Good morning 👋

Love them or hate the, you can’t ignore what a16z has done to venture as an asset class.

They have eaten a larger percentage of new LP dollars, and they now manage billions in AUM

They are leading more unicorn investments than any other fund (by a wide margin)

They pioneered the ‘media is eating investment firms’ movement

They have no created the playbook on how to build ecosystems around an investment firm, and every multi-stage firm is desperately trying to copy what they’ve built

All of that, and they’ve only been around for 15 years.

They announced David Booth as their new head of ecosystem last week, and in his announcement post, he shared the flywheel of a16z as a firm

As somebody who loves studying flywheels, I loved going deeper on this and breaking it all down.

This one is long, so if you want to read it all, I would suggest reading it online so it doesn’t get clipped by Gmail.

Let’s get into it.

P.S. We’ve changed the cadence of these emails based on feedback.

Free subscribers will still get these emails 1x / week on Mondays.

Upgraded subscribers will get them 5x / week + will unlock more based on which subscription plan they choose.

If you want to explore upgrade options and start getting more daily updates from us, you can do so here 👉 https://confluencevcweekly.beehiiv.com/upgrade.

Big breakdown

The a16z flywheel

“A startup needs to get into a loop where it’s accruing more and more resources as it goes … qualified executives, technical employees, future downstream financing, positive brand momentum, public perception, customers, revenue, ability to throw weight in the government … all of these resources you need to succeed as a business. You’re either a snowball rolling down the hill, picking up resources, gaining size and scope and scale, power, credibility as you go... or you’re not – you’re stuck at the top of the hill as a snowflake, and you’re just not going anywhere."

"The question becomes how do you get started? ...to the point where the next resource that you need is more likely to attach to your thing, as opposed to somebody else. That’s the mechanical process that drives the power law. Economists call it preferential attachment.”

This is historically where VCs have stepped in and bridged their credibility to put a stamp of approval for the companies they work with. The companies then harvest that credibility in the form of customers, personnel, and brand.

VCs have traditionally done “preferential attachment” non-scalably.

Building trust through hands-on work with founders

Ability to allocate personal time and attention

Make introductions into their personal network

Maintain a sense of intimacy with the company

Keeping context around the challenges companies are trying to overcome

The problem, of course, is that this level of intimacy doesn’t scale.

“As a result, venture can feel like the opposite of a network-effect business: the bigger the portfolio, the more dilute your attention, and the weaker VC’s incremental value-add on helping any particular snowflake attach to the snowball.”

Here are some takeaways from the flywheel above and David’s thinking about the a16z ecosystem:

It all starts with owned media. Even though the real work begins when a16z officially backs a company, they believe that most of that first interaction is upstream from that.

Media today = be everywhere. GPs + other investors are expected to constantly be putting out quality content. Podcasts and newsletters are experimented with internally to see what works so they can pour more into those channels.

Content —> subscriptions —> engagement —> invitations. All are conversion events that can be optimized. The goal with all content is to reach and find people who they can invite into their orbit.

The bottom of the funnel for content is to meet with interesting people. You should be writing for a specific type of person that you want to meet with. Generic, mass appeal slop content gets ignored or attracts the wrong batch of people.

Better curation of people = better curation of companies. This works even better when you give these people skin in the game and a tangible reason to pull their best founder friends into your orbit.

The talent network scales as a result of the curation work done above. Not everybody consuming a16z’s content is cut to be a founder; many are talented operators, and as more of them get pulled into their ecosystem, it becomes more of a talent wedge for their portfolio companies.

All of the work done being everywhere creates compounding distribution advantages. This helps build brand, grows influence, and gives more mindshare to the firm.

Forward deployed networks. This is how he thinks about the platform of a16z - open doors in unique ways to the company.

Read more:

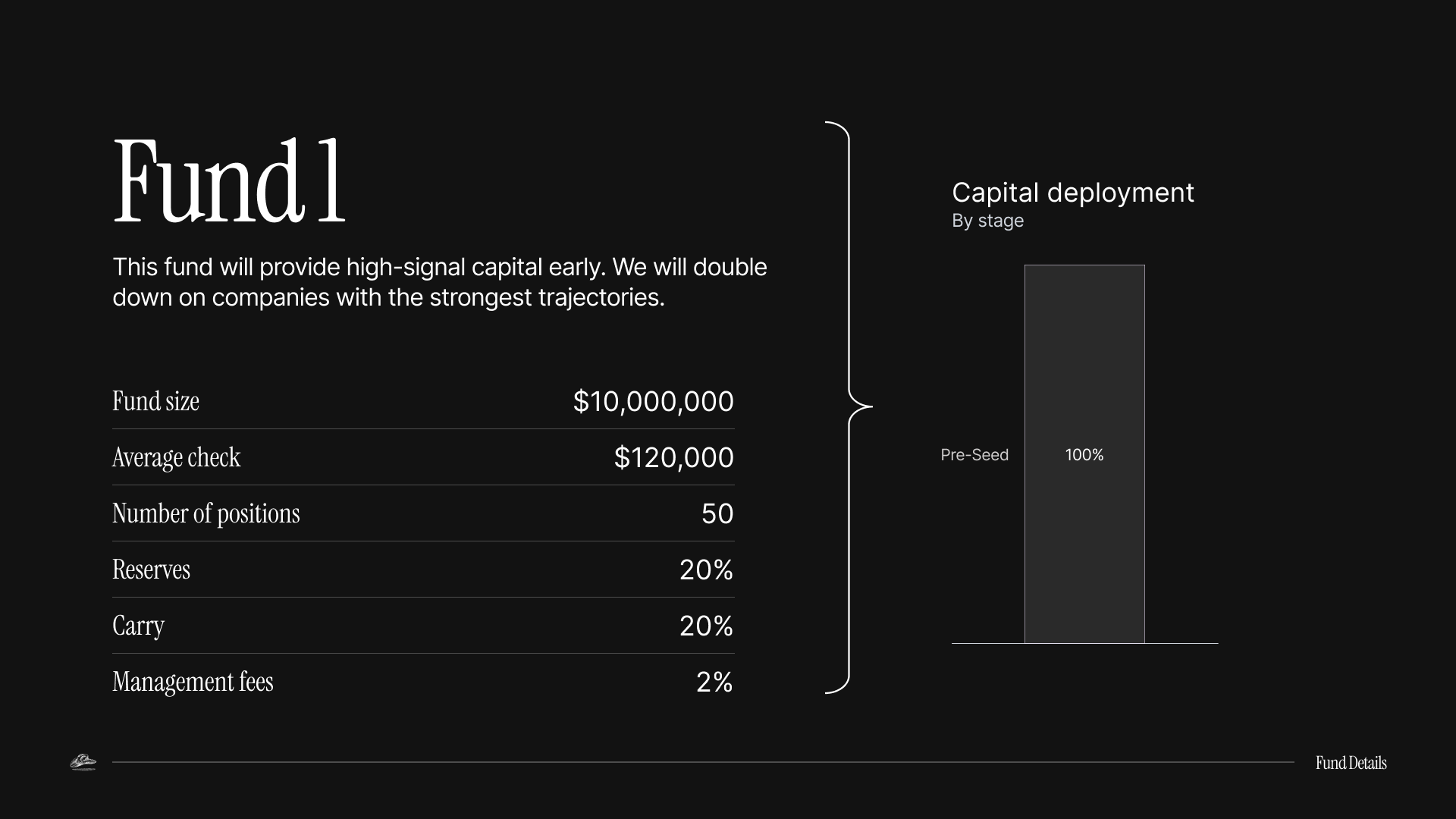

Fund updates

Everything described in the flywheel above is similar to the playbook that I am running for Outlaw.

Build content that people actually look forward to reading

Use that content as a magnet to attract the right types of GPs, founders, and other talented people into my orbit

Use the fund to fuel the best companies that I see as a result of the work in bullets #1 + #2

Leverage the content business to help the founders I work with tell their stories to a larger, high-quality audience of people

Utilize the network of curated people in our audience to help portfolio companies in unique and interesting ways

Of the first five companies I’m planning to invest in with first close, three of those came through a connection point of this newsletter. We expect this trend to continue.

ICYMI

the DNA of Thrive: What makes Thrive great

momentum is not a moat: Some thoughts on the AI bubble

some unfiltered thoughts for somebody thinking about starting their own investment firm: Playing devil's advocate against the advice that everybody should start their own firm

some thoughts on engineering luck: Ways to get luckier

Share Confluence.VC

Share this newsletter with your friends, or use it as a pickup line.

1 referral

Free month of Insider

5 referrals

Free month of Operator

👉 Your current referral count: {{rp_num_referrals}} 👈

Or share your personal link with others: {{rp_refer_url}}

Thanks for reading this far and giving us a little bit of your attention this week. Feel free to unsubscribe whenever this stops becoming valuable to you.

Want to start getting 5x MORE emails like this?

Become a paying subscriber to get daily updates from our team and unlock more subscriber-only access ...

Get your first week FREEHere's what else a paid subscription gets you:

- 5x posts / week (20x posts / month)

- 2x / month investment memos on pre-seed companies we find interesting

- Market maps on up-and-coming verticals (with company data)

- Database of 2,000+ venture capital firms with firmographic data