Together with

Good morning 👋

When we got started in venture ~8 years ago, the world was a different place. If we were starting all over today, maybe we’d rethink some of our original assumptions.

As the AI adoption curve plays out, more pressure is felt at the bottom of organizations, and we think it’s time for a lot of pre-partner private market investors to do some soul searching.

Here are some more thoughts on why …

P.S. 🎧 We’re giving away a pair of Airpods Pro 2 to one lucky reader …

Whoever refers the most new subscribers this quarter (ending June 30) will win a brand new pair of Airpods on us.

Today’s highlights

Are venture jobs losing their appeal?

Data is the new oil = fracking humans for their thoughts

Looking for a tech job has never been more confusing

TOP

the future of private market jobs

Given that a lot of our readers are pre-partner investors, I think it’s important to note some of the things that other career VCs won’t tell you about the realities of the path ahead:

A LOT of the work done by junior investors is being eaten by AI

All pre-partner roles become more competitive with less flexibility

Your path to partner was already narrow, but it has become even more narrow

We had teased some of this a few years ago, but I think others are seeing the writing on the wall.

Let us know in the poll below what you think.

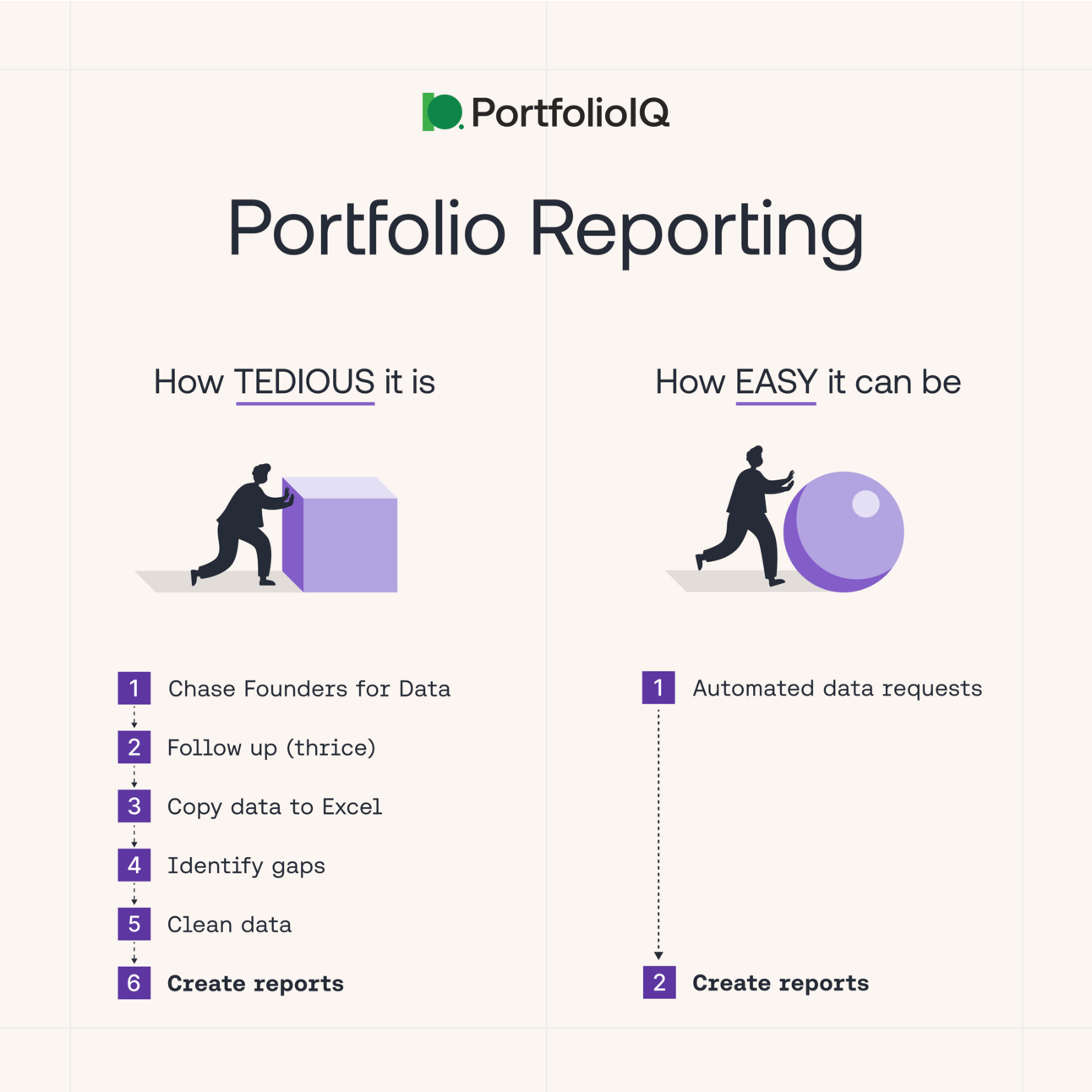

Together with PortfolioIQ

Automate your fund ops ⚙️

Question: On a scale of 1-10, how much stress enters your life when LPs start asking for portfolio updates?

If that number is higher than a ~3, it’s probably time to start using something like PortfolioIQ.

Their platform organizes your portfolio data, automatically, and it helps investors:

✅ Set up automated data requests

✅ Extract data from documents

✅ Standardize data for metric name & currency variations

✅ Track and source-map every data point

And most importantly, stop the quarterly reporting scramble.

Hyper-automate your ops with PortfolioIQ (it’s free to get started).

TWEET

MEMOS

Outtake: Thoughtful cyber agents to secure high-profile people

HumanLayer: Human-in-the-loop agents

Chima: Interoperability for AI agents

Superpower: The all-in-one subscription for preventative healthcare

Documenso: The DocuSign killer

HEADLINES

How emerging managers can capture aligned LPs (VCJ)

VC balances AI potential with avoiding its own extinction (Axios)

Endowments Need Cash, but VC Firms Have None to Offer (The Information)

Looking for a Job in Tech Is More Confusing Than Ever (WSJ)

POLL

Is private equity and venture capital still a "growth industry" for your profession?

RECS

📝 Insider: Get investment memos, market maps, behind-the-scenes updates, and other things we don’t send to the rest of the list. (Get your first memo free)

⚙️ Operator: Get everything in Insider plus all of the best tools, data, and other resources we have used to build this business. (Get 20% off)

📶 Boardroom: Add our team as fractional problem solvers (whenever you need it).

LINKS

♟️ How to Increase Your Salary and Understand Your Market Rate: A professional compensation negotiator shares tactical answers and strategies

🤥 Bad Misses: You never know when you’ll need the flexibility that only reliability can earn you

💬 Turning ChatGPT Prompts into Profitable Startups—How AI-Generated Ideas Are Creating the Next Wave of Founders: AI tools have evolved from smart assistants into entrepreneurial launchpads

🧨 David Sacks Explains How AI Will Go 1,000,000x in Four Years: The All-in Podcast talks with David Sacks about the rate of AI progress

🎯 You Should Really Qualify Your LPs: Not every LP will be a fit so save yourself some time and qualify the LPs and then tailor your approach to each

Thanks for reading this far and giving us a little bit of your attention this week.

Feel free to unsubscribe whenever this stops becoming valuable to you.

- Clay

(Founder @ Confluence.VC | GP @ Outlaw)