Fund | Recruiting | Sponsor | Community

Good morning 👋

And welcome back to the grind.

This is part two of a four-part series on how I think about designing a thesis-driven investment firm.

If you choose to be a thesis-driven, you are subscribing to the belief that investments are downstream from other parts of your thinking.

Philosophies → Themes → Theses → Investments

Guiding philosophies are most useful for choosing which asset class to play in. I believe that early-stage venture has, is, and will continue to be the most interesting asset class, and I have shared some of my reasons for why here.

After philosophies are established, it becomes time to be an observer and look through macro patterns on the world is heading. As somebody who regularly talks to people smarter than myself and has written about these types of things for the past ~six years, I am pretty opinionated on themes.

After a lot of narrowing and with the help of hours worth of Claude refinement, these are the five major themes that have created the category for our investment zone.

Investment themes

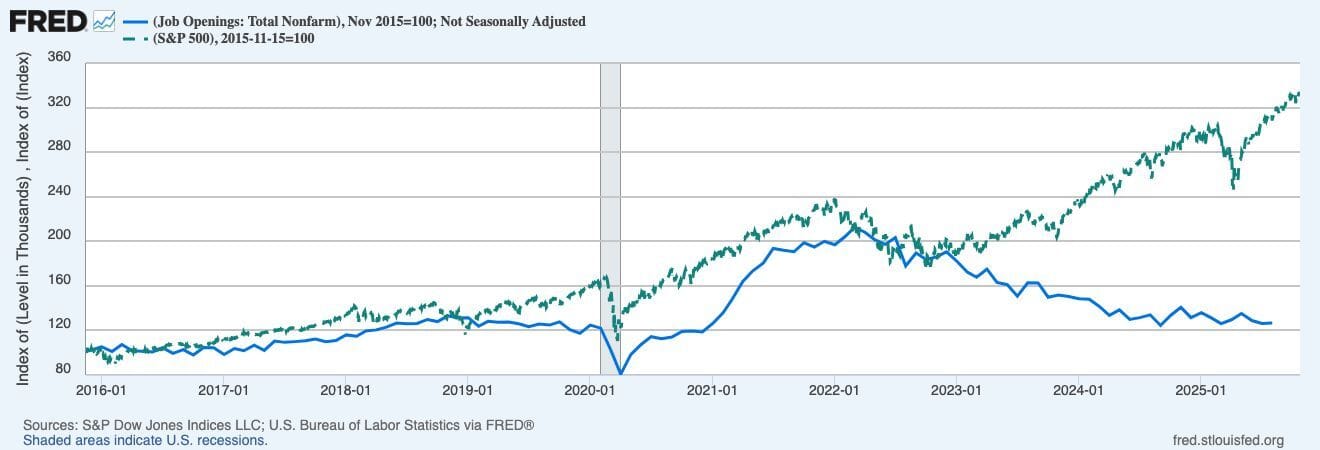

Labor decoupling and K-shaped economies

As the disconnect between asset appreciation and wages widens, we believe all roads lead to buying or building assets.

K-shaped consumer spending:

The top 10% of Americans now account for 49% of all consumer spending.

The wealthiest 10% hold over two-thirds of the nation's total wealth, while the bottom 50% collectively hold just a fraction.

Middle class shrunk from 61% in 1971 to 51% in 2023.

K-shaped labor split:

Companies are operating fine with dramatically fewer people. Elon firing 80% of Twitter staff and platform continuing to function was the mask-off moment, and every company realized they were carrying corporate bloat.

500,000 white-collar software workers expected to be laid off over next 2-3 years (70% with 4-12 years experience).

The result: fewer workers, same or better output, higher margins.

K-shaped wage split:

Automation has replaced the need for many entry-level and back office roles. It is no longer feasible to hire most junior roles - software has already replaced them. It is now moving up chain of command, and no role is safe anymore.

Offshoring and visa programs have reduced the supply of “jobs worth pursuing”. There is always somebody cheaper who wants your role. The farther away your role is from creating revenue, the easier you are to replace.

Inflation and suppressed wages has already (and will continue to) lowered quality of living. The life that was afforded to the previous generation on a single W2 salary now requires two W2 salaries. Pretty soon, even that will not be enough.

The Golden Age for builders

There has never been a better time in history to be a founder.

The infrastructure tax of starting a business has disappeared.

Over the past two decades, the fixed costs of running a basic internet company has reduced from $150k / month to ~$1k / month. In today’s world, you can build, ship, and scale to thousands of users before needing outside capital. At the same time, audiences can be built for free to validate demand before building. All of the traditional barriers - capital, infrastructure, distribution - are gone.

Superhuman tools for us mortals.

Cursor autocompletes entire features. Lovable ships production apps from prompts. Replit goes from idea to deployment in one conversation. V0 generates React components on demand. Claude writes documentation. Midjourney creates marketing assets. The entire creative stack is now accessible to anyone.

Status comes with building.

~20 years ago, there was no status to being a founder; it was a “profession” for the misfits and unemployable. Fast forward to today, and everybody wants to be a founder. The private markets have ballooned, Harvard teaches entrepreneurship classes, the Hollywood-ification of startups has attracted a new audience, and younger generations see entrepreneurship as the only way out of the W2 rat race and a declining lifestyle. As more smart people are steered towards startups (many of whom would never consider them in a previous generation), the influx of talent creates is a new generation of builders.

Everything is computer

"Software ate the world. Now the world is being rebuilt in software's image.”

Software creation became free, and the value moved elsewhere.

When everyone can build software (Cursor, Lovable, Replit), building software is no longer the moat. Distribution, adoption, and integration are now worth more than the software itself. The value in software is moving up the stack: from code → to deployment → to integration → to orchestration.

The long tail of software exploded.

If anyone can build software, then every company becomes a software company, and every niche gets its own custom tools. Platforms will continue to emerge that let non-technical domain experts build software businesses (Shopify for e-commerce, Webflow for websites, Airtable for databases, Retool for internal tools). The next decade belongs to platforms that abstract away software creation entirely and let people focus on their actual expertise while the platform handles the code.

Software stops becoming a product and starts becoming an ingredient.

APIs won. Every company is now building on top of Stripe, Twilio, Plaid, Segment, and hundreds of other API-first services. The new software stack is composable building blocks > monolithic applications. This explains why AI companies are racing to become infrastructure; OpenAI, Anthropic, and others know that being the underlying API is worth more than being the end product. The opportunity today has shifted away from building another standalone SaaS app and towards building the foundation that 10,000 other apps depend on.

Agents became the new users.

When your customers are increasingly agents, not humans, the UX paradigm breaks. Agents don't need pretty dashboards or intuitive navigation, but they do need APIs, structured data, and clear schemas. This is why "AI-native" software looks nothing like traditional SaaS. No UI (just endpoints), no onboarding flows (just documentation), no customer success (just reliability). The companies rebuilding their products for AI consumption (machine-readable data, agent-friendly APIs, programmatic access) will eat the companies still optimizing for human dashboards. Software is becoming infrastructure that agents orchestrate, not products that humans operate.

GTM is the new engineering

The most important hires within a business today are working on GTM.

Building good software is now table stakes.

Winning the attention war, solving GTM, and building repeatable sales systems are the new bottlenecks.

Companies are dying on GTM, not product.

Five years ago, failed startups usually had product problems - they built something nobody wanted. Today, most failed startups have great products. They die because nobody knows they exist. The Product Hunt launch gets 500 upvotes, then traffic dies. The blog gets no readers. The outbound gets ignored. The paid ads are too expensive. They raised $2M, built an amazing product, and ran out of money before achieving distribution. Product-market fit without distribution-market fit = death.

Distribution is distributed (aka multi-channel).

The traditional SaaS playbooks was simple: "Build great product, add sales team, scale ARR." That worked when there were fewer products and buyers had time to evaluate. Now buyers are overwhelmed. Inbound is dead for most companies. Outbound is saturated (cold email agencies and AI SDRs have made all of our inboxes noisy and crowded). Organic content takes forever to see results. Paid ads are expensive. Events are expensive with unknown ROI. Affiliate programs are hard to manage. There is no one-size-fits-all solution to scaling in today’s world. The companies winning are the ones diversifying distribution across multiple channels simultaneously.

GTM engineering became hottest new role in tech.

GTM used to be "hire sales reps, give them a script, measure conversions." That approach is dead. Modern GTM requires technical sophistication approaching engineering: data pipelines, attribution modeling, A/B testing infrastructure, programmatic SEO, AI-powered outbound, multi-touch attribution, predictive lead scoring, conversion optimization, funnel analytics. The "GTM engineer" emerged as a distinct role, and it is quickly becoming one of the most sought-after positions in a company.

Finance as culture

The financialization of everyday life is accelerating. Finance has become the dominant framework through which people understand value, make decisions, and interpret the world.

Over the past ~five years, finance has become entertainment.

Not very long ago, finance was a boring industry.

Buying stocks was boring.

Personal finance was boring.

Pursuing home ownership was viewed as the primary pursuit for wealth.

Alternative assets were largely ignored and reserved for the “experts”.

That has all changed thanks to a variety of reasons, and we believe there is no putting the genie back into the bottle. As finance permeates more into our daily lives, there are a handful of second-order effects that we believe create opportunities for the well-positioned.

Independent media has given rise to the individual kingmaker.

As established media lost trust, the next generation looked for places where they could find truth. Many of them found it from many different sources.

The attention economy exploded, everybody is pursuing eyeballs, distribution became the bottleneck, and a handful of names emerged in every different industry. In finance along, you have small media companies like Exec Sum, High Yield Harry, Short Squeeze, Confluence.VC, and Not Boring collectively winning mindshare from a bulk of the finance industry every morning. This is a small sample of from one industry, and there are dozens of others within every niche imaginable.

The newly established media names hold real influence, and in the age of infinite leverage, the best ones have already layered on complementary products and services designed specifically for their unique audiences.

Everyone started thinking + acting like owners.

When finance was still considered “boring”, nobody talked about it, and when nobody talked about it, nobody knew what they didn’t know.

Fast forward to today, and the explosion of media has given us access to the minds of people who have built real wealth. Their message has been heard and repeated: you cannot build real wealth without pursuing equity.

Labor began emulating capital - side hustles, solopreneurship, "owner mindset" became corporate gospel. SMBs (not just startups) started offering equity compensation. Harvard started teaching acquisition entrepreneurship classes. The creator economy embraced equity structures (splits, revenue shares). "Invest in yourself" replaced traditional investment advice. Portfolio composition became as important as job title.

Fund updates

Thanks for following along as I document how I think about early-stage investing and the frameworks that have lead me through firm building. I will share more on the theses and categories for investment next week.

For those of you curious about Outlaw,

Becoming chief capitalist to future world-defining individuals.

Thesis

Outlaw is a thesis-driven fund that narrows down opportunities based on theses, themes, and investment philosophy.

We believe that out-of-distribution companies are created by out-of-distribution people. A founder with a successful exit has vastly different odds than a 24-year-old first-time founder. The founding engineer at Cursor has different odds than someone who's only held junior engineering roles. The founding GTM person at Ramp has different odds than someone who's only held generic sales jobs.

The fund invests in individuals, not companies. We do not fish in the same ponds as multi-stage investors, we generally avoid live rounds, and we tune out everything except the founders in our underwriting.

We believe in the art of finding under-discovered talent. The most talented people in the world were once unknown names. In a world of consensus investors, we believe the most upside belongs to those willing to do the work finding talent before it becomes obvious in hindsight.

I have attached my latest thesis deck to the right that breaks down my overall approach and more on how I think about curation.

For those of you looking to get more involved, I’m happy to chat. My calendar is linked.

Thanks for reading this far and giving us a little bit of your attention this week. Feel free to unsubscribe whenever this stops becoming valuable to you.