Venture capital and private equity are no longer cottage industries.

New capital has created more competition, and investment firms are more willing than ever to adopt new tools that will make them more effective and beat benchmark returns.

The modern investment firm looks a lot more like a tech company than a traditional financial services company.

Lean teams

Outsourcing the non-core work through software

Higher output-per-employee

Ability to scale AUM without scaling headcount

We don’t expect this to change, and we expect this revolution to accelerate.

The winners in this category will allow funds to act more agile, organized, and efficient.

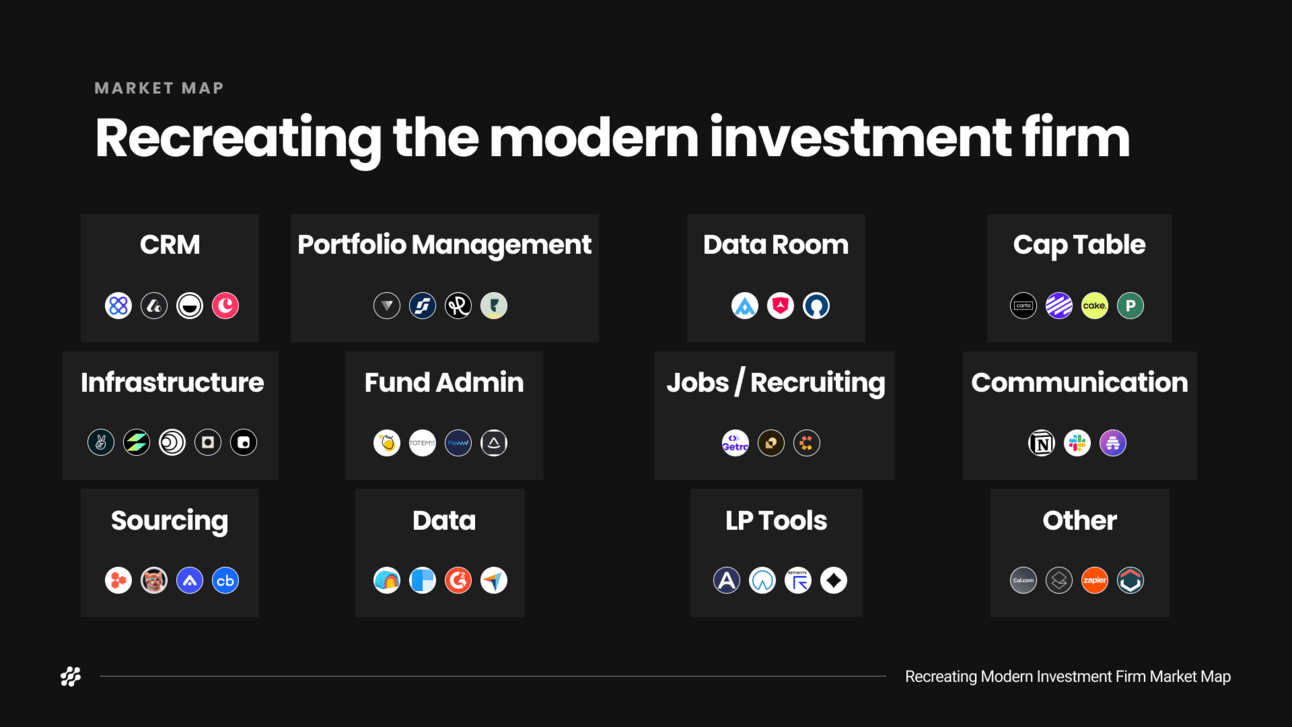

Here is our breakdown on the different markets in this category and the opportunity zones in each.

What’s inside

The smart CRM revolution

Automating portfolio data collection

Fund admin-as-a-service

The modern investor’s communication stack

LP tooling

Other software that modern funds are powered on

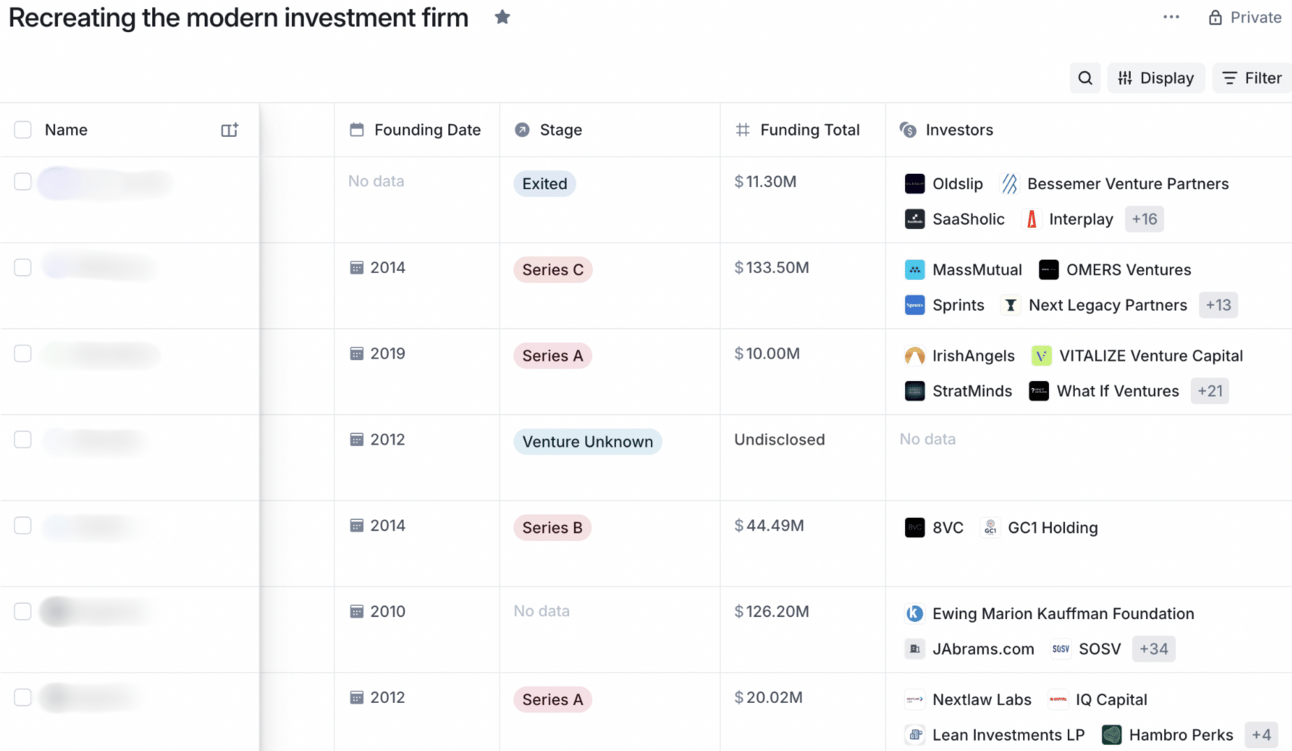

Built with Harmonic

This entire market map was created through Harmonic.

It’s one of the few tools we use to run our business every day, and we think every investor is actually at a disadvantage if they don’t use it.

The modern investment firm tech stack

Smart CRM

Venture is a relationships game, and the CRM is the lifeblood of many investment firms.

Incumbent CRMs were built for sales teams, they are priced accordingly, and their feature sets do not match up with the needs of the modern investment firm.

Scrappy first-time funds have pieced together a functional CRM with Airtable, Notion, and Zapier. These are not permanent solutions for most, and when their needs upgrade with their AUM, these companies are building for those needs.

Portfolio Management

Anybody that has ever had to chase down quarterly updates for 30+ portfolio companies will tell you: that process SUCKS.

Standardizing data, capturing the nuance of what’s not shared in the financials, and creating dashboards that can be used internally and shared with LPs - all of these things take time, effort, and the resources of 1+ people.

Modern portfolio management tools can do all of these functions for a fraction of the price of a full-time person, and we are seeing more and more forward-thinking funds adopting these vendors.

Companies: Visible, Standard Metrics, Rundit, Edda

Data Room

The first thing LPs request in a fundraising process is access to the data room.

If only they knew how much went into creating, organizing, and maintaining a data room …

These companies are making it easier for GPs to share everything that’s going on under the hood of a venture firm.

Cap Table

You would be surprised shocked at how many funds still manage their equity positions in an old Excel or Google Sheet.

Maintaining audited records of investments manually is the opposite of operate like a modern investment firm, and the inability to easily factor in dilution, liquidation preferences, and outcome scenarios makes it harder for firms to plan for different outcomes.

Carta was the first-to-market, but we’ve talked to enough Carta users to realize that there is still plenty of white space in this market.

Infrastructure

10 years, infrastructure was one of the largest barriers to starting a new fund.

Today, modernized infrastructure is a catalyst for more individuals being able to operate like professional investors.

Infrastructure includes SPV tooling, scout fund tooling, fund hosting, and anything else that makes it easier to set up the back office of an investment firm.

Fund Admin

The back office of a venture firm is messy.

Managing documents, subscription docs, wire instructions, tax information, capital calls, and a million other things to stay compliant quickly becomes a massive burden to any fund.

Many firms have outsourced fund admin to a service provider, but that has led to communication gaps, additional work, and heavier expenses.

Fund admin software consolidates all of this work and allows funds do manage themselves more efficiently.

Jobs / Recruiting

Founders choose funds based on their brand and ability to attract talent.

True value-add investors roll up their sleeves and help with hiring, and the best ones use software to help with recruiting, talent management, and distribution of jobs.

Communication

“The worst communication is no communication.”

That includes external and internal communication.

For external communication, investment firms used to be closed off with their thoughts. That has completely changed over the past 15 years. Today, it is a massive disadvantage if you are not sharing thoughts, opinions, updates, and other work to an audience.

For internal communication, better decisions can only be made with better context. Operating in silos, only relying on email, and not documenting processes and thoughts ultimately results in the inability of an investment firm to scale.

Data / Sourcing

90% of a junior investor’s job is expanding the top of the pipeline, and their performance is evaluated by a) how many deals they bring to the table and b) the quality of those deals.

Relying on relationships and inbound is an old person’s game, and if you’re still cutting your teeth as an investor, you will have to be creative with how you source deals.

Many sourcing software solutions cater to different audiences of investors with more expensive options like Pitchbook and Harmonic catering to investors with more AUM, and free / freemium software like Crunchbase and Product Hunt catering to smaller funds.

We also see opportunity in data cleaning and enrichment solutions, APIs that can scrape directory websites, and other solutions that can make it easier for any investor to fill their pipeline with more high-quality deals.

Companies: Harmonic, Product Hunt, Acquire, Clay, Clearbit

LP Tools

Powering the LP login is a powerful market to play within.

Especially in today’s environment, it has become harder to keep LPs happy, and many allocators have either lost faith in venture or put a pause on their new investments. For their existing exposure, they want an easy way to check in on everything, and ideally they have the flexibility to do this whenever they want and not only once a quarter.

Modern LP tools make this possible through the aggregation of portfolio updates, pipeline data, and other internal notes worth sharing with LPs.

Conclusion

The modern investment firm will look, feel, and operate very differently than investment firms of the past.

The tools in this list create huge amounts of leverage for investors, and it allows them to create more output and free up more time to work on the things that matter in the venture game: building relationships and focusing on the core parts of being an investor.

If you’re building in this space, please reach out. We’d love to talk.

Get the full list

65+ companies recreating the modern investment firm built with Harmonic

Become a Tier 1 Pro subscriber, unlock the full list, and get all of this too:

An incredible list. 65 high-potential companies, curated by our team, supported by exclusive data.

Traction details. We include information on web traffic, headcount growth, funding per employee, and other signs of traction whenever possible so you can get a sense for how far along they are.

Links to leadership. We’ve added LinkedIn URLs that make it easy to review the people behind the businesses.

All other resources we’ve built for Pro subscribers. That includes access to all of our other databases (VC fund data, internal deal flow data, recommended service providers, etc.), behind-the-scenes access to how we build this business, bi-monthly deal flow reports, and all future market map lists like this one.

Unlock the full list 🔓

Get full access to the companies in this market map along with all future market maps we share ...

Upgrade