Good morning 👋

Today we’re going inside the mind of Rex Woodbury (@rex_woodbury) - Founder & Managing Partner @ Daybreak.

Rex is one of the more interesting emerging managers I’ve met over the past few years.

He is a former partner @ Index

He is the author of Digital Native where he writes a weekly newsletter to 65k readers about how tech is shaping humanity (and vice versa)

He is the founding partner of Daybreak - a thesis-driven pre-seed fund investing across health, sustainability, learning, community, and job creation

We wanted to learn more about how he is thinking about the world, so we asked him 10 questions about trends, unconventional theses, pairing a newsletter alongside a fund, and some hard truths about VC.

Here’s what he had to say …

P.S. If you’re looking for more investor talks like this one …

Explore all investor deep dives here.

Rex Woodbury

GP @ Daybreak

What's the most unconventional investment thesis you've developed, and why?

A long-held thesis I had was what I call "the selfie thesis" — as we become a more visual culture, we care more about how we look. Anything that helps us look good in a selfie probably has tailwinds behind it. We have a dermatology company, Honeydew, in the Daybreak portfolio that fits this thesis. More recently, I wrote a piece about the second $100B AI company (after OpenAI) that posited that it would be a consumer company. Spending time in consumer has become somewhat unconventional, though it shouldn't be.

Of the annual “charts shaping the world” you share every year, has there been one that has stood out to you that gives you optimism?

I'd have to say a chart that captures exponential technology — for instance, the Moore's Law chart in this piece. It excites me how rapidly innovation is happening. Think how far we've come in the last 25 years, and think how far we can go in the next 25. Innovation has driven improvements in quality of life and standard of living around the world. That keeps me optimistic and excited.

Of the same charts, has there been one that scares you the most?

The charts on teen mental health worry me. This is a full-blown epidemic. One of our Daybreak portfolio companies, Marble Health, is addressing this, but we're going to need a huge, collected social movement to fix this problem. It's something that I think about and worry about a lot.

What would you say is the biggest edge and advantage for Daybreak?

As venture has matured as an industry, most of the top firms have become asset managers. They are in the business of accumulating larger fund sizes and collecting fees. Even if they still operate with the right mentality and motive, larger funds need to focus on putting capital to work. Small, early-stage investments don't warrant the same attention. Daybreak is meant as a "back to basics" for venture, true to the original artisanal ethos of the industry. Can we build a firm that's more craftsman-like than asset manager, laser-focused on first capital in and company building in the zero to one stage? Founders recognize that $1M doesn't move the needle for a big multi-stage fund, but it's a big deal for a Daybreak; all our founders have 24/7 access to us, and we roll up our sleeves in the early stages of company building. We also have a point of view and deep conviction in our thematic focus areas, and we're looking for founders who share that conviction.

As somebody with a larger newsletter than us, how are you now thinking of pairing that audience alongside the fund?

Venture is really four jobs: sourcing, diligencing, winning, and partnering. Having content and distribution can help in each one. It helps find great founders—founders like to get to know VCs, and I can build relationships over years of writing Digital Native, and attract founders who share the same worldviews and interests. Writing also helps synthesize thinking, helping analyze companies and sectors. On the winning front, Digital Native can demonstrate a track record of interest and expertise in a specific space or theme. And we can write about our companies, helping them attract talent and customers. I'm a big believer in learning in public, and content is a helpful forcing function for doing so. Hopefully we can expand that content strategy over time as the firm grows.

As an emerging manager on the fundraising trail, what has been most effective for you in terms of a) getting in front of and b) closing new LPs?

In terms of getting in front of LPs, fellow emerging managers are the secret. Established GPs at big funds can help, but their networks mostly consistent of LPs that won't do first-time funds (you're too small for them) — those are relationship-building meetings. (If I do my job right, maybe we get that endowment in Fund III.) Emerging managers know which LPs are actually serious about Fund I's, and fellow managers have been generous with intros. I've tried to start returning the favor to folks now setting out.

In terms of closing, it's challenging to create urgency — many LPs want to wait until final close, and they have incentives to do so (they can see what deals you've done, they can have a read on the market, they can prioritize funds in final close). I found it helpful to send frequent updates to folks and to over-share — to share an investment memo on a new deal, for instance, or an updated thesis.

What's one mistake you think emerging fund managers commonly make when choosing how to position themselves (markets to focus on, portfolio construction, how they allocate operational resources for the fund, etc.)

I think you need a real reason to exist. Capital is so abundant these days; why will a founder choose to work with you? You want to have real differentiated sourcing, real domain expertise, real ability to partner with entrepreneurs. For a few years, it became "cool" to launch a fund — in this market, that's dissipated a bit, and people are realizing it's hard work. But emerging managers should still have a good reason for investing. Managers should also make sure the math works: I geek out about portfolio construction, and you have to trust your model (check size, ownership, and so on). It's fun to be in the hot deal, but not if the math on ownership doesn't work.

Are there any common piece of startup advice you strongly disagree with?

My view is that market sizing is largely a fallacy. Great founders expand their market with a 10x product. I'm a very founder-centric investor; of course you need good market dynamics and a compelling "why now" but at the end of the day, it's all about the entrepreneur at the earliest stages.

What's a hard truth about venture capital that few people openly acknowledge?

This job is a sales job. You're in service of your founders. As a fund manager, there are sales on multiple sides of the equation. Your fundraising is sales to LPs; on the other side, you're selling to the best entrepreneurs on why they should take your money over someone else'. This job rewards hustle in the near-term, but deep relationships in the longer term. Both matter.

Are there any other emerging managers that have really impressed you over the past few years?

So many! A few that I'm a big fan of: Sophie @ Planeteer, Byron and Taylor @ TwelveBelow, Heston @ Banter, Gaurav @ Timeless, Jessica and Kate @ Hannah Grey, Zoe @ Ex/Ante. The list is long. It's a great community, and I have many fellow emerging managers to thank for their support, help, and friendship.

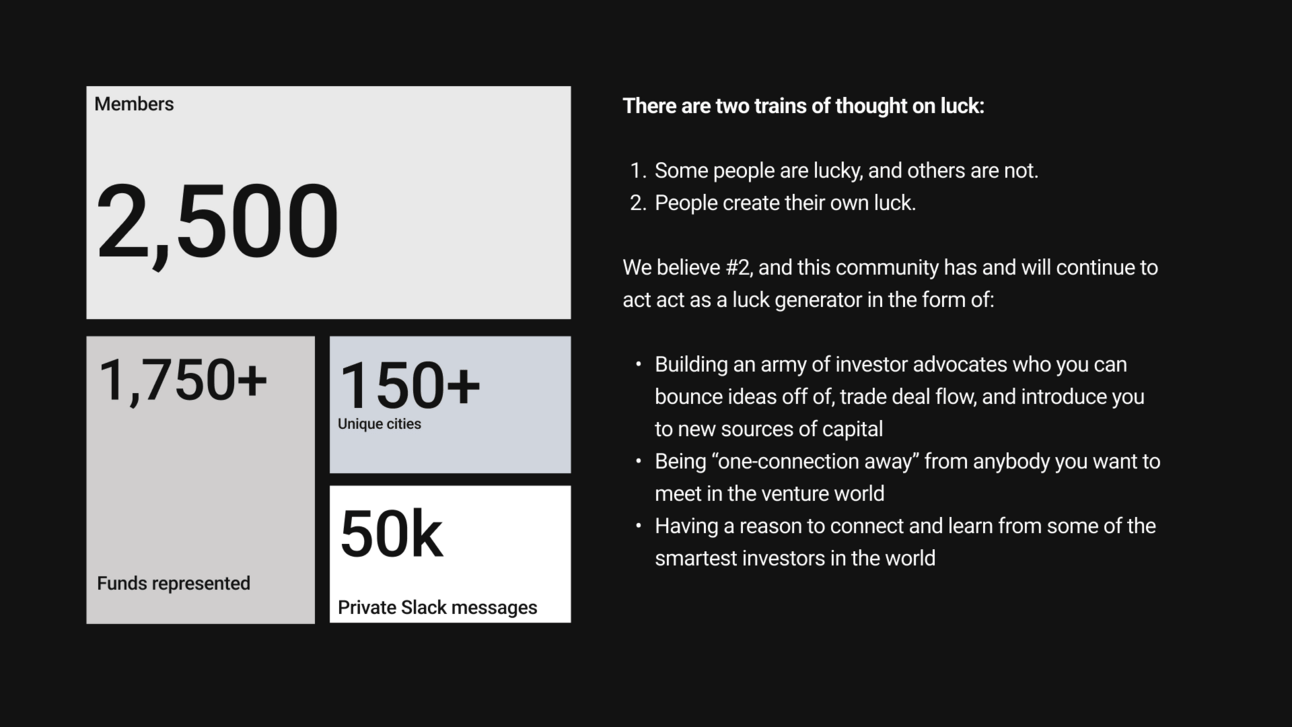

COMMUNITY

”A luck generator” for anybody working in venture 👥

Because who doesn’t like getting lucky …

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay