Good morning 👋

And Happy Easter! We’ll be taking Monday off to celebrate.

Earlier this week, I told you I was deep into reconfiguring a fund model.

Instead of keeping all of that work to myself, I figured I’d share it publicly to show you what all needs to happen behind-the-scenes in order to hit 3x DPI for a fund.

Here’s the math …

ICYMI: Did you know you can get free stuff from us just by telling your friends to subscribe?

We’ve even made a how-to guide that shows you how some other readers have unlocked more and more free stuff from us …

Today’s highlights

A deep dive on portfolio construction

How to get a free investment memo from our team

OpenAI is buying Windsurf

TOP

how to 3x a fund 👇

I spent the first few years of my venture career not fully understanding everything that needs to happen in order to actually make money in this game.

Knowing what I know now, it has changed the way I approach early-stage investing.

So I’ve spent the week reconstructing my own model from scratch to help you think more clearly about some of the assumptions and requirements needed from a fund to 3x distributed capital back to LPs.

If you have any thoughts on the model, want to see more of my math, or just want to talk portfolio construction, shoot me a reply here.

**This assumes no recycling for simplicity. In this example, 20% recycling will result in a 3.49x DPI.

Fund Basics:

Fund Size | $ 10,000,000 |

|---|---|

Carry | 20% |

Management Fee % (over life of the fund) | 20% |

Expenses | $ 500,000 |

Total Fees | $ 2,500,000 |

Capital Deployed (w/o Recycling) | $ 7,500,000 |

Fees + expenses eat away 25% of the fund.

You are left with $7.5m in investable capital.

Reserves:

Fund Reserves % of Capital | 20% |

|---|---|

Fund Reserves $ of Capital | $1,500,000 |

Power law outcomes suggest that you want to own as much of your winners as possible.

At the same time, smaller funds = smaller checks, smaller checks = earlier bets, and earlier bets = harder to find “winners”

Allocation Strategy:

Pre-Seed % of Capital | 35% |

|---|---|

Pre-Seed $ of Capital | $ 2,100,000 |

Seed % of Capital | 35% |

Seed $ of Capital | $ 2,100,000 |

Series A % of Capital | 30% |

Series A $ of Capital | $ 1,800,000 |

Some investors prefer to only operate at one stage; others want to be multi-stage.

Splitting capital contributions across different stages creates different investment durations (longer holding periods for pre-seed investments; relatively shorter holding periods for Series A investments) .

Investment Assumptions:

Check size matches stage of the company, and average checks equate to ~1% of each business at time of investment.

What is not shown here is the difference in diligence process and the amount of time required for different strategies:

Less to underwrite at pre-seed = faster decision-making process

More to underwrite at Series A = slower decision-making process

Dilution is assumed to be steeper the earlier you invest.

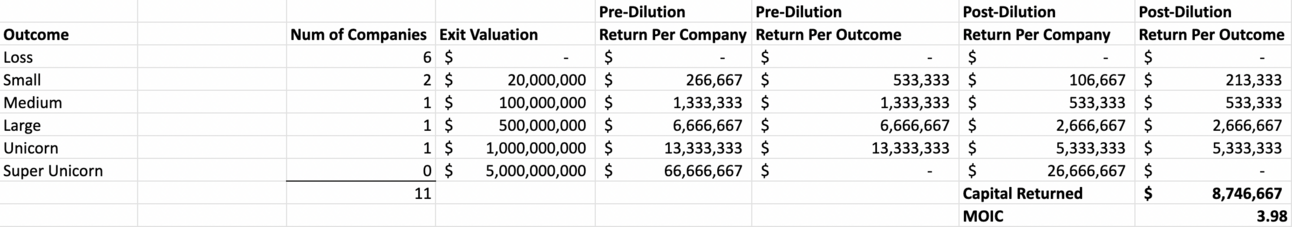

Outcome Assumptions:

The majority of investments will create losses, some will create small wins, and the bulk of distributions come from a small amount of winners.

This is most evident in the % of total proceeds where ‘Large’ and ‘Unicorn’ outcomes drive ~90% of the proceeds for the fund.

Especially as a first-time fund manager, the consensus opinion is that you need to create enough opportunities for yourself to get lucky (maximize shots on goal), and in this example, we have 39 shots.

The average holding period for different outcomes will be useful later on when you want to start showing IRR to market fund performance.

Pre-Seed Outcomes:

Most go to 0, but this is expected. (If will get first looks at that founders’ next company if you aren’t a terrible capital partner.)

The small and medium outcomes do not move the needle enough to alter returns.

The emphasis comes down to backing one large exit ($500m) and one unicorn ($1b+).

Side note: The pre-seed investors that have actually had this level of success are not solely “picking” the companies they work with. They are active investors, and they are doing everything they can to give companies better odds of success.

Seed Outcomes:

Similar to the above, returns come from two types of outcomes. Modest exits are not considered “wins”.

Side note: Seed and pre-seed investing are the most collaborative stages of venture. If deal flow is currency, the best positioned seed investors are usually the ones with the deepest relationships with other seed investors that can trade information with.

Series A Outcomes:

In this example, Series A investments have roughly the same allotment of capital as the other two stages, but only four investments due to the larger average check size.

The bar for Series A’s is higher, the loss ratio is lower, but the emphasis on finding power law outcomes stays the same.

Follow-On Outcomes:

Follow-ons allow you to trade on information arbitrage if you have early access to a portfolio company breaking out.

The issue with too high of a reserve ratio for this size of fund is that each reserve check takes away multiple pre-seed / seed checks, and so the tradeoff we are making in this example is a smaller reserve strategy in order to write a larger coverage of first checks.

Fund Totals:

Capital Returned | $ 34,680,000 |

|---|---|

Capital Returned to LPs | $ 29,744,000 |

Capital Returned to GP | $ 4,936,000 |

MOIC | 4.62 |

DPI | 2.97 |

Gross IRR | 23.79% |

Net IRR | 16.41% |

MOIC = Capital Return / Investable Capital

$34,680,000 / $7,500,000 = 4.62

DPI = Capital Returned to LPs / Fund Size

$29,744,000 / $10,000,000 = 2.97

Gross IRR = MOIC ^ (1 - Avg Hold Period to Exit) - 1

4.62 ^ (1 - 7.18) - 1 = 23.79%

Net IRR = DPI ^ (1 - Avg Hold Period to Exit) - 1

2.97 ^ (1 - 7.18) - 1 = 16.41%

Other Notes:

Most venture math is not meant to be put into a spreadsheet. Hardcoding outcomes is a fool’s game, and I recommend building scenarios (Bear, Base, Bull) to model out how the math changes for different levels of success.

Recycling changes the math. I would recommend duplicating a separate tab to show how the math changes with this assumption.

This assumes a 10-year fund lifecycle although many of the largest companies are opting to stay private longer. Staying private longer bumps up average holding period to exit which bumps down gross and net IRR. (Secondaries are providing more liquidity to get around this, but this is a separate tangent.)

This does not factor in time and taste required to run this strategy. If you assume a 4-year investment period, one GP, a 2% selection rate on pre-seed and seed investments and a 1% selection rate on A’s, that equates to 500 targets screened a year. That equates to roughly ~250 hours of screening calls before any hours are put towards additional diligence, support, running the fund, etc.

If you have any questions or want to talk about this more, shoot me a note here or at [email protected].

Together with Velvet

Milken, Beverly Hills, private soirée …

Our friends at Velvet are throwing a private event for investors, family offices, and celebrities for Milken this year.

We’re not big fans of “events”, but this one is different.

A panel on the convergence of venture + entertainment

Live DJ set by Autograf

Charity auction

Spots are limited, so secure yours before they sell out …

RECS

Insider: Get your first investment memo from us delivered to your inbox for free. Don't like it? Don't pay.

Operator: Get 20% off all of the best tools, data, and other resources we have used to build this business

Boardroom: Get access to our team (whenever you need it)

Confluence.VC courses: Pay less for all of our courses and info products

HEADLINES

OpenAI is reportedly in talks to buy Windsurf for $3B, with news expected later this week (TechCrunch)

Elite university endowments confront a ‘parade of horribles’ (Pitchbook)

AI eats up 58% of global venture dollars as fear of missing out drives up dealmaking (Pitchbook)

'Fully Replacing People': A Tech Investor Says These Two Professions Should Be the Most Wary of AI Taking Their Jobs (Entrepreneur)

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

(Founder @ Confluence.VC | GP @ Outlaw)