Presented by

Good morning 👋

You’ve heard that software is eating the world, but we’ve reached the point where software (companies) are now eating VC.

Microsoft, Amazon, Nvidia, and Google are aggressively investing into startups, and they’re doing it on their terms.

We break down those terms, give out two cents on why it matters, and predict what happens next in this week’s piece.

P.S. In case you missed it …

We’ve rebuilt our Analyst-as-a-Service offer.

If your fund can’t afford to hire a full-time person but you still need to get things done, this is for you. Here’s how it works.

We’re limited with the number of funds we can work with, so let us know if you need a hand and want to start working together.

TL;DR:

NEWS

New VCs in town 👀

Microsoft, Amazon, Alphabet, and Nvidia have officially started their takeover of venture investing.

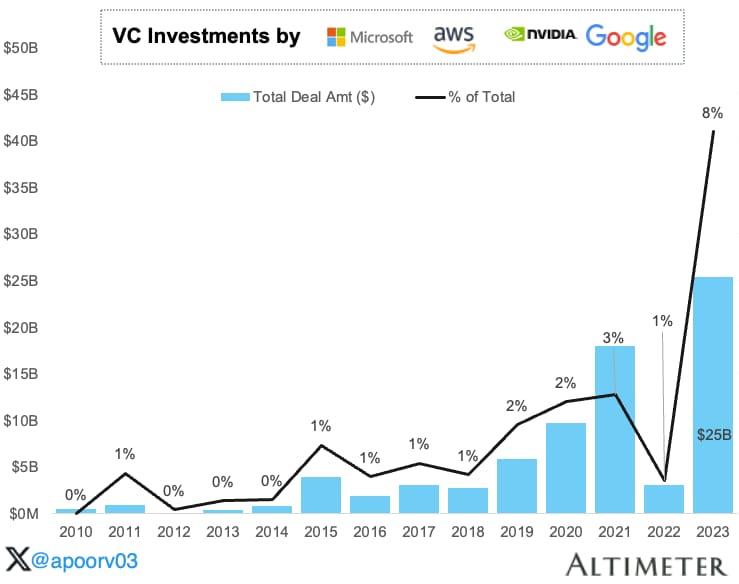

In 2023, ~8% ($25+ billion) of the total venture capital raised in North America came from at least one of these CVCs.

This is a huge trend for the entire startup ecosystem, but it should be TERRIFYING for traditional VCs.

Why it matters:

The amount itself is staggering, but the structuring of these deals is what really matters.

Instead of traditional equity financing, most of the capital commitment is in the form of cloud credits (not cash).

“Only a fraction of Microsoft’s $10 billion investment in OpenAI has been wired to the startup, while a significant portion of the funding, divided into tranches, is in the form of cloud compute purchases instead of cash, according to people familiar with their agreement.”

These cloud credits are then used by the companies to save costs on computing (one of the largest costs especially for LLM companies).

In other words, nearly half of the capital committed in these rounds translates back to revenue for each of the corporates financing these companies.

In the short term, this allows Microsoft, Amazon, Alphabet, and Nvidia (MANG) to create a circular loop that boosts their top line while making these venture-backed companies more reliant on their own services. Not to mention, it also gives them an edge to win deals over other VCs who can only offer capital and ~their value~.

In the long term, this creates a massive amount of enterprise value to each of the MANG companies participating in this type of financing. Each dollar of revenue generated has a multiplier effect (~10x for MSFT at the time of writing), so each dollar invested has a 5x effect on market cap ($1 × 50% cloud credits x 10x revenue multiple).

What happens next:

The “adapt of die” adage is already playing out for many traditional venture capital funds, and this is just making it harder for the same old-school funds to compete.

This type of financing structure gives founders distribution advantages, a lower cost of capital, and access to state-of-the-art infrastructure from these corporate VCs that most other VCs can’t possibly compete with.

That said, the biggest concern we have with this type of financing is the misaligned incentives between investors and founders.

CVCs are strategic investors (not purely financial). This difference in incentives can rear its head in the form of blocked acquisitions, product direction, or even placing limits on who can become a new customer. Not a deal breaker, but definitely something to note.

If you want a deeper dive into all of this, I highly recommend checking out this piece by Apoorv Agarwal.

TOGETHER WITH HARMONIC

Access the complete startup database 🔎

Finding a unicorn is hard.

But finding the next unicorn without the right sourcing tools?

That’s impossible.

That’s why we use Harmonic for all of our company and talent sourcing needs.

REFER

Earn free stuff 🎁

You can get free gifts by telling your friends and family to sign up 👇

{{rp_personalized_text}}

Copy & paste this link: {{rp_refer_url}}

LINKS

👉 Our favorite newsletters: 11 newsletters we actually read

📧 State of Newsletters: beehiiv’s 2024 state of the union

💡 Twitter ads for newsletters: 30+ campaign ideas

🌎 The inevitability of remote work: How beehiiv uses it as a competitive advantage

🔥 12 takes on the tech industry: Greg Isenberg breaks it down

🤷♂️ 59 contrarian takes about people: A simplified way to look at humans

📶 25 lessons from David Sacks: Mental models from the Craft Ventures GP

💡 Junior VC roles (explained): What to expect when starting out in VC

TWEET

JOBS

Finding your next role in venture 📌

👉 Post a job 👈

Featured venture jobs

Greycroft is looking for an associate in LA

Energy Impact Ventures is looking for an investor in NY

Forum Ventures is looking for an analyst in NY

Mucker is looking for a senior associate in Chicago

Capital Factory is looking for an IR coordinator in Austin

P.S. 👉 If you’re hiring investors …

We’re building a better way for venture capital and growth equity funds to build world-class investment teams.

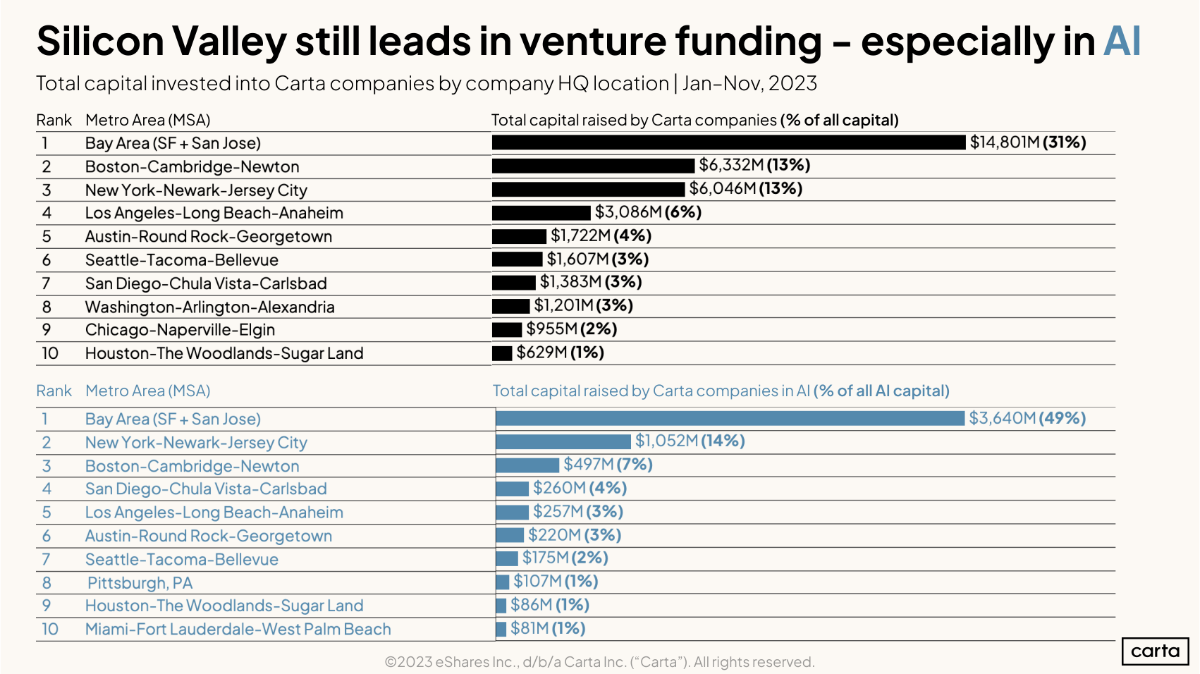

VISUAL

MEMES

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

P.S. Here are the results from our poll question in last week’s piece:

Would you still use Carta today?

🟨🟨🟨🟨🟨🟨 Yes - absolutely ✅ (27)

🟩🟩🟩🟩🟩🟩 No - not a chance ❌ (28)

55 Votes