Good morning.

Over the past decade, I’ve spent my life in or around startups. For the most part, this has been a great experience.

But over the past ~year or so, I have started to hate a lot of things about startups and startup culture.

This is a non-exhaustive list of some of those things. It will probably piss some people off.

If there are others that I missed, let me know in the comments.

Big breakdown

Things I currently hate about startup culture

996 culture. Every founder is free to build their own culture, and I respect the hustle. But I think this type of place rewards time in office > results. IMO that attracts individual contributors and not the types of people you need to actually reach scale. It’s also impossible to be creative while working 12 hours a day 6 days a week, but sure, convince yourself you’re being productive in the office all that time at the expense of everything else life has to offer you.

Not drinking. I have gone both directions here, and I have had periods of my life drinking too much and drinking too little. With the benefit of hindsight, I can say that drinking, going out, and being social has absolutely helped my career in non-obvious ways. There is obviously a balance and rules that come with mixing booze and work, but I think that people who avoid drinking to “optimize” are ironically putting themselves in a position to never get lucky.

“Cracked founders”. I can promise you that the best founders do not refer to themselves as “cracked”. Neither does their cap table.

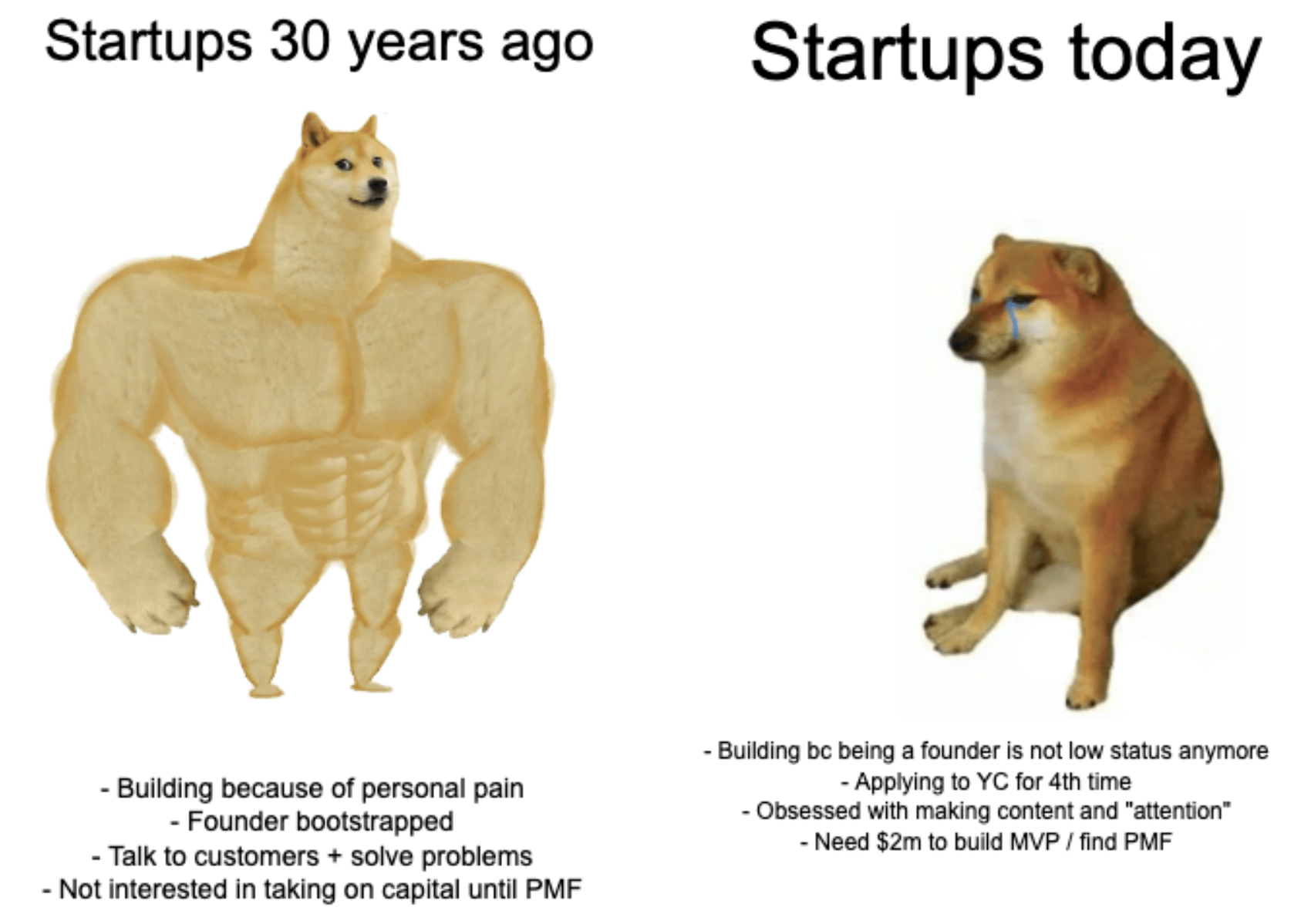

99.9% of YC. Never been a huge fan, have gotten to know multiple founders who went through the program and got nothing out of it, but I think it’s gone completely off the rails as of late. There used to be this belief that the best seed founders were choosing YC, and maybe there was a period where that was the truth. But now the best founders have zero interest in giving up 7% of their company in exchange for a demo day pitch, the YC quality bar has been drastically lowered as they moved to four batches per year, revenue round-tripping is a real problem, and many of the best investors don’t see the value in paying a “YC premium” for these companies post-graduation.

Requests for startups. Do you really think you’re going to find a founder working on their life’s mission when you tell them explicitly what to build? Or do you think you attract and reward short-term thinking by putting bounties on products you’re looking for today?

Revenue round-tripping. ARR used to mean annual recurring revenue. Most of the time today, it is not annual, it is not recurring, and (more often than not) it is not even revenue (credit swapping). This has gotten completely out of control, it destroys whatever credibility this industry has left, and it will probably result in people going to jail in the future.

Anybody that still believes you have to be in SF to make it. From somebody who has spent considerable time in all of the major tech hubs, the more time I spent there, the more I started to think like everybody else. Maybe there’s a case for spending time there, but I’ve found that most of the most-vocal SF-only crowd are justifying their own life choices.

Internet-native deal guys. In the past when deals were done in person, you got exposed for not having presence and not being able to read a room and negotiate. Fast forward to today with a lot of deals being done over the internet, and the skills being rewarded are different. I think it leads to a zero-trust environment, and hopefully it does not last.

Believing you can spot outlier founders when they are in high school. I promise you that you cannot. VCs that do this are not serious people, and it’s weird for too many reasons to count.

The death of customer obsession in exchange for the pursuit of eyeballs. You realize you can make a lot of money by channeling that obsession into your customers, right?

The slopification of the timeline. It has never been easier to spot an original thinker. It has also never been easier to sabotage your reputation by outsourcing your thinking.

Paid marketing for venture funds. This got exposed over the past couple of weeks. Not surprising, but dollars follow incentives.

Cluely. This is obvious, right?

Tripe, triple, double, double. There is this idea that growing 100% YoY is not enough, and that world-class AI companies are able to sustainability (key word) grow even faster. There are outliers that support this take, but outliers shouldn’t redefine the definition of what “great” growth looks like.

AI maximalists. I understand that AI improves some aspects of knowledge work, but the “AI is coming to take your job crowd” are objectively the worst. Living through tech bubbles will callus your brain to these types of ideas.

Status seeking becoming more and more direct. People who need to borrow credibility to introduce themselves. Where you went to school, who you used to work for, blah blah blah. I understand venture is a pattern-matching game, but can you be less blunt about it?

Unironically using the word “taste”. Have noticed a pattern where everybody who does this has some of the worst “taste” I’ve ever seen.

AGI. You’ve been online too long. Touch grass.

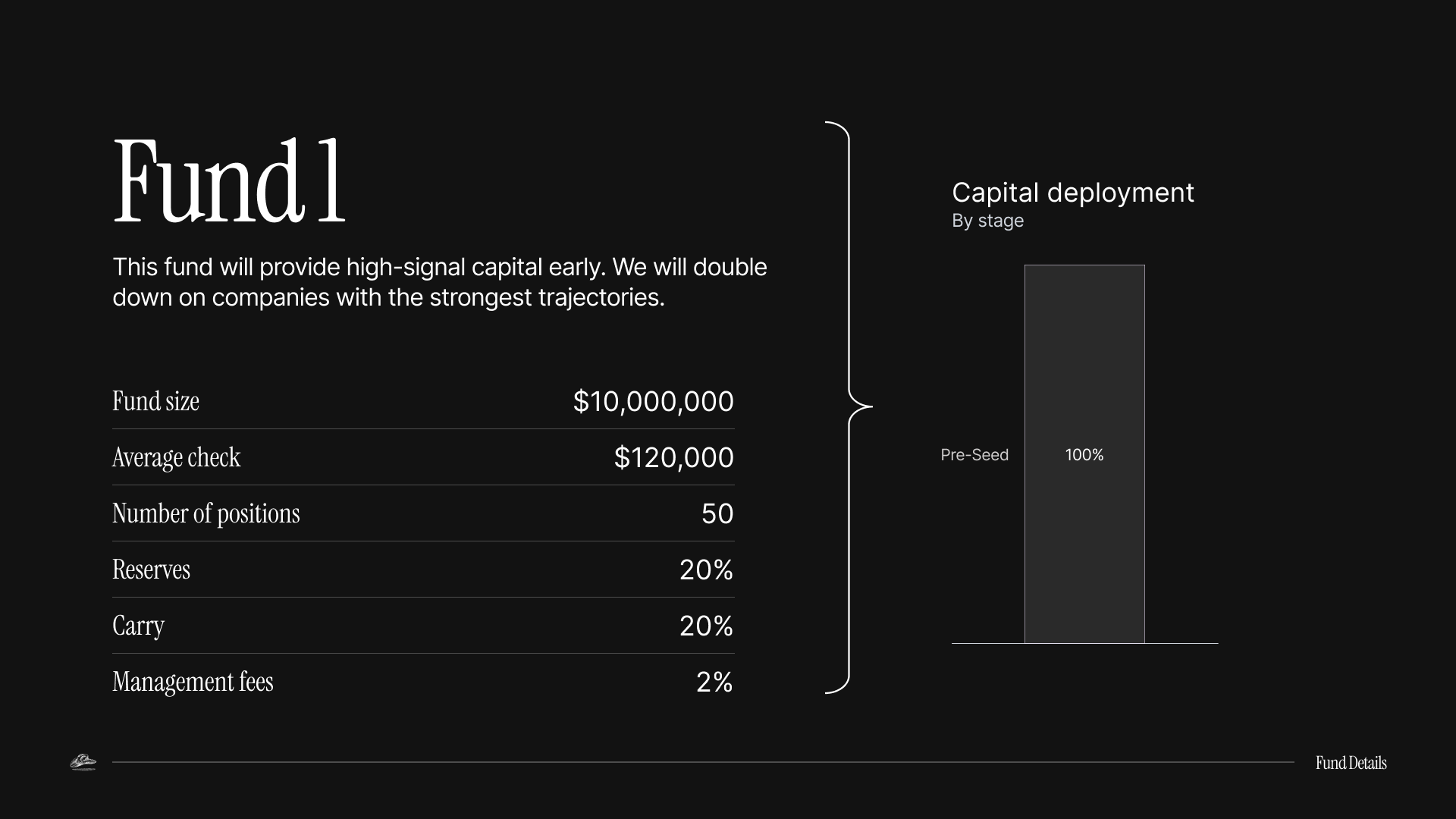

Fund updates

What I’m up to

I’m sending out the Outlaw Q3 update tomorrow to update early backers on:

The first set of companies that I will back from this fund

Why I think seed investing is broken + why you need to have a system to go earlier in the company formation process

How to de-risk execution ability (or at least how I am going about it)

Building a firm that provides what pre-seed founders actually want on their cap table

Terms that I am offering to first close LPs that are only available for the first close

I’ll spare the details, but if you want to get added to that list, let me know.

More

ICYMI

Best of last week

the vertical AI playbook: How we got here, some differences between selling AI and selling software, and five steps to winning in vertical AI

negative gross margins, supernovas, and the end of pricing power: Questioning the logic around negative margins for supernova AI companies, lessons from investing in challenger banks, and which types are agents are getting the most utility

the future org chart: Away with the traditional pyramid structure, the late innings of institutional compounding, VC fund performance cheat sheet, and some data on a16z returns

AI long tails: Layers of AI adoption, some fund data from Carta, the most valuable private companies, and some thoughts about rejecting compression

agent managers and the new middle management: The rise of the agent manager, some stats from the launch of Outlaw, why we're terrified of one-way doors, and is an MBA worth anything anymore?

Share Confluence.VC

Share this newsletter with your friends, or use it as a pickup line.

1 referral

Free month of Insider

5 referrals

Free month of Operator

👉 Your current referral count: {{rp_num_referrals}} 👈

Or share your personal link with others: {{rp_refer_url}}

Thanks for reading this far and giving us a little bit of your attention this week. Feel free to unsubscribe whenever this stops becoming valuable to you.

Upgrade 🤝 unlock more

Join 100's of other readers getting more exclusive content by upgrading below ...

Get your first week FREEHere's what else a paid subscription gets you:

- 5x posts / week (20x posts / month)

- 2x / month investment memos on pre-seed companies we find interesting

- Market maps on up-and-coming verticals (with company data)

- Database of 2,000+ venture capital firms with firmographic data