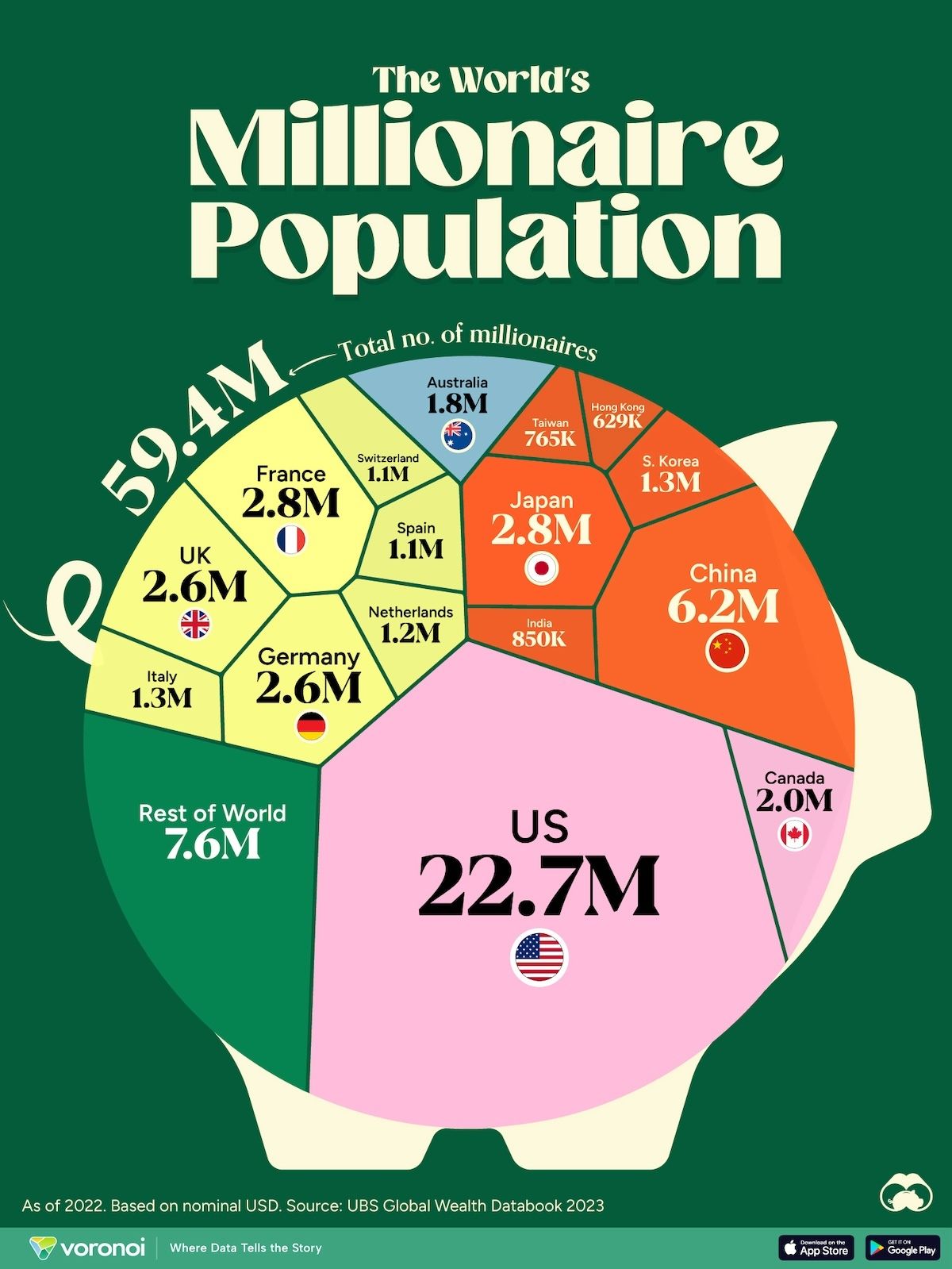

VISUAL

RECS

Sponsored

Last Money In - Newsletter on Venture Capital Syndicates

Written by the global leaders in venture capital, we’ll teach you how to how to break into VC, become a better startup investor and gain access to the venture capital ecosystem.

Sponsored

Big Desk Energy

startup insights, stories, and vibes sent to your inbox every Tuesday

TOOLS

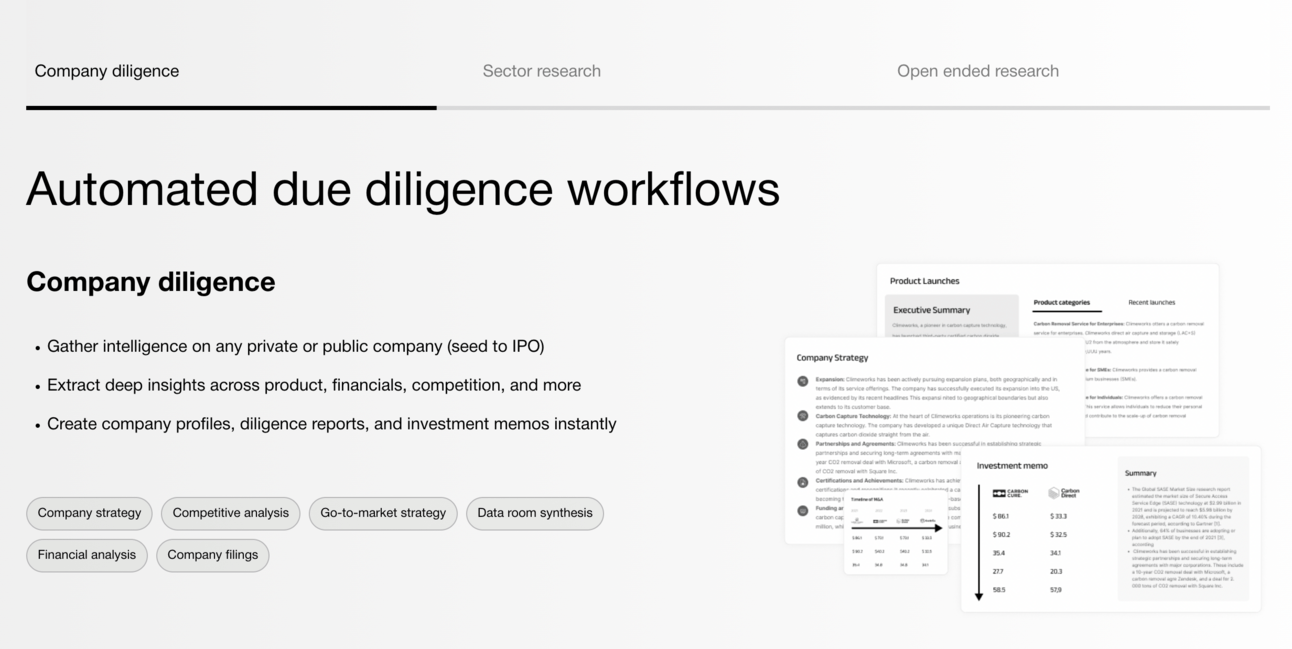

Academic-style research reports in minutes 📋

Investors are always looking for an edge.

Automate research, company info extraction, and other parts of the DD process.

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay