Good morning 👋

And Happy New Year.

We sent out our 2025 annual letter last week. There were some teasers in there of where we think the world is heading, but we’re doing a more dedicated piece to predictions this week.

This time of year, a lot of people in the venture world make broad stroke claims on what they think will happen in the upcoming year. Most of the time, you have to filter the source as all of these people are incentivized to talk their book.

I have read hundreds of other annual recaps, prediction letters, and thought posts, and I have distilled down my favorite takes from other partners and GPs on what you should expect this year.

Let’s get into it.

Big breakdown

2026 predictions

For newer GPs, audience > pedigree

Especially for fund I’s, fundraising will have less to do with where you worked and more to do with who already pays attention to you.

Real distribution is rare, and GPs that can point to newsletters, communities, and followings as a source of competitive advantages will spend less time on the road. Not all audiences are created equal, and an audience of 1,000 high-value readers is infinitely more valuable that an audience of 100,000 low-value readers.

LPs won’t frame it this way, but they’re increasingly underwriting three things:

Who trusts you? How will you win allocation?

Who reads you? How do you think and make decisions?

Who would follow you into a deal? How do you solve the coverage problem with other co-investors?

In the next cycle, it will be normal for LPs to ask about audience size, engagement, and inbound founder flow as part of diligence, especially for first-time funds.

As knowledge gets cheaper, networks get more expensive

Knowledge is getting cheaper by the day, and AI is flattening diligence, sourcing, and analysis faster than most VCs want to admit. Everyone will have access to the same information and the same tools.

What is scarce in the age of abundance? Trust. And trust comes in many forms.

Audiences are a proxy for trust. Reference calls (ideally off-sheet) are the best indicators of trust.

Good GPs are routers of people, and being highly trusted makes being a good router 100x easier.

Firms that can’t clearly explain their network advantage will slowly lose access to the best deals even if their brand still looks strong on paper.

The next generation of GPs will be “too online” - and that’s a feature

Assuming you do not come from money, I personally do not think it is possible to raise a new fund today if you are not:

Writing constantly

Thinking in public

Very opinionated on the world

Humba has a saying that they like “spiky” founders. If you look at the few emerging managers who have raised new funds over the past two years, labeling them spiky from being too online is a fair assessment.

The average age of first-time fund managers will drop, and their distribution advantage will matter more than their resumes.

The “VC career path” will collapse (if it hasn’t already)

When we started this community five years ago, many of us were sold on the idea of a path to partner. You can’t make real money in venture without owning a piece of the carry, and all of us junior investors wanted to work towards a piece of that in the future.

Having watched tons of my friends fall out of venture to chase a different career, I started to notice a pattern.

Analyst → associate → principal → partner is far from the norm today.

Most of the work previously done by analysts and associates can be done with the help of ChatGPT, Harmonic, and Clay, and it has become harder to justify the cost of these junior roles. As the bottom of many venture firms gets hollowed out, I am watching what will happen with succession planning.

As a fallout from this, I believe next generation of GPs will come from nonlinear paths (writers, operators, community builders, etc.), and I think all of these newer GPs will have an advantage in architecting systems and building leverage for a leaner firm.

The cowboy SPV era will end (again) with a lot of lost money

There is massive demand for pre-IPO companies, and if you’ve worked on the LP side, chances are you’ve all seen the same recycled allocations for Stripe, Databricks, Anduril, SpaceX, and a handful of others. These are all great companies, and I’m sure that they will all have great outcomes whether they choose to go public or continue to operate privately.

It gets dicey when people start syndicating massive deals for more unproven companies after an A or B, and yet I still see a lot of family offices and HNWIs choosing this route with many of them paying multi-layered fees for an asset they will get no information rights or visibility into.

License and acqui-hire deals will (unfortunately) become more normalized

For those unfamiliar, these are a few deals where the buyer acquihires the founding team while leaving the shell company to fend for itself. Here a few of those types of transactions over the past two years:

Windsurf → Google ($2.4B)

Groq → Nvidia (~$20B)

Scale AI → Meta (~$14.3B for 49%)

Character AI → Google (~$2.7B)

Inflection AI → Microsoft (~$650M)

Covariant → Amazon (~$400M)

Adept → Amazon (undisclosed)

This could be a byproduct of an AI talent shortage or unclear regulation, but the secondary effects don’t paint a good picture for the startup world.

Many employees (unless fully vested) don’t get paid out, and nearly all of the staff from the acquisition company are not brought on to the new company post-acquisition.

Giving your life to a startup is already incredibly risky and not for the faint of heart, but the calculus gets even worse when it becomes a pattern of expecting the rug to get pulled out from under you even if your company gets acquired.

Businesses pay more for AI agents than people for the first time

This has already happened with consumers. Waymo rides cost 31% more than Uber on average, yet demand keeps growing. Riders prefer the safety & reliability of autonomous vehicles. For rote business tasks, agents will command a similar premium as companies factor in onboarding, recruiting, training, & management costs.

2026 becomes a record year for liquidity.

SpaceX, OpenAI, Anthropic, Stripe, & Databricks IPO, with SpaceX & OpenAI ranking among the ten largest offerings ever. The pent-up demand from 4+ years of drought finally breaks. Fear of disruption by fast-growing AI systems drives defensive acquisitions exceeding $25b as incumbents buy rather than build.

The web flips to agent-first design.

Most developer documentation & many websites become agent-first rather than people-first. This shift occurs because many purchasing decisions are now informed first through agentic research. Consequently, the front door needs to be designed for robots, while the side door caters to people.

CHROs, not engineers, are AI workforce architects

In 2026 AI will no longer be a tool. Companies will embed AI in their strategy as part of what it truly is: a new architecture for how work gets done. The best ones will design agentic workflows from the ground up, deciding which tasks are owned by people, which are executed autonomously by AI systems, and how the two reinforce each other. Doing this well demands a different kind of leadership profile: close enough to the work to understand the nuances of product, operations and customer feedback and experienced enough to architect workflows and decide where human oversight is essential. And it requires a shift in ownership. AI’s impact is organizational, not just technical. These are not engineering questions, they are people questions. CHROs and talent leaders will become stewards of the AI transformation, defining how work gets done in truly AI-native companies.

Digital marketing changes with the first ChatGPT ad

The first paid ad unit will appear in ChatGPT as OpenAI joins the ranks of the other major ad networks. In many ways, ads have always been inevitable, and recently the company has made inroads to make it a reality, as evidenced here, here and here. As eyeballs and searches continue to accelerate towards OpenAI - which will soon eclipse 1B active users - OpenAI ads will be among the most valuable inventory online. And if you’re planning to fund $1.4T in capex over the next decade, high margin ad revenue really helps. I do not believe OpenAI is looking to copy its predecessors’ ad formats so the second part of my prediction is that the first ChatGPT ad unit will look very different from banners or native ads.

When algorithms mediate attention, your story becomes your strategy

In 2026, brands won’t just need media: it becomes media, and media now means more than reporters and press coverage. Media is every surface where people form an opinion about and begin to trust you: WSJ, LinkedIn, a podcast, an event hallway, even ChatGPT. We’ll run comms like editorial franchises built on consistent narratives, recurring formats and distribution across owned and earned channels. That’s because algorithmic intermediaries now shape what gets seen and by whom, and they reward clarity and consistency above everything else.

The shift means vanity metrics stop mattering. Consistency beats volume, and narrative clarity means discoverability. Success becomes far more precise to measure: better deal flow, stronger retention, deeper participation. And that’s freeing. When original content is table stakes, the real differentiator becomes human judgment: the relationships we build, the conversations we spark, and the trust we earn in all the places algorithms can’t reach.

AI inequality inside the firm becomes visible and starts driving organizational design

OpenAI’s December 2025 enterprise report shows large usage gaps between frontier and median users. Frontier workers are sending 6x more messages per seat than the median user. In 2026, we expect companies to double down on enablement and internal playbook investment as their AI returns concentrate on power users. This may open new roles and budgets for AI operations as productivity deltas become a talent retention and performance-management issue.

We also see a huge boom in non-AI, IRL businesses.

It’s easy to forget, amongst the AI hype, that there’s a great big world of atoms out there. And most people are yearning for “human” experiences.

Superagent Ari Emanuel has an interesting thesis he calls “The Anti-AI Bet” that involves building and investing in live, authentic, physical experiences. The thinking goes: AI will supercharge productivity, and we’ll all get more time back. Most people will opt to spend their newfound leisure time on real-world entertainment. I buy this thesis completely, and think it’s a smart play.

Outside of startup-land, we see real innovation happening here. The Sphere in Vegas. Emanuel’s WWE in wrestling. Another example, to return to Live Nation, is the entertainment giant’s $1B commitment to build and renovate 18 major venues across the US. People are hungry for IRL experiences, and the growing anti-AI sentiment mentioned earlier will also power this boom.

I’m interested in how this applies to startups too. What are the ways to build and invest around the real world? I’m bullish on AI, but I’m also bullish on our own version of “The Anti-AI Bet.”

Pricing flips, with platform fee + usage taking the place of per-seating pricing.

Per-seat pricing has ruled software for years. That’s already started to change with AI, but I expect we’ll see a dramatic overhaul in 2026. To put numbers to it: let’s predict that per-seat pricing falls below ~30% of new SaaS revenue in 2026.

In its place, we’ll see platform fee + usage-based pricing. A doctor’s office, for instance, might pay you $10K a year for your voice AI product, plus a certain volume-weighted dollar figure for the number of calls your voice agents make.

Salesforce was pivotal in popularizing SaaS, with its 1999 cloud-native CRM that delivered software online and by subscription. Today, as a result, finance teams are tracking license counts. They’ll soon be tracking “agent hours” or something of the like. And Marc Benioff is apparently thinking of pulling a Zuckerberg and changing his company’s name to reflect this new age: the new name could be… drum roll please…Agentforce.

If that isn’t the sign of a new era for software + business models, I’m not sure what is.

Death of the CRM.

CRMs exist because humans are pretty terrible at remembering stuff: we need to log contacts, notes, communications. CRMs are sort of externalized human memories residing within a company.

Another reason that CRMs exist is because software couldn’t understand messy, unstructured data. Emails, calls, meetings, Slack messages, docs. They were tough to ingest and understand.

AI changes the game. Agents are smart, and unstructured data doesn’t present as much of a problem. We no longer need clean fields, because AI systems can read and interpret our communications. This means we see the death of the CRM, or at least the CRM traditionally defined. Last week we wrote about Salesforce (maybe) changing its name to Agentforce, which is indicative of the shift.

How we organize and pull information within orgs will change dramatically in 2025, and everyone who has ever mind-numbingly filled in a CRM will breathe a sigh of relief.

Systems of record lose ground

In 2026, the real disruption in enterprise software is that the system of record will finally start to lose primacy. AI is collapsing the distance between intent and execution: models can now read, write, and reason directly across operational data, turning ITSM and CRM systems from passive databases into autonomous workflow engines. And as recent advances in reasoning models and agentic workflows compound, these systems gain the ability not just to respond, but to anticipate, coordinate, and execute end-to-end processes. The interface becomes a dynamic agent layer, while the traditional system of record slips into the background as a commodity persistence tier—its strategic leverage ceded to whoever controls the intelligent execution environment employees actually use.

The end of the screen time KPI in AI applications

For the last 15 years, screen time has been the best indicator of value delivery in both consumer and business applications. We’ve been living in a paradigm focused on hours of Netflix streaming, mouse clicks in a healthcare EHR UX (to demonstrate meaningful use), or even time spent on chatGPT as the key performance indicator. As we move to a future based on outcome-based pricing that perfectly aligns incentives between vendors and users, we’ll first move away from screen time reporting.

We’re already seeing this in practice. When I run DeepResearch queries on ChatGPT, I capture an enormous amount of value despite almost no screen time. When Abridge magically captures the patient-provider conversation and automates downstream activities, the doctor barely looks at the screen. When Cursor develops entire applications end-to-end, the engineer is planning the next feature development cycle. And when Hebbia drafts a pitch deck from hundreds of public filings, the investment banker is getting well deserved sleep.

This presents a unique challenge: how much an application can charge per user requires a more complex method of measuring ROI. Doctor satisfaction, developer productivity, financial analyst wellbeing and consumer happiness all increase with AI applications. The companies that tell the simplest sales pitch on ROI will continue to outpace their competitors.

AI reinforces business models

The best AI startups aren’t just automating tasks; they’re amplifying the economics of their customers. In contingency-based law, for example, firms only make money when they win. Companies like Eve use proprietary outcomes data to predict case success, helping firms pick better cases, serve more clients, and win more often.

AI strengthens the business model itself. It drives more revenue, not just lower costs. In 2026, we’ll see this logic extend across industries, as AI systems deepen alignment with their customers’ incentives and create compounding advantages legacy software can’t touch.

Prompt-free and proactive applications arrive

2026 marks the death of the prompt box for mainstream users. The next wave of AI apps will have zero visible prompting—they’ll observe what you’re doing and intervene proactively with actions for you to review. Your IDE suggests the refactor before you ask. Your CRM drafts the follow-up email when you finish a call. Your design tool generates variations as you work. The chat interface was training wheels. Now AI becomes invisible scaffolding woven through every workflow, activated by intent rather than instruction.

Forward-deployed motions take AI to the 99%

AI is the most exciting technology breakthrough of our lifetimes. So far, though, most of the benefits from new startups have accrued to the 1% of companies that are in Silicon Valley—either literally in the Bay Area or part of that extended network. This makes sense, too: startup founders want to sell to companies they recognize and can easily get to, whether that means driving to their offices or getting a connection from the VC on their board.

In 2026, this will flip. Companies will realize that the vast majority of the AI opportunity lives outside of Silicon Valley, and we’re going to see new founders use forward-deployed motions to discover more opportunities that are hiding inside big, legacy verticals. The opportunity stands to be massive in traditional consulting and services industries, like system integrators and implementation firms, and in slower-moving industries like manufacturing.

AI creates a new orchestration layer - and new roles - in the Fortune 500

In 2026, enterprises will shift further from isolated AI tools to multi-agent systems that will need to behave like coordinated digital teams. As agents start to manage complex, interdependent workflows—like planning, analyzing, and executing together—organizations will need to rethink how work is structured and how context flows across systems. We’re already seeing this happen with companies like AskLio and HappyRobot, which deploy agents across entire processes instead of single tasks.

The Fortune 500 will feel this shift most acutely: they sit on the deepest reservoirs of siloed data, institutional knowledge, and operational complexity, much of which sits in people’s brains. Turning that context into a shared substrate for autonomous workers will unlock faster decisions, compressed cycles, and end-to-end processes that no longer rely on constant human micromanagement.

This transition will also force leaders to reimagine roles and software. New functions will emerge, like AI workflow designers, agent supervisors, and governance leads responsible for orchestrating and auditing coordinated fleets of digital workers. And on top of today’s systems of record, enterprises will need systems of coordination: new layers to manage multi-agent interactions, adjudicate context, and ensure reliability across autonomous workflows. Humans will be focused on handling the edge and most complex cases. The rise of multi-agent systems isn’t just another step in automation; it represents a restructuring of how enterprises operate, how decisions are made, and ultimately where value is created.

AI startups selling to other AI startups reach scale

We’re in an unprecedented moment of company creation driven by the current AI product cycle. But unlike previous product cycles, incumbents aren’t asleep at the wheel; they’re adopting AI too. So how does the startup win?

One of the most powerful, and underrated, ways for startups to win distribution over incumbents is to serve companies at their formation: greenfield companies (i.e., brand new businesses). If you attract all of the new companies at formation and grow with them, you will become a big company as your customers become big companies. Stripe, Deel, Mercury, Ramp, and others have all followed this playbook. Indeed, many of Stripe’s customers didn’t exist when Stripe was founded.

The enterprise AI ROI reckoning

For the third consecutive year, venture capitalists are predicting that 2026 will be “the year” enterprises finally see meaningful returns from AI investments. CIOs are now pushing back on what they’re calling “AI vendor sprawl”: companies testing dozens of tools with little to show for it. After spending billions on pilots and experiments, the pressure is on to prove value or pull back.

The consensus view is that enterprise AI adoption will meaningfully accelerate in 2026.

TechCrunch surveyed 24 enterprise-focused VCs who “overwhelmingly think 2026 will be the year when enterprises start to meaningfully adopt AI, see value from it, and increase their budgets.” Michael Stewart (M12, Microsoft’s VC arm) notes that “investors are expecting to see conversions become the leading part of the story after six months of pilot use.” Andrew Ferguson (Databricks Ventures) predicts “2026 will be the year that CIOs push back on AI vendor sprawl… enterprises will cut out some of the experimentation budget, rationalize overlapping tools, and deploy those savings into the AI technologies that have delivered.”

We’re witnessing the “Lucy pulling the football” phenomenon. VCs said the same thing about 2024 and 2025. The real story is that most enterprises still can’t demonstrate concrete ROI because they’re treating AI like traditional SaaS when the economics are fundamentally different (unpredictable margins, retention shifts, rapidly changing capabilities). We believe 2026 will be a filtering year: a small number of AI companies will prove genuine value, while most will quietly pivot or fail. The winners won’t be selling “AI,” they’ll be selling outcomes with AI embedded invisibly. Look for companies that amplify their customers’ economics, not just productivity. Two portfolio examples: Keebler automates condition diagnosis, collapsing days into minutes while increasing billable identifications. Draftaid delivers 10× faster CAD design with fewer errors, transforming engineering economics.

Applied AI VS. foundation models: The returns divergence

60% of VC funding flows to AI companies, but there’s a massive split opening between two types: foundation model companies (building the underlying AI, like OpenAI, Anthropic) and applied AI companies (using AI to solve specific business problems, like AI medical coding or legal research). Foundation models raise hundreds of millions and chase AGI. Applied AI companies raise smaller rounds and target profitability. The returns gap is becoming clear: applied AI companies are hitting $100M ARR and profitable exits while foundation model companies burn billions with uncertain business models.

The consensus view is that applied AI companies will deliver better venture returns than foundation models in 2026.

Recent exits prove the point: AI legal research tools sold for $600M, AI medical coding platforms reached $100M ARR, AI accounting assistants became profitable in Year 2. Meanwhile, OpenAI has $157B valuation on less than $2B revenue, spectacular for late-stage investors, but seed-stage ownership was diluted to nothing. One seed investor notes: “24 were building ‘infrastructure’ or ‘platforms’, 6 were solving specific business problems. Guess which ones had customers?”

During any tech paradigm shift, the Application Layer is typically 10× the size of the infrastructure layer. With $2T being deployed to infra, that represents a $20T opportunity over the next 10 years. At New Stack, we’re aggressively tilted toward applied AI, but with a specific filter most investors miss. The pattern we’re seeing: applied AI companies win when they improve their customers’ business model, not just productivity. AI legal tech that helps contingency-based law firms pick better cases results in more wins and more revenue for lawyers. That’s business model improvement. AI that helps lawyers “write faster” is just productivity (a nice-to-have, not a must-have).

Our diligence question: “If your AI delivers exactly as promised, does your customer make more money, or just have easier days?”

More money equals must-have. Easier days equals nice-to-have. In 2026’s tighter environment, only must-haves get budgets. We’re passing on AI productivity tools (even if technically impressive) and backing AI business model accelerants. Big difference. Small shift in framing, massive shift in outcomes.

AI-driven white collar job displacement

CEOs are explicitly pivoting their companies to be “AI-first,” and the memo is clear: replace expensive humans with AI systems as fast as possible.

Shopify’s CEO and Duolingo’s CEO both published internal letters outlining aggressive AI adoption to cut headcount in sales, customer support, and HR. This isn’t about augmentation anymore. It’s about replacement. The technology may not be entirely ready, but companies are pushing forward anyway, driven by cost pressure and competitive fear.

White collar job displacement will accelerate dramatically in 2026.

Charles Hudson (Precursor Ventures) observes: “AI-driven white collar job destruction is happening much faster than predicted even last year. While neither memo explicitly talks about replacing employees with AI, the discourse around these articles suggests that informed employees see the writing on the wall and know that AI is coming for many of their jobs even sooner than people thought a few years ago. Whatever comfort there might have been that AI would take a while to go for white collar jobs in sales, customer support, and HR has been dispelled.”

The Shopify and Duolingo CEO letters make it explicit: efficiency gains from AI are too significant to ignore, even if the technology isn’t perfect.

Fund updates

What I’m up to

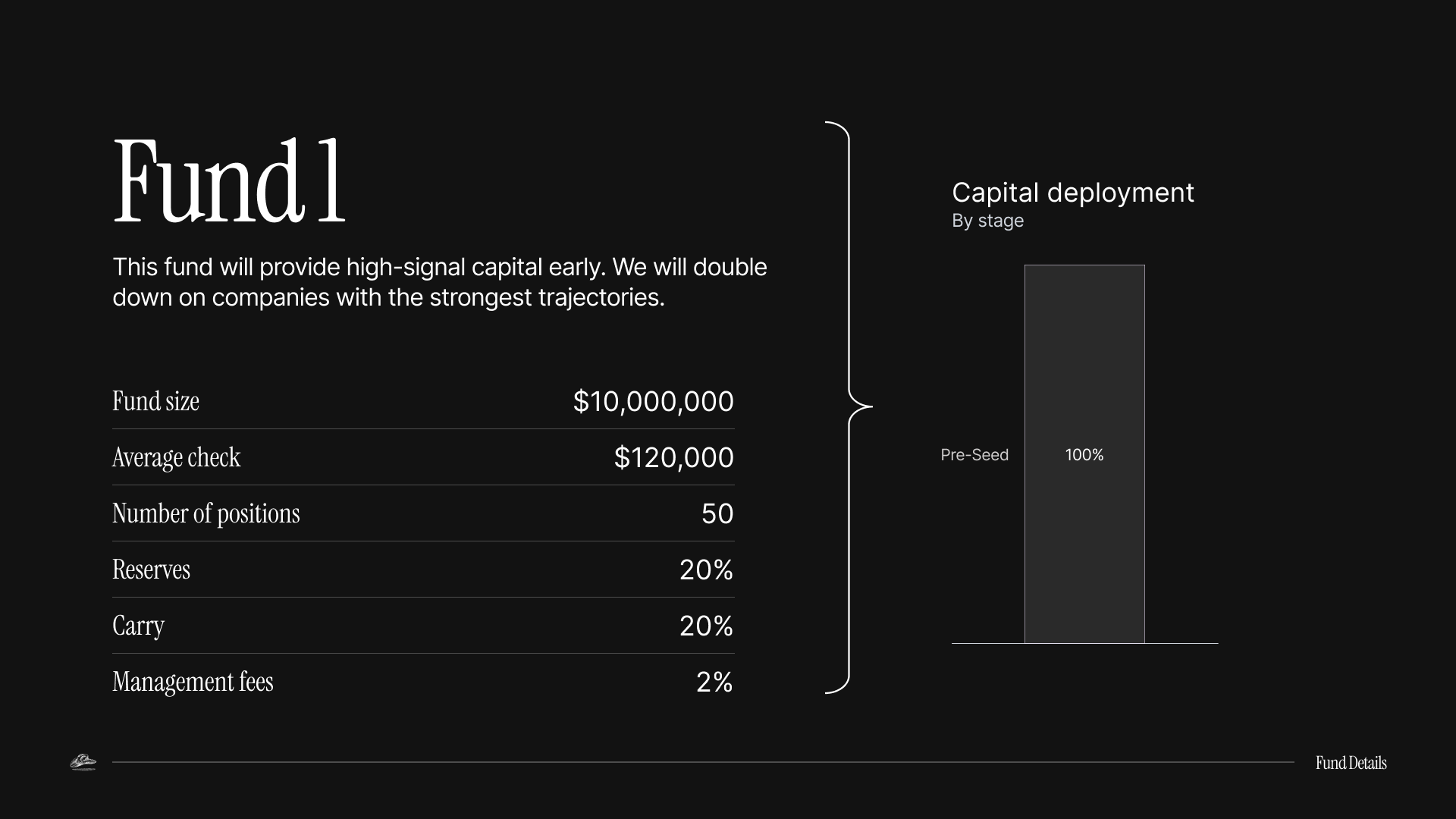

I sent out the 2025 annual letter last week (redacted version linked). That letter gave some guidance on where I think the pre-seed venture world is heading and where I plan to spend my time in 2026.

Fundraising sucks, but the best advice I have gotten over the past year has been to do whatever you can to reduce blind pool risk (ie. investing in the fund before investing alongside you in deals to see your taste, work quality, etc.). I have taken that advice and have started to put together SPVs for the best companies I meet with.

If you are interested in seeing those memos and writing checks to some of those companies, you can join the syndicate here.

Companies, companies, companies

The most painful part about fundraising is not having committed capital when a good deal comes across your table. We feel that we have developed a system to consistently see high-quality deals that fall within our strike zone:

High levels of founder execution ability: As we mentioned in the annual letter, founders with former exits, early Pareto employees at unicorn companies, and founders with audiences of 50k+ B2B followers with a deep understanding of their pain points have been the main personas for my early deals. I am a first-time fund, I am not naive, and I cannot rely on referrals like many more established funds; I have to do a lot of outbound. As a result, I am spending a huge percentage of my week on LinkedIn, Sales Nav, Harmonic, and Twitter to find these people. Anybody telling you there is a shortcut to finding great founders is lying.

Thematically aligned on growing revenue-per-employee: Venture outcomes take 10 (15?) years to unfold - sometimes more. As companies are staying private longer, the world is becoming more and more unpredictable, but we think that one trend is clear: more and more white collar work will be automated, companies will be able to create more output with fewer inputs, and new businesses (especially venture-backed ones) will be evaluated on efficiency in relation to their growth rate. Back office hiring gets tightened (more repeatable work to automate for cheaper than hiring a person); more budget goes back towards the less repeatable work on the front office side of the house. We have told all of our friends the same advice: if you are thinking ahead and want some sort of job stability, you want to get as close to generating revenue as you can.

“Non-consensus” valuation: Consensus investing creates consensus pricing, and consensus pricing favors the founder a lot more than it favors investors. A pre-seed round with a $30m cap on <$50k of “ARR” is not a fit for us. A pre-seed round with a $10m cap on ~$500k of verifiable recurring revenue is. If you’re on VC Twitter, there is a lot of talk about the former becoming the new normal for pre-seed rounds, but we think that is just admitting that you have bad pre-seed deal flow. Good deals still exist - you should have to get your hands dirty to find them.

Sectors

There are really two categories where I am spending most of my time meeting and talking with new companies:

Back-office systems of action: Basically anything that allows back-office departments (finance, accounting, compliance) run with less human involvement

GTM tooling: This is becoming more widely-encompassing, but I’m spending most of my time on anything that helps growth teams create more leverage

For bullet #1, most of the companies I am most excited about are building for core workflows across the finance, accounting, support, and / or legal departments.

For bullet #2, some of the companies I have liked the most are building specifically with CROs and CMOs in mind (with more of a focus on manager tools and less of a focus on individual contributor tools).

If you’re building in any of these spaces, I’d love to talk.

Share Confluence.VC

Share this newsletter with your friends, or use it as a pickup line.

1 referral

Free month of Insider

5 referrals

Free month of Operator

👉 Your current referral count: {{rp_num_referrals}} 👈

Or share your personal link with others: {{rp_refer_url}}

Thanks for reading this far and giving us a little bit of your attention this week. Feel free to unsubscribe whenever this stops becoming valuable to you.

Paywalls are the WORST.

This will be the last time you ever see one of these from us if / when you upgrade below. We've even included a welcome offer for you ...

Claim your welcome offer ...Here's what else a paid subscription gets you:

- 5x posts / week (20x posts / month)

- 2x / month investment memos on pre-seed companies we find interesting

- Market maps on up-and-coming verticals (with company data)

- Database of 2,000+ venture capital firms with firmographic data