Fund | Community | Sponsor | Recruiting | Careers

Good morning 👋

“Don’t tell me what you think, tell me what you have in your portfolio.”

I believe that all investments are downstream from world beliefs, and you cannot truly evaluate an investor without first understanding their views on the world.

As a thesis-driven investor, your investments are a byproduct of the following lines of thinking:

Philosophies → Themes → Theses → Investments

It is easier to understand investments when you have a thesis. It is easier to have a thesis when you understand broader themes. And it is easier to pick themes when you have a guiding philosophy and set of beliefs on where the world is trending.

These are some beliefs that I hold that have led me to certain choices, shaped my worldview, and influenced my investment approach.

Together with Carta

Funds of funds (FoFs) spend one-third of their time manually processing and standardizing GP data

Carta surveyed 100 industry leaders to uncover how fragmented reporting is straining operating margins (spoiler alert: it’s not good).

This report breaks down the consequences of these inefficiencies and identifies the automation strategies firms are adopting to remain competitive.

Guiding philosophies

The age of infinite leverage

Jack Butcher has been one of the most influential people I have learned under, and he gave me a cleaner way to think about leverage, compounding, and why individuals have never held more power than they do today.

We used to have to trade our time directly for output – a 1:1 relationship, but now we have leverage.

For the majority of human history we did NOT have leverage. Humans evolved in societies where there was no leverage. If I was chopping wood or carrying water for you, you knew eight hours put in would be equal to about eight hours of output.

That is no longer true.

We live in an age of leverage where you can maximize the output of your work to a ridiculous, exponential degree. As a worker, you want to be as leveraged as possible so you have a huge impact without as much time or physical effort.

Old school leverage (capital + labor) are expensive and require permission. New school leverage (code + media) have no marginal cost of replication and are permission-less.

A leveraged worker can out-produce a non-leveraged worker by a factor of one thousand or ten thousand. With a leveraged worker, judgment is far more important than how much time they put in or how hard they work.

Modern people can methodically apply, increase, and compound leverage until they stand on a mountain of levers - accomplishing 1,000x their peers, and the gap between the levered and the un-levered is going to keep growing.

Pareto, feast or famine, and the cruel mistress of power laws

“All the critiques about the “VC industry” miss the fact that it is and always has been the best business in the world if you’re really good at it and terrible if you’re not.”

As power law has become consensus, every opinion about power laws has already been stated. For a quick refresher on the game we’re all playing now …

Number of companies that raise VC funding per year | ~4,000 |

|---|---|

Number of those companies backed by “tier one” funds | ~200 |

Number of those companies that reach $100m ARR | ~15 |

Percentage of returns that those companies create for the asset class | 97% |

If this math holds true and you have a deployment period over the next five years, that means there will be roughly 75 companies (15 × 5) worth pursuing if your portfolio construction incentivizes you to pursue these types of outcomes.

You will need to spot, pick, and win an allocation into (at least) one of those ~75 companies in a sea of 20,000 (4,000 × 5) other venture-backed opportunities that surface over the same time period.

Very few companies are responsible for the bulk of returns. Very few people within those companies are responsible for the bulk of the decisions that led to scale. The secrets to scale are underpriced, they are not public, and very few people have them.

Which is a good transition to my next two beliefs …

Out-of-distribution inputs —> out-of-distribution outputs

Nothing about venture capital follows a normal distribution, and thinking within a normal bell curve is a recipe for underperforming the S&P.

We are in the business of finding out-of-distribution ideas, people, and companies.

Extreme returns require extreme GPs

Extreme GPs require extreme execution

Extreme execution require extreme investments

Extreme investments require extreme founders

Extreme founders require extreme inputs

Venture is a power law business, and power law games require out-of-distribution outputs.

Understanding the companies that break the bell curve can be best understood by first understanding the DNA of the people who make decisions within the firm.

Investing in extreme individuals

“The people who are the best in the world at what they do aren't 2-3x better, they're 100-1000x better."

I believe the most underpriced people in venture are:

Founders who have started, scaled, and exited companie

Founding employees at outlier companies who were responsible for the bulk of that company's scale

Founders with unique audiences and distribution angles

Resumes are proxies for execution ability, but psychological traits predict outlier outcomes. Some traits from people I like working with:

High pain tolerance: Pain is a moat. Success is a byproduct of failing a lot more than winning. Extreme success requires extreme suffering first.

Observable obsession: You will be able to get a sense of a person’s level of obsession based on how well they know their industry inside and out. They know the rules, they know the players, they know the incentives, and they know what is exploitable today (and in the future). Kobe Bryant would study the rule book given to referees so he would know where to stand to be in their blind spots so he could get away with more fouls on defense.

Range: There are exceptions to this, but I have found that many of my most talented friends are talented in multiple domains. Whether that is in skill, areas of interest, or fluency across subject, I have found myself more interested in working with skilled generalists.

Consciousness: I have found that a lot of people don’t actually know what they want out of life. Without understanding your “why”, you naturally become reactive to the world. I believe it is incredibly difficult to make money for yourself and for others without being a proactive person who enforces your will on your environment.

Venture is a power law business, and power law games require out-of-distribution outputs.

Understanding the companies that break the bell curve can be best understood by first understanding the DNA of the people who make decisions within the firm.

Positioning and building your own “yacht”

Positioning is the most important skill in the world, and nobody will teach you how to best position yourself.

Without disclosing my source, here are some laws of positioning that have become ingrained into my subconscious:

No apex man has ever existed without unapologetically wielding an unfair advantage from an unfair position. Trump, MJ, Ken Griffin, Elon, Bezos, Steve Jobs - all of them yielded an unfair advantage from an unfair position. You simply cannot exist at the top of any skill, endeavor, sport, industry, or government without the UA/UP combination.

Unfair advantage and unfair position are laws of nature. Lions, orcas, crocodiles, and hawks are all apex predators, but if pitted up against each other, they would fare differently based on the environment. Apex predators are at the top of the food chain because they have built skills / attributes that position them at the top of their given environment.

Everyone on the planet has an unfair advantage and an unfair position. Born rich? Connections, money, access. Born poor? Tenacity, street smarts, survival instincts, willingness to do whatever it takes.

You should only take high ROI action. The majority of your results come from a very small sample of the actions you take.

Always play for position. Do you know where you want to be in 1 year? 5 years? 10 years? How can you put yourself in an unfair position today to conquer the next territory?

You should always be leveraging your current UA/UP to achieve an even more powerful and effective UA/UP. There is always another level.

You may need to abandon your current UA/UP in order to achieve a better UA/UP combination. Risk and embracing change is part of the game.

Your game + your rules + arena of your choosing. The orca will always win in freezing cold salt water. The lion will always win on the open African plain.

People are your greatest resource. Understanding and creating effective win/win relationships with people puts them in an unfair position to succeed.

Betting in chaos: options > equity

I want to give credit to Jordan Nel (Hummingbird) for shifting my thinking here.

“Focus on payoff of outcome, not probability of outcome.”

Black Swan events are increasing in frequency, the world is becoming more volatile, and in this type of environment, you want to own options rather than equity.

If you want to hedge negative tail risk, buy puts or gold.

In a world of increasing extremity, allocating to the “sure bet” is increasingly a worse idea.

Fatter tails mean more returns come from the outliers (less from the median).

You get to the tail by increasing the variance (or the scale) rather than raising the expectation.

Vol-of-vol chart over the past 20 years

Venture’s mechanics benefit from chaos as a venture fund is a portfolio of (out-of-the-money) call options.

Buying the index becomes riskier. The S&P is full of companies optimized for continuous predictability. When discontinuous change hits, they're poorly positioned.

Ironically, concentrated bets on variance become safer. Venture portfolios are designed to capture extreme outliers. When tails get fatter, they benefit automatically.

Options beat equity. If you believe the trend of high-volatility continuing, you want to own asymmetric payoffs (venture, out-of-the-money calls) rather than linear exposures (stocks, bonds). You're essentially buying insurance that pays off when the world gets weird.

When outcomes become more extreme (fatter tails), these asymmetric bets become more valuable, even if the average outcome stays the same.

Increased surface area for path dependent outcomes. Things compound faster, and the money printer has given us fatter tails and a bigger power law. COVID pulled forward retail trading demand, GFC allowed for trustless money, and bank runs (SVB) was a catalyst for stablecoin infrastructure. Each of these represents a discontinuous shift where the “sure bet” incumbents were poorly positioned, and the variance (outliers) captured disproportionate value.

Power laws changing underwriting expectations. The winners have become much bigger. A decade ago, seed funds would underwrite an outlier as a company exiting at a billion dollar valuation. Today, Stripe, Databricks, Anduril, Anthropic and many others are valued at $100b+ as private companies.

Winner-take-all dynamics have accelerated. There is a case to be made that if you aren’t in the top ~15 names each year, the math tells you it doesn’t make sense to be in the asset class. More on the math behind this logic is found in the section below.

Speed to scale has dropped considerably. Never in history have companies been able to accomplish more, faster. It took the internet 13 years to reach 800m users. ChatGPT was able to reach the same scale as two. Although ChatGPT remains an outlier, there are countless other examples of companies reaching $10m ARR, $20m ARR, and $50m ARR at lightning fast paces.

Fund updates

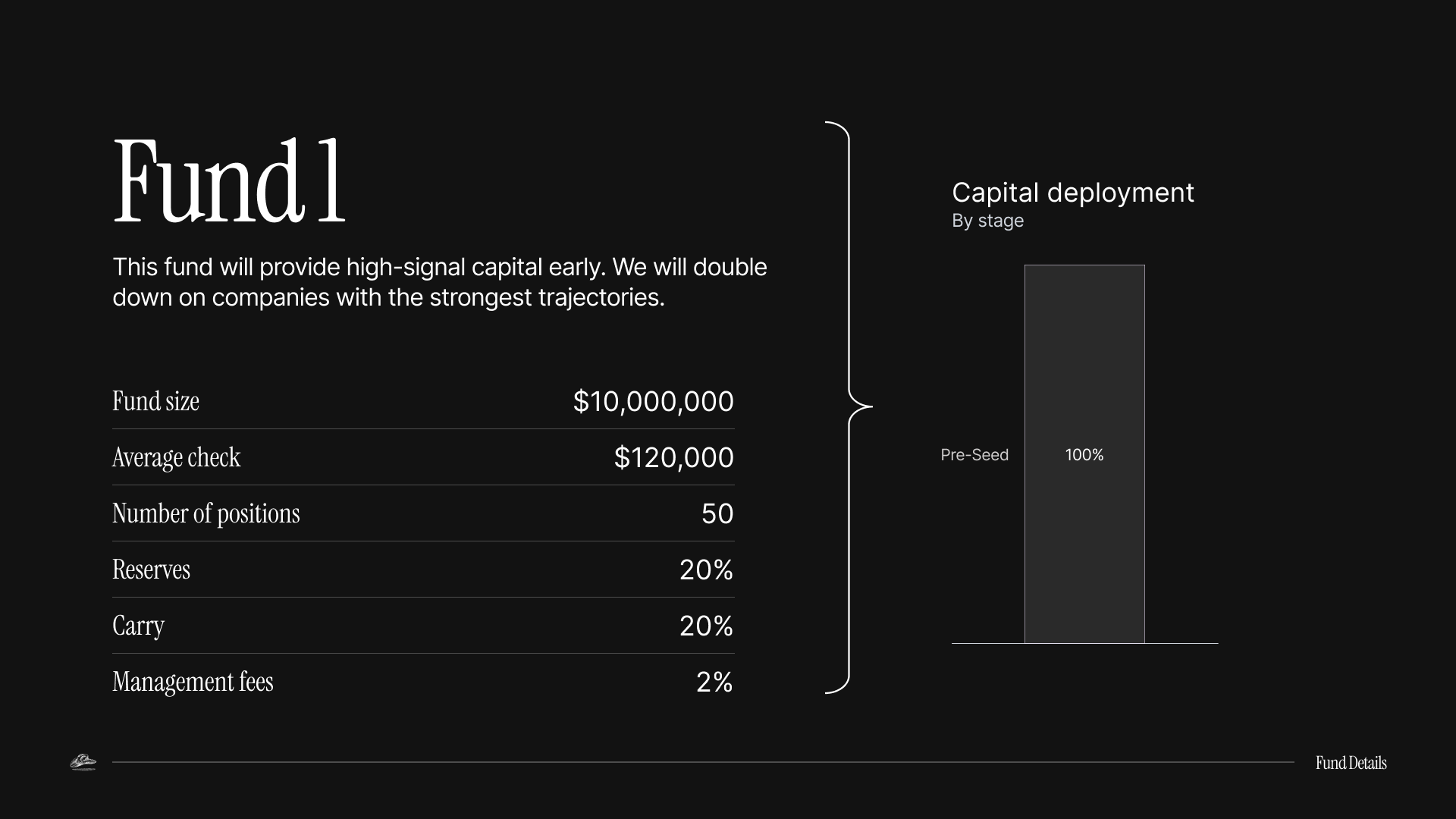

Outlaw aims to be the chief capitalist to future world-defining individuals.

For people who want to learn more about the strategy and my philosophy, thesis, and approach, I have shared more in the links below.

Thanks for reading this far and giving us a little bit of your attention this week. Feel free to unsubscribe whenever this stops becoming valuable to you.