Good morning 👋

And happy hump day to those who celebrate.

If you’ve talked to other seed investors, you’ve probably heard about some of their frustrations.

Everything is expensive, pricing is out of control, and it’s become harder and harder to find high-quality seed deals without paying up to get an allocation.

Peter Walker from Carta has broken down some data on seed valuations, and we give our two cents on how things are trending in today’s piece.

Let’s get into it.

P.S. 🎧 We’re giving away a pair of Airpods Pro 2 to one lucky reader …

Whoever refers the most new subscribers this quarter (ending June 30) will win a brand new pair of Airpods on us.

Today’s highlights

Seed rounds are more expensive than they’ve ever been

Craft is the antidote to slop

The OpenAI mafia

Lessons from Roelof Brotha

TOP

How much is a seed?(!)

The general consensus from all of my seed GP friends is that the signal-to-noise ratio at seed investing is off the charts right now.

Too much multi-stage capital

Push for earlier entry prices from AUM firms who view their seed portfolio as option bets

An abundance of first-time founders who have not thought through the effects of overpricing yourself with your first round of capital

Every founder says they are optimizing for great capital partners and average dilution until somebody comes in with a higher price on a competing term sheet.

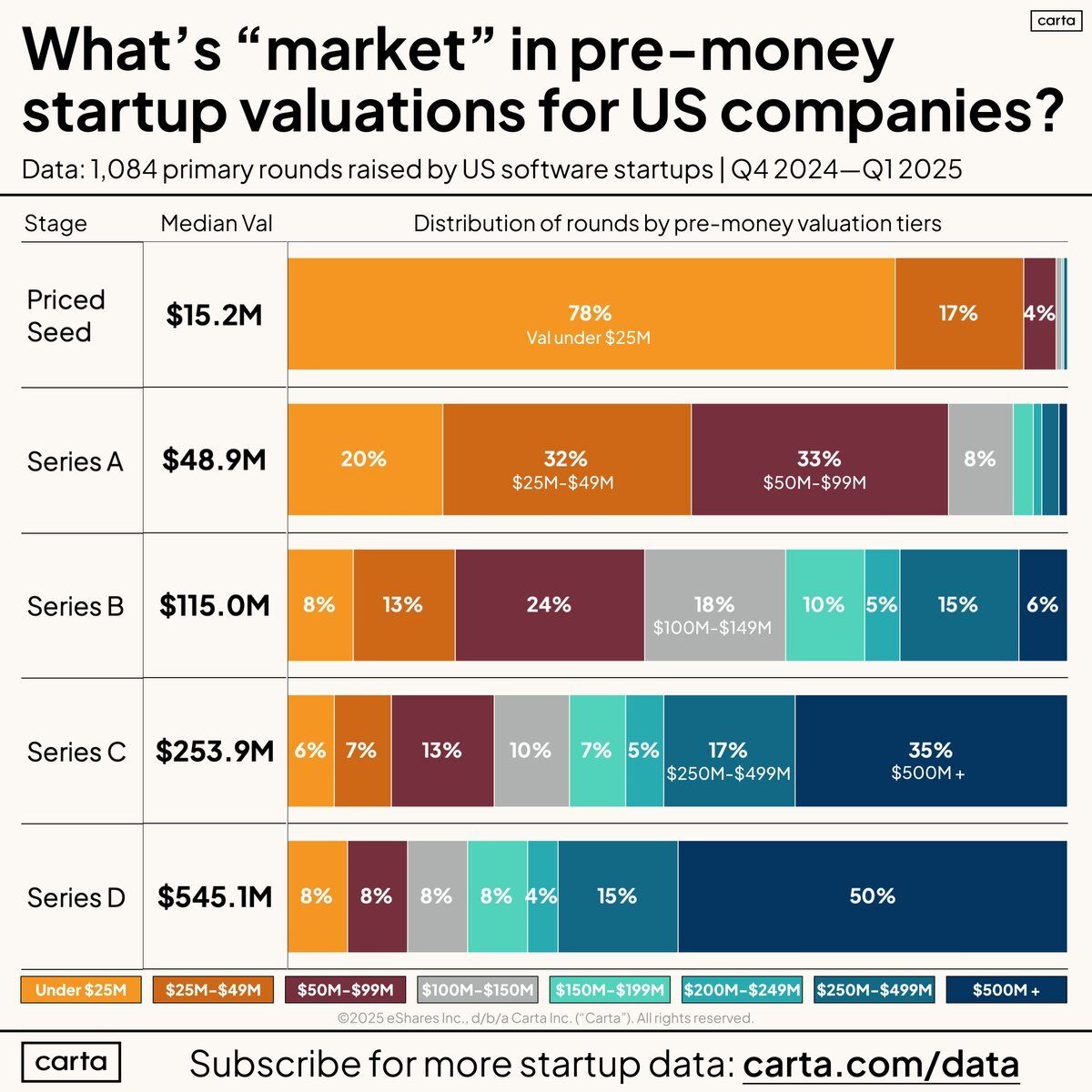

As Peter notes in his research, the $15.2m median valuation for seed deals is the highest it has ever been.

Maybe this self-corrects. Maybe it doesn’t.

Either way, here’s why I think it’s an idiotic to auction your company at the seed:

You optimize for the wrong capital partners (dumb money). The best investors I know do not chase FOMO, and the VCs you actually want on your cap table will walk if your valuation does not match your company progress. By prioritizing the highest valuation for your seed round, you have ironically adversely selected your cap table.

Sales multiples at the seed are not the same sales multiples at the A. Sales multiples come down as a business matures, and I can promise that the sales / EV ratio investors were willing to overpay for an allocation to your seed is not the same ratio that Series A investors will be willing to pay. As this ratio gets smaller, your sales numbers must get larger, and this puts more and more pressure on teams to execute on their already-aggressive GTM plans.

You adds tons of future signaling risk if and when your company does not grow into the revenue assumptions needed to hit your next funding milestone. If seed investors are betting on your ability to grow into your unrealistic valuation, what do you think happens when you inevitably struggle to do so? They are not there to follow on, you have set yourself up for a down round, and you have to find a new set of investors who are willing to reprice your business (at a much more realistic valuation).

TWEET

HEADLINES

The OpenAI mafia: 15 of the most notable startups founded by alumni (TechCrunch)

Crypto fuels uptick in European fintech VC investment (Pitchbook)

Tomasz Tunguz: Secondaries as the new IPO is no passing fad—it’s a VC evolution (Fortune)

Venture Firm Thrive Bets on Buying Firms That Can Benefit From A.I. (NYT)

RECS

Insider: Get investment memos, market maps, behind-the-scenes updates, and other things we don’t send to the rest of the list.

Need more of a reason? Get your first investment memo from us delivered to your inbox for free. Don't like it? Don't pay. (Here’s how)

Operator: Get everything in Insider plus all of the best tools, data, and other resources we have used to build this business.

Still on the fence? Get 20% off all of the best tools, data, and other resources we have used to build this business. (Discount linked here)

Boardroom: Add our team as fractional problem solvers (whenever you need it).

Need proof first? Tell us a little about you, your business, and where you are stuck, and then we can book some time if we can help you. (Submit form here)

LINKS

⓴ Lessons from 20 Years of Venture Capital—Roelof Botha: Managing Partner at Sequoia Capital speaks with The Generalist about what it takes to see the future first, capitalize on it, and help founders build enduring companies

♟ KYVC—Know Your VC: Mostly Metrics breaks down the spectrum of VC strategies and what they mean for founders

🌎 AI in Procurement: Now is a good time to be a founder or investor in the global procurement market

🖼️ 6 Storytelling Frameworks Every Entrepreneur Needs To Know: Chris Donnelly provides the framework that will help entrepreneurs tell their story and connect with their customers

📶 How AI Invests: Brad Gillespie, GP @ IA Ventures in NY, shares his process of what he looks for in companies, how he invests, how he works with companies, and how he communicates

REFER

Win a free pair of Airpods Pro …

Refer more than other readers between now and June 30, and we’ll send you a paid on the house👇

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

(Founder @ Confluence.VC | GP @ Outlaw)