Good morning 👋

AngelList has a better seat than most at what’s going on in venture. That’s why we love reading their annual reports recapping us on what we missed.

Their latest one came out last week, so we’re trying to sum things up for you in today’s piece.

Today’s highlights

Making sense of the latest AngelList report

Measuring signal in a digital world

The latest investment memos from our team

8VC is launching a recruiting company

TOP

2024 state of venture report 📊

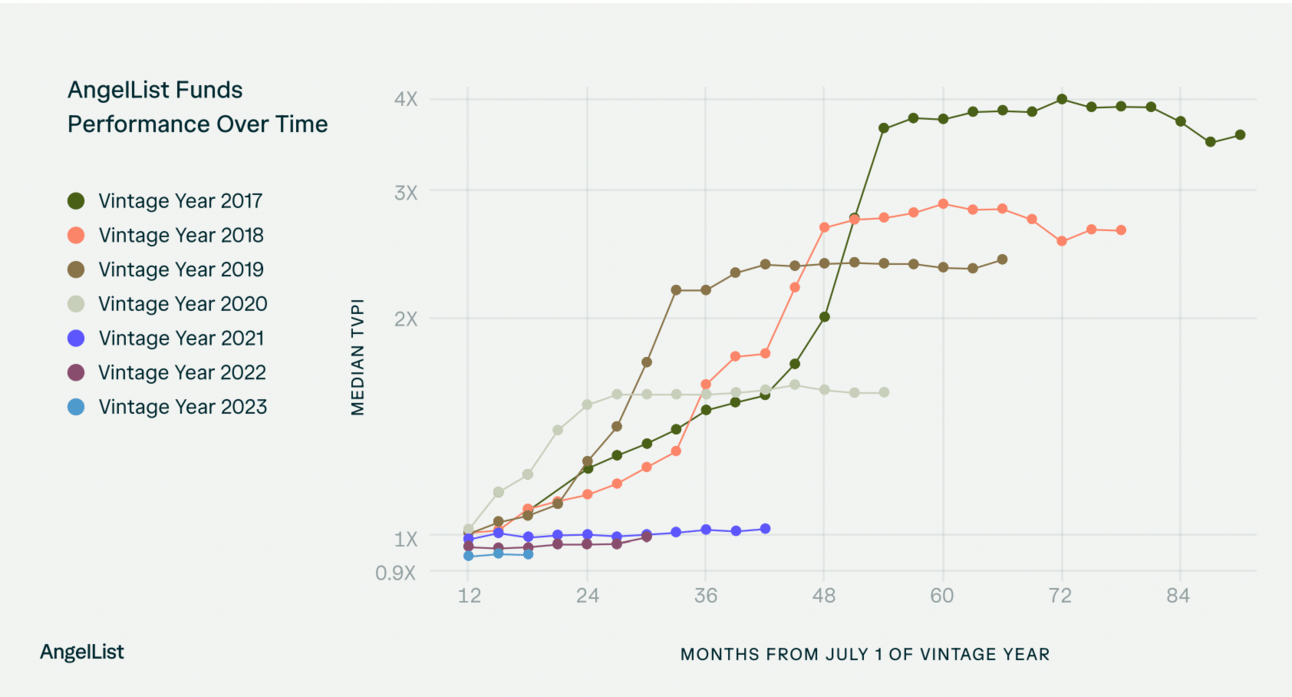

The 2024 venture landscape is a very different one from the free-money era of 2021.

Fundraising is brutal, valuations are down, and capital efficiency is back in vogue.

Here’s the high-level on where things are today and how smart investors are taking advantage of the current conditions.

Key takeaways

1️⃣ Fundraising is (still) frozen)

💰 $67B—That’s the total capital raised by U.S. VC firms in 2023, a 60% drop from 2021. LPs have pulled back, citing lackluster returns and more attractive alternatives in private credit and public equities.

📉 First-time funds are getting crushed: Emerging managers raised just $4.3B last year, a 72% YoY decline. If you don’t have an established track record, good luck convincing LPs to cut a check.

What’s driving the LP pullback?

High interest rates—Allocators can get a risk-free 5%+ yield elsewhere.

Longer exit timelines—IPOs are still slow, and M&A has stalled.

Overexposure to venture—Many institutional LPs hit their target allocations in 2021-22 and are now overweight.

Who’s still writing checks?

Family offices

Founders-turned-LPs

Sovereign wealth funds (especially Middle East-based investors)

Bottom line: If you’re a GP, expect smaller funds, longer raise timelines, and LPs asking tougher questions about differentiation.

2️⃣ The valuation reset is still resetting

🚨 40%—That’s how much median late-stage valuations have dropped since 2021.

🔻 Series B and later rounds are feeling the most pain:

Pre-2021 unicorns are raising at 30-50% lower valuations (if they can raise at all).

Down rounds, secondary sales, and structured deals are the new normal.

💡 Loom’s exit to Atlassian for $975M was framed as a disappointment because it was below its last round’s $1.5B valuation—despite being a solid outcome. Expect more of this as companies adjust to the new pricing reality.

Bottom line: If your portfolio hasn’t tested the market in 2+ years, assume it’s worth 20-30% less than you think.

3️⃣ Capital efficiency is back (for real this time)

🔥 The "grow at all costs" era is dead. Investors now reward companies that can scale without burning mountains of cash.

📊 Revenue-per-employee is the new favorite metric, and startups with efficient growth are getting premium valuations.

👀 What’s getting funded?

Businesses that break even quickly

AI infrastructure (where compute costs are the real moat)

Companies helping enterprises cut costs (not just drive revenue)

Bottom line: If your startup doesn’t have a clear path to profitability, funding options will be severely limited.

4️⃣ Corporate VCs are eating traditional VC’s lunch

💸 $25B—That’s how much Microsoft, Amazon, Nvidia, and Alphabet (MANG) poured into startups last year—8% of all U.S. venture funding.

But here’s the kicker: Most of this isn’t cash.

Microsoft’s $10B OpenAI investment? Mostly Azure cloud credits.

Nvidia’s startup deals? Primarily GPU access.

🚨 Why this matters:

CVCs can offer distribution + infrastructure, making them much more attractive than traditional VCs.

Traditional funds struggle to compete—cash alone isn’t enough anymore.

Bottom line: The biggest venture rounds now come with strategic strings attached.

5️⃣ The Best Funds Are Playing Offense, Not Defense

🏗️ VCs are launching their own startups to secure higher ownership stakes.

Examples:

Greylock’s Edge program helps pre-seed founders with AI, hiring, and customer discovery—without taking equity upfront.

Primary and Up Partners are using incubation models to increase ownership without overpaying.

🛠️ The shift:

Instead of fighting for allocations, top firms start companies themselves.

Incubating startups allows them to control ownership without bidding wars.

Bottom line: Expect more funds to move toward an operating + incubation model to stay competitive.

COMMUNITY

The OS for private investors 🕹

Good venture investors need to have:

Good background knowledge and an understanding of how venture dynamics work

A source of good deal flow so that you see founders first

An elite investor network that you can share notes, deals, and other information with

Mental frameworks to understand company building, scale, and what makes a good vs. great investment

Connections to other high-quality people that become future co-workers or portfolio company employees

That’s why we built this.

2,500 other investors from places like Bessemer, Insight, Accel, and Founders Fund already use it, and we think you should too.

LINKS

🐦 Darwin’s Finches in AI: A timeline of how AI evolution has compressed in just the last two years

🔬 State of the Private Markets: Mostly Metrics begins a new monthly series that delivers valuation, hiring, and revenue insights on pre-IPO candidates

🧰 The Generalist’s Productivity Stack: Mario Gabriele shares his techniques and tools for getting things done

🌅 Rising Starts—10 Startups with Strong Momentum and Success Signals: Data-Driven VC’s picks of the week

🫨 DeepSeek Rocks the Tech Industry: The Pragmatic Engineer dives into the shock wave sent throughout the AI sector when an almost unknown Chinese lab released an AI model that’s open, free, and as good as ChatGPT’s best models, and, cheaper to operate

TWEET

HEADLINES

8VC and Slow Ventures hatch AI-driven recruiting startup (Pitchbook)

Emerging GPs no longer closing more VC funds than experienced peers (Pitchbook)

Guo’s Conviction Partners adds Mike Vernal as GP, raises $230M fund (TechCrunch)

They Invested Billions. Then the A.I. Script Got Flipped. (NYT)

MEME

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

RESULTS

Here are the results from our poll question in yesterday’s piece:

Would you pay for real investment memos delivered to your inbox weekly / monthly?

🟩🟩🟩🟩🟩🟩 Yes - just take my money

🟩🟩🟩🟩🟩🟩 Yes - but want to better understand how companies are selected

🟨🟨🟨⬜️⬜️⬜️ Yes - but only if I can also talk to the person who wrote it

⬜️⬜️⬜️⬜️⬜️⬜️ No - not right now