Fund | Community | Sponsor | Recruiting | Careers

Good morning 👋

Over the past ~four years, I have created Apple Notes for every month to store the best things I am reading that change how I think about the world. Given the world I operate in, the bulk of these relate to early-stage venture and private markets investing.

If this newsletter is the front end of my thinking, those notes are the back end.

Looking back so far this month, most of my reading and notes have been centered around thesis-driven investing, recipes for out-of-distribution games, founder archetypes, and who to study if you want to get better at specific investor traits.

More on each of those below.

P.S. For those of you looking at, looking for, or are generally interested in thesis-driven funds …

We have refined the thesis for Outlaw and have created a 25-page report that maps out how we narrow down opportunities based on philosophies 𐃘 themes 𐃘 theses 𐃘 investments.

If you are curious about how we are looking at things, you can do that here.

Investing notes

Notes on USV’s history

It was a small team deliberately kept that way and scaled organically. Following the experience with Flatiron, Fred was very deliberate in scaling the team slowly and preferred integrating the new GPs with patience and from the immediate ecosystem of people they know and trust.

It’s not about the physical proximity, but rather about the mind share. They built the fund in NYC (and without any GPs on the ground in the Bay Area) to become one of the best in history, with the biggest outliers still coming from the Bay Area. They had some great success from the NYC startup ecosystem, but the biggest value drivers like Coinbase, Twitter, and Zynga all came from the Bay Area. Sometimes one differentiates with a killer blog and by being an outsider vs. being the Nth local firm (our Brazilian friends call this the Gringo effect).

If done well, writing goes a long way. One of the biggest differences in Fred’s 2004 practices vs. pre-dotcom is blogging. Fred says thinking in public made them smarter and made it easier to meet people. Listening to their past videos, one sees that they were wrong in their theses at least as much as they were right, but had the creativity to recognize asymmetric ‘big if true’ ideas.

Their first ideas were not their best ideas. The thesis started wider initially (companies like Tacoda, Instant Information) and then became more and more niche towards the application layer for the internet and large online networks of engaged users, where they nailed their biggest value drivers of USV Fund I, like Etsy, Twitter, Zynga.

Exits took care of themselves. One of the USV’s core beliefs was that if one builds a valuable product, value accrual will take care of itself. See Fred’s post in 2007 after the Twitter investment, noting “The question everyone asks is ‘What is the business model?’ To be completely and totally honest, we don’t yet know.”. Funny enough, in his 2010 Mixergy interview, he predicts Elon’s eventual buyout, noting that “There is no reason why Twitter doesn’t have a change of ownership the way Skype did, and it doesn’t need to be an eBay type acquisition, more options we’ll see, not just sale to a strategic buyer or an IPO.”

Notes on Multicoin Capital

By studying a particular market or trend, team members commit to a specific perspective they believe will be predictive. Once codified, the thesis-driven capitalist searches for investments that match their mental model. The hope is that by forming a point of view, the investor better knows where to look and what attributes to prioritize.

“I frequently joke with our investment team that their job is not to find good investments. I don’t care if they find good investments. I want them to find good theses. And we happen to monetize their theses by investing.”

“Someone that forms theses is more valuable than someone who finds investments, because you’re likely to get several bites of the apple. It’s more important to know what’s true.”

“The best way to get the right answer on the internet is not to ask a question; it’s to post the wrong answer.”

“A meaningful percentage of my tweets are fishing expeditions. It’s extraordinarily effective.”

We spend an inordinate amount of time talking about how we think the markets are going to play out. What do we believe, and at what probability?

I think a common thing you’ll hear about us is that, whether we end up investing or not, we typically ask the hardest and most nuanced questions about how the market will play out. We really press them on that. And that’s probably been the single most effective tool of winning deals. Founders realize those questions are forcing them to think about their market in a way they hadn’t before.

Parasite strategies

“The most effective alpha-generating investment strategies are parasites ... [which] uses the market itself as its habitat. It’s not an investment strategy based on the fundamentals of this company or that company – the equivalent of a geographic habitat – but on [exploiting] the behaviors of market participants [behaving for non-economic or institutionally-caused biases]. A parasitic strategy isn’t the only way to generate alpha – but I believe that the investment strategies with the largest and most consistent “edge” are, in a very real sense, parasites.”

Your competition is you

“And as of today, there are 40,000 “contrarians” attending the Berkshire Hathaway meeting, chances are in most stocks you traffic, the person selling to you is the “contrarian” sitting in the bleacher seat next to you. You are trading against you, with each person believing that the person selling to them is behaviorally defective, analytically deficient, and mostly devoid of the information necessary to calculate a price-earnings multiple.”

On front running

“The only way to make money reliably on Wall Street is by front running. Front running means to buy or sell things ahead of others, knowing or expecting that other people will follow you later. Short term front running is often called ‘illegal’. Long term front running is often called ‘investing’.”

Founder archetypes

Koko Xs (GP @ Nova)

On commerciability

“At Goldman Sachs, they have this term, “Is someone commercial?” And I think of that – I love that word. And I think of commercial as people who give off this vibe of, “I’m going to create more value than I capture here,” versus somebody who’s more transactional is trying to capture all of the value.”

On language being an indicator of where you are in your investment journey

“Good investors create their own language. And so when people use a lot of jargon and clichés and language that, at times, doesn’t feel like their own, to me, that’s a sign that maybe they’re a little bit earlier, and they could use another stage of apprenticeship.”

On startup marketing in 2026

“2024 was the year of going direct. That led to 2025 being the year of companies starting factory-farming for “CEO content” and “storytelling.” That takes us to the current moment, and the winners of narrative alpha in 2026 will come from doing real things.”

On building a $10b business

If your goal is to build a $10B company, the first few years are not primarily about being right. They are about building an engine that can move fast once you are directionally right. That engine is people plus capital.

Thematic investing framework

Koko Xs (GP @ Nova)

On the meta game of venture

I would argue that 95% of firms today forget that priority #1 is to create DPI.

More investors on the team = more of a focus on getting deals done to get promoted = individuals more concerned about personal track record

More interested in markups to showcase to LPs = markup investing lens = favors multistage funds

On the simplicity of venture

“Very good investing comes down to owning a lot of a very few businesses over a long duration. Complicating that equation is the root of all wasted investment dollars.”

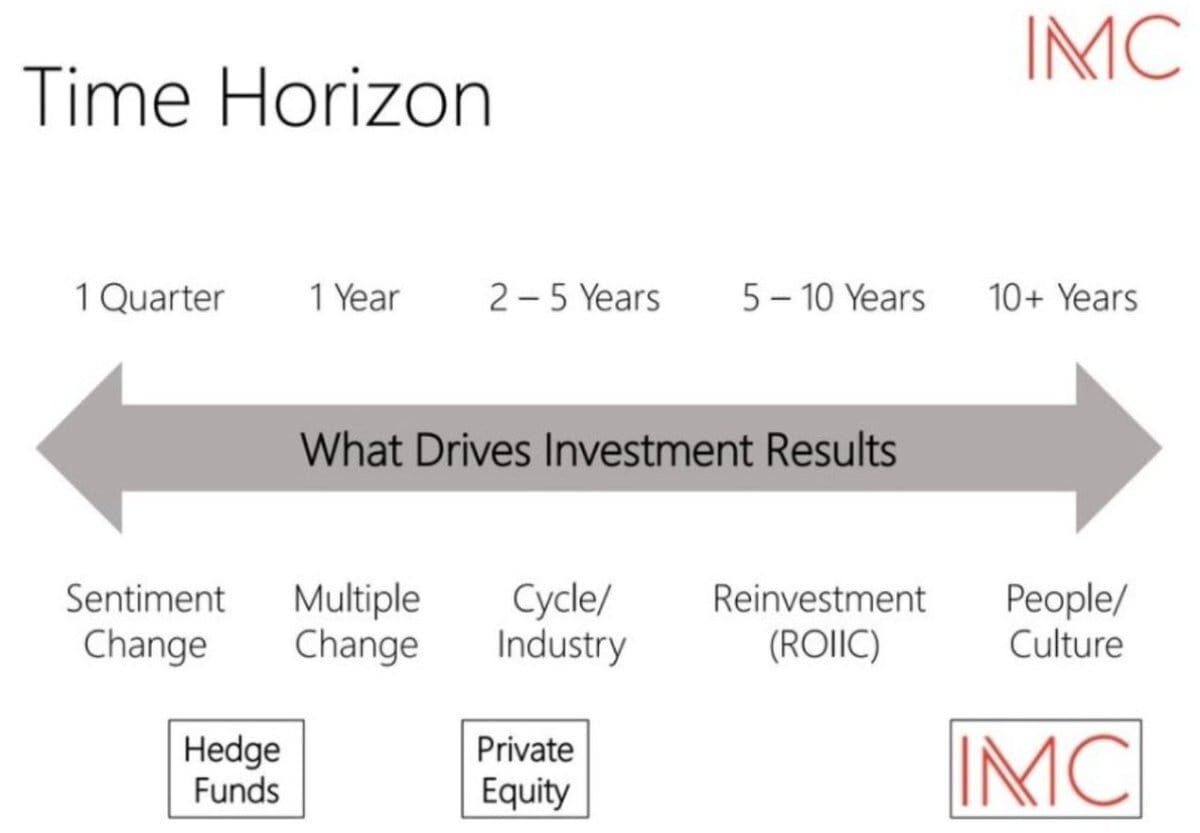

Time horizons, levers, and best-positioned funds

The real business of venture

“There are distributions, and everything else is a story. ARR growth, partnerships, podcast appearances. Fortune 500 clients, tier-1 checks. Valuation growth, marks, IRR. Anti-trust, IPO windows. Venture capital is a storytelling business that occasionally distributes capital.”

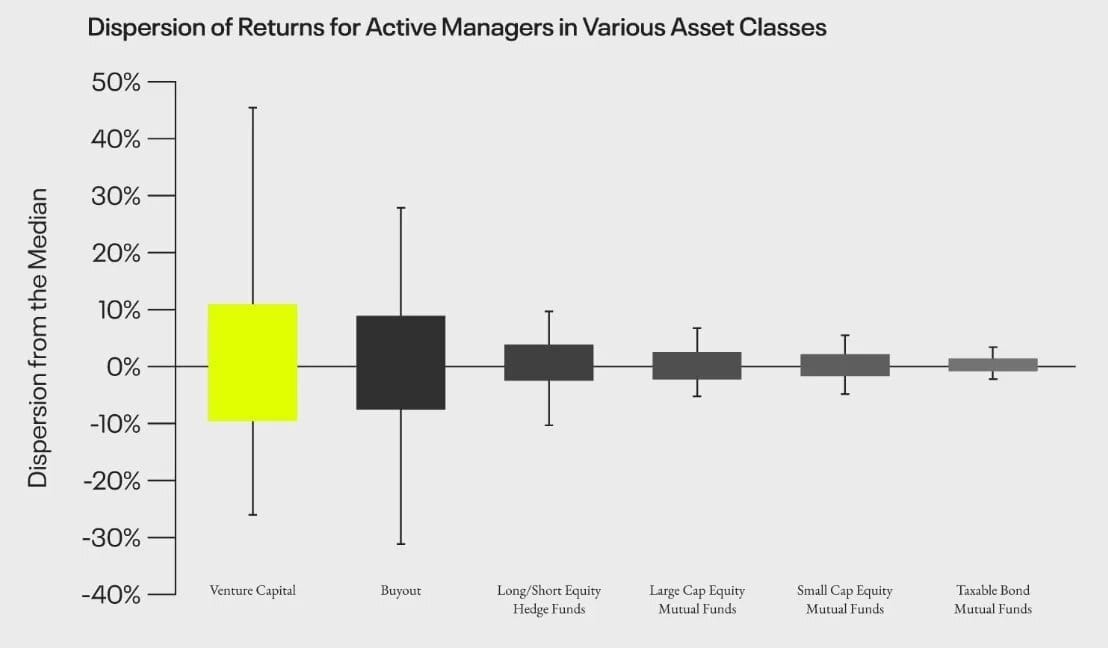

Venture fund returns dispersions

The cycle of human behavior

“Everyone is either entering a crisis, in a crisis, or exiting a crisis.”

Investors to study

If you want to learn how to treat your fund as a business, study Steve Schwarzman.

If you want to learn about the importance of consistent focus, obsession, improvement over decades, and opportunistically finding new financial frontiers, study Ken Griffin.

If you want to learn about patience paired with intellectual curiosity, designing incentive structures, and thinking in centuries, study Jim Simons.

If you want to learn how to treat LPs (and build capital products they like), study Ray Dalio.

If you want to learn about brand dominance in a world of commoditized capital, study Henry Kravitz.

If you want to learn about hidden patterns of the universe, study George Soros.

If you want to learn about creativity in finance, study Michael Milken.

If you want to learn about finding alpha in overlooked opportunities, study Leon Black.

If you want to learn about resilience and coming back from the abyss, study Bill Ackman.

If you want to learn applying game theory to investing, study Paul Tudor Jones.

If you want to learn about conviction, study Masa Son.

Ingredients to becoming an n-of-1 company

Emergence of a new atomic unit of value: Every era has a raw “resource” (oil, idle cars/gig workers, friend graph, etc.) that when captured, catalyzes an immense wave of innovation within a sector. These are obvious and highly contested in hindsight but are largely non-obvious to incumbents at the time of discovery. Commentators often dismiss the initial market as “too small”. N-of-1 companies recognize this reorientation early and effectively build technology products that take advantage of external macro trends to capture an early foothold in acquiring the newly discovered unit of value.

Capture of this atomic unit of value: N-of-1 companies are able to translate their early foothold into a dominant position to acquire the newly viable atomic unit as fast as possible. Dominance over the atomic unit enables these companies to build category-defining businesses around the resource thus cementing their position for the long term. As a result, incumbents and newcomers quickly face uncrossable moats in their attempts to compete with the N-of-1 firm.

Transformation into a central utility: With dominance and control of the atomic unit, N-of-1 companies are able to rapidly extend their family of products. Once these companies create scarcity of the atomic unit, adjacent economic activity refactors around the companies leading to broader market disruption. An ecosystem starts to emerge because other companies of different types start to rely on each N-of-1 company for their own survival. The N-of-1 companies become immovable central fixtures — utilities. In doing so, N-of-1 companies transform from merely services to central utilities that power entire ecosystems.

Firm > fund

“I believe that most investors are running funds, and very few people are building firms. What do I mean by that? A fund, by my definition, has a single objective function: “how do I generate the most carry with the fewest people in the shortest amount of time?” Whereas a firm, in my definition, has two objectives. One is delivering exceptional returns, but the second is equally interesting: “How do I build a source of compounding competitive advantage?”

Fund updates

Becoming chief capitalist to future world-defining individuals.

Thesis

Outlaw is a thesis-driven fund that narrows down opportunities based on theses, themes, and investment philosophy.

We believe that out-of-distribution companies are created by out-of-distribution people. A founder with a successful exit has vastly different odds than a 24-year-old first-time founder. The founding engineer at Cursor has different odds than someone who's only held junior engineering roles. The founding GTM person at Ramp has different odds than someone who's only held generic sales jobs.

The fund invests in individuals, not companies. We do not fish in the same ponds as multi-stage investors, we generally avoid live rounds, and we tune out everything except the founders in our underwriting.

We believe in the art of finding under-discovered talent. The most talented people in the world were once unknown names. In a world of consensus investors, we believe the most upside belongs to those willing to do the work finding talent before it becomes obvious in hindsight.

I have attached my latest thesis deck to the right that breaks down my overall approach and more on how I think about curation.

For those of you looking to get more involved, I’m happy to chat.

Thanks for reading this far and giving us a little bit of your attention this week. Feel free to unsubscribe whenever this stops becoming valuable to you.