Fund | Recruiting | Sponsor | Community

Good morning 👋

This is the fourth and final essay in a series about how I think about building a thesis-driven fund from the top down.

We started with guiding philosophies, then covered investment themes, then narrowed into investment theses.

Today we bring it all together.

This is the overarching investment thesis for Outlaw 1.0:

Chief capitalist to out-of-distribution individuals.

There are two parts to that sentence. We'll unpack the second part first, and then cover the first.

P.S. This is a longer post and will get clipped by Gmail. We recommend clicking ‘Read online’ at the top of this email to get the full, unclipped version.

Together with Delve

Screenshots … your days are numbered

Delve CUA is a computer-using AI agent that securely navigates your tools to capture compliance screenshots and attach them directly to the correct controls.

It eliminates manual evidence collection so your team can focus on building and shipping, not documenting.

Compliance is now fully automated end-to-end.

Investment thesis

Part I: Out-of-distribution individuals

As we covered in the first essay of this series, several guiding philosophies have led to our thesis being centered entirely around the individual before the company, the market, or the technology.

Very few companies are responsible for the bulk of returns in the venture asset class. Very few people within those companies are responsible for the bulk of the decisions that led to scale. The secrets to scale are underpriced, they are not public, and very few people have them.

"The people who are the best in the world at what they do aren't 2-3x better, they are quite literally 100-1000x better."

Who are out-of-distribution individuals?

Resumes are proxies for execution ability. Prior exits and founding employee status at outlier companies are the strongest signals we've found.

We believe the most talented people in the world were once unknown names. In a world of consensus investors, the most upside belongs to those willing to do the work finding talent before it becomes obvious in hindsight.

The founding engineer at Cursor operates with different odds than a 24-year-old first-time founder. The founding GTM person at Ramp possesses different capabilities than someone with only junior sales roles. Elite employment or prior exits serve as high-signal proxies for execution capability - not guarantees, but dramatically better odds.

Our pipeline reflects this, and 100% of tracked companies feature founders with either prior successful exits or were elite early performers at companies like Cursor, Decagon, Attio, ElevenLabs, Ramp, Notion, and others.

Part II: Chief capitalist

Identifying out-of-distribution individuals is only half the equation. The other half is being the type of investor they actually want on their cap table.

Being the "chief capitalist" requires an investment product that provides exactly what these types of individuals need at the moment we start to get involved.

From working closely with hundreds of stealth and pre-seed founders over the years, a few patterns have emerged.

Starting a company has never been easier, and the barriers to building product have collapsed. Cursor, Lovable, and Replit write code. AWS provides infrastructure. Stripe handles payments. Decagon handles support. Claude and OpenAI offer intelligence APIs.

Building is no longer the bottleneck. Getting people to care is.

"When these companies are just getting started, at least from my experience, they only care about three things:

1. Can you help them via distribution?

2. Can you help them hire people they need and otherwise wouldn't be able to hire?

3. Can you intro them to downstream capital who will not later become a distraction on the cap table?"

This informed how we designed the firm as an investment product.

We have tried to position the media business as a scalable asset that can be used in parallel to solve for the major bottlenecks we hear from stealth and pre-seed founders:

Distribution

Newsletter reach to 20,000+ high-signal readers. The ability to drive traffic, awareness, and inbound interest in perpetuity for the founders we work with.

Talent

Dedicated search infrastructure and access to hundreds of operators via the newsletter. Help founders hire people they otherwise couldn't.

Downstream capital

An ultra-curated list of capital connections who can write growth checks and will not become a distraction on the cap table.

Our goal with fund I is to have the highest helpfulness-to-check-size ratio on the cap table.

Part III: The simplified strategy

Here is how I have condensed the goal of Outlaw to new LPs:

Find the most talented founders

Underpriced individuals with a history of out-of-distribution execution ability.

Previously exited businesses, responsible for creating scale at companies reaching $100m ARR, and other signals of elite performance.

Building in the themes we care about

Artificial labor markets, the token revolution, Software 3.0, and the modernization of the private investment firm.

These four theses sit at the intersections of the macro investment themes we've identified. More on each in Part V below.

As early as possible

Average entry valuation of less than $12m.

We believe in the art of finding under-discovered talent. The most upside belongs to those willing to do the work before it becomes obvious.

Develop an investment product that meets their needs

Use the newsletter as scalable infrastructure to help founders build distribution, close hard-to-win talent, and find long-term capital partners. The media business is not separate from the fund; it is the fund's core competitive advantage.

The fund objective is to own 1.5% of a $5b business. Every decision we make (portfolio construction, follow-on strategy, types of founders we pursue, etc.) is in pursuit of that outcome.

Fund I at a glance:

Fund size | $10m |

|---|---|

# of positions | 40 |

Avg check | $150k |

Avg entry valuation | $12m |

Avg initial ownership | 1.25% |

Reserves | 20% |

Part IV: How the flywheel works

It is difficult to understand the fund strategy without first understanding the newsletter business, its purpose, who it attracts, and why I continue to write it.

The newsletter is the "front-end" for my thinking. It is a surface area expander that gives me scalable access to people and ideas I otherwise wouldn't come in contact with. Hard-to-meet people are attracted to writing, they proactively choose to give me their attention each week, and I have created unique ways to parlay that trust into deals that match the fund thesis.

The newsletter and the fund are interconnected, and each flywheel compliments the other.

Newsletter flywheel: ideas → content → audience → trust → opportunities

Fund functions: finding (heavily boosted by audience and opportunities created in fund flywheel), picking (improved with ideas strengthened judgement via writing), winning (improved as newsletter asset differentiates from other investors who provide capital only), and helping (talent pipeline, distribution-as-a-service, downstream capital available to portfolio)

Part V: Where we are investing

While the fund invests in founders rather than markets, we maintain active theses in four areas where we believe the next legacy-defining businesses will be built.

These theses are downstream from the broader investment themes I outlined earlier in this series, which themselves flow from a set of guiding philosophies about how the world works.

In the second essay, I laid out five macro themes shaping the world over the next decade. Below is how each thesis maps back to those themes.

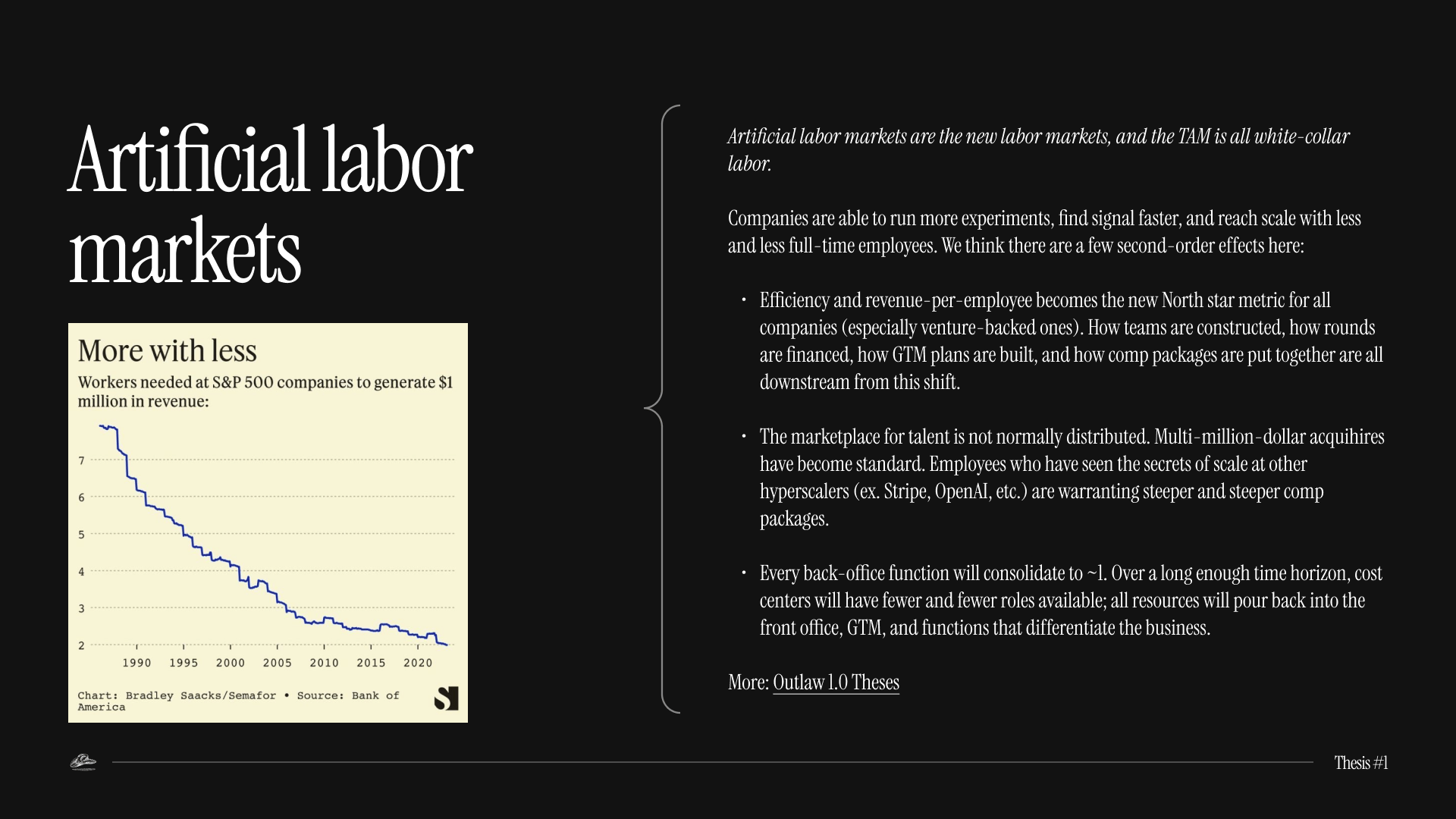

1. Artificial labor markets

"When a $500/month agent outperforms a $100k/year employee, hiring humans stops being an operational necessity and becomes a margin decision."

As I wrote in the themes essay, companies are operating fine with dramatically fewer people. Elon firing 80% of Twitter and the platform continuing to function was the mask-off moment. Every company realized they were carrying corporate bloat. 500,000 white-collar software workers are expected to be laid off over the next 2-3 years.

For artificial labor, the TAM is labor markets.

The pursuit of the 10-person billion-dollar company is no longer theoretical. The only way to reach the scale required for ~$100m ARR without a proportional headcount is by consolidating everything that doesn't differentiate: finance, accounting, support, HR, legal - these become AI + workflow + one person overseeing output.

Revenue-per-employee is becoming the new North Star metric. Companies like Midjourney ($500m revenue, 40 FTEs) and ElevenLabs ($100m revenue, 50 FTEs) are proving the model works today.

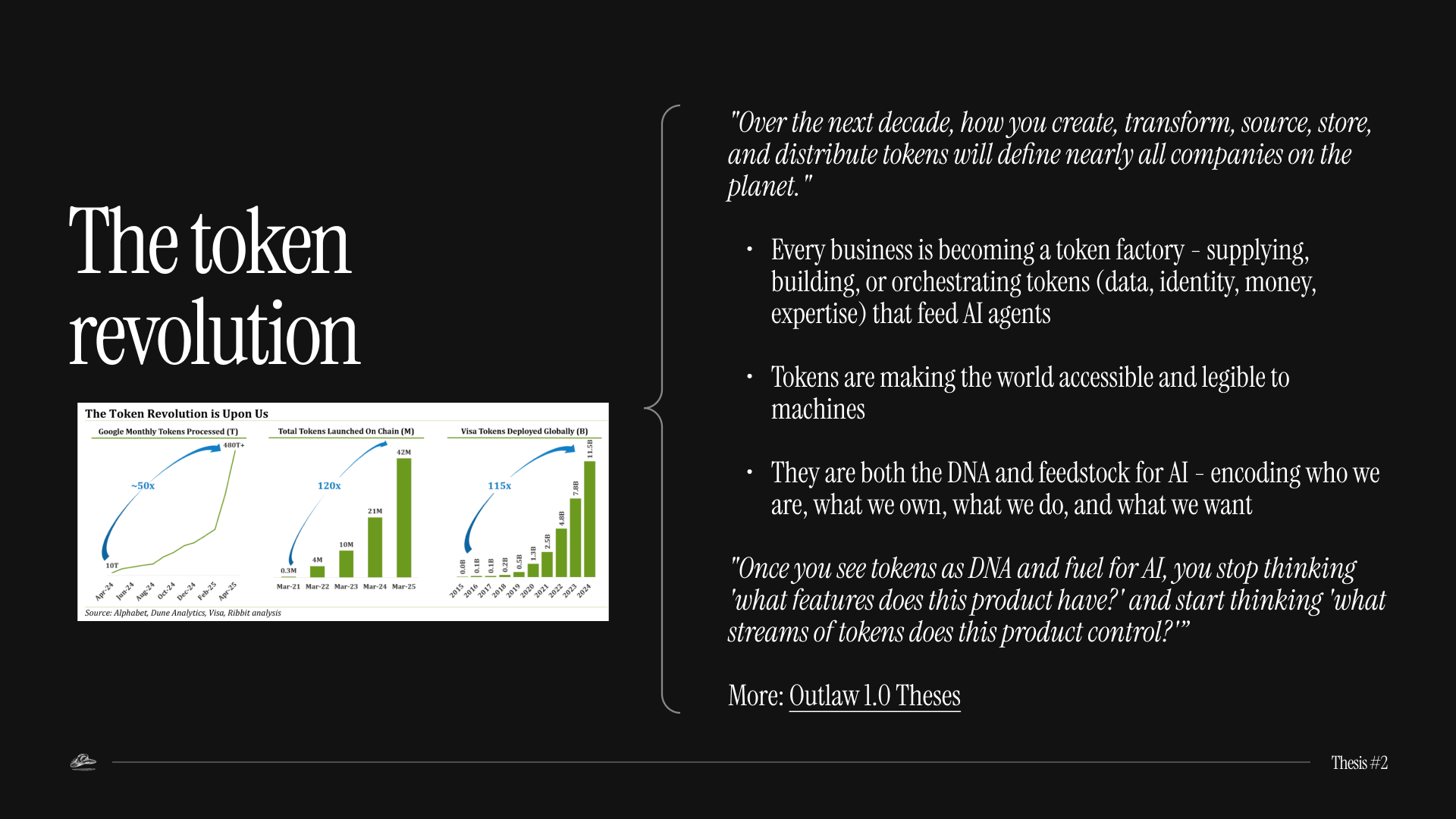

2. The token revolution

"Over the next decade, how you create, transform, source, store, and distribute tokens will define nearly all companies on the planet."

As more of the world economy transforms around intra-computer coordination, every company will need to answer the question of which part of the token factory they are servicing.

Every business is becoming a token factory - supplying, building, or orchestrating tokens (data, identity, money, expertise) that feed AI agents. Tokens are the DNA and feedstock for AI, encoding who we are, what we own, what we do, and what we want.

Three categories define the space:

tokens for value (how machines store and transfer financial resources)

tokens for expertise (how machines learn to do what humans do

tokens for personalization (how machines learn about individuals).

Every software business can be modeled as supplying, building, or managing token factories, and the companies that control the most valuable token streams will define the next era.

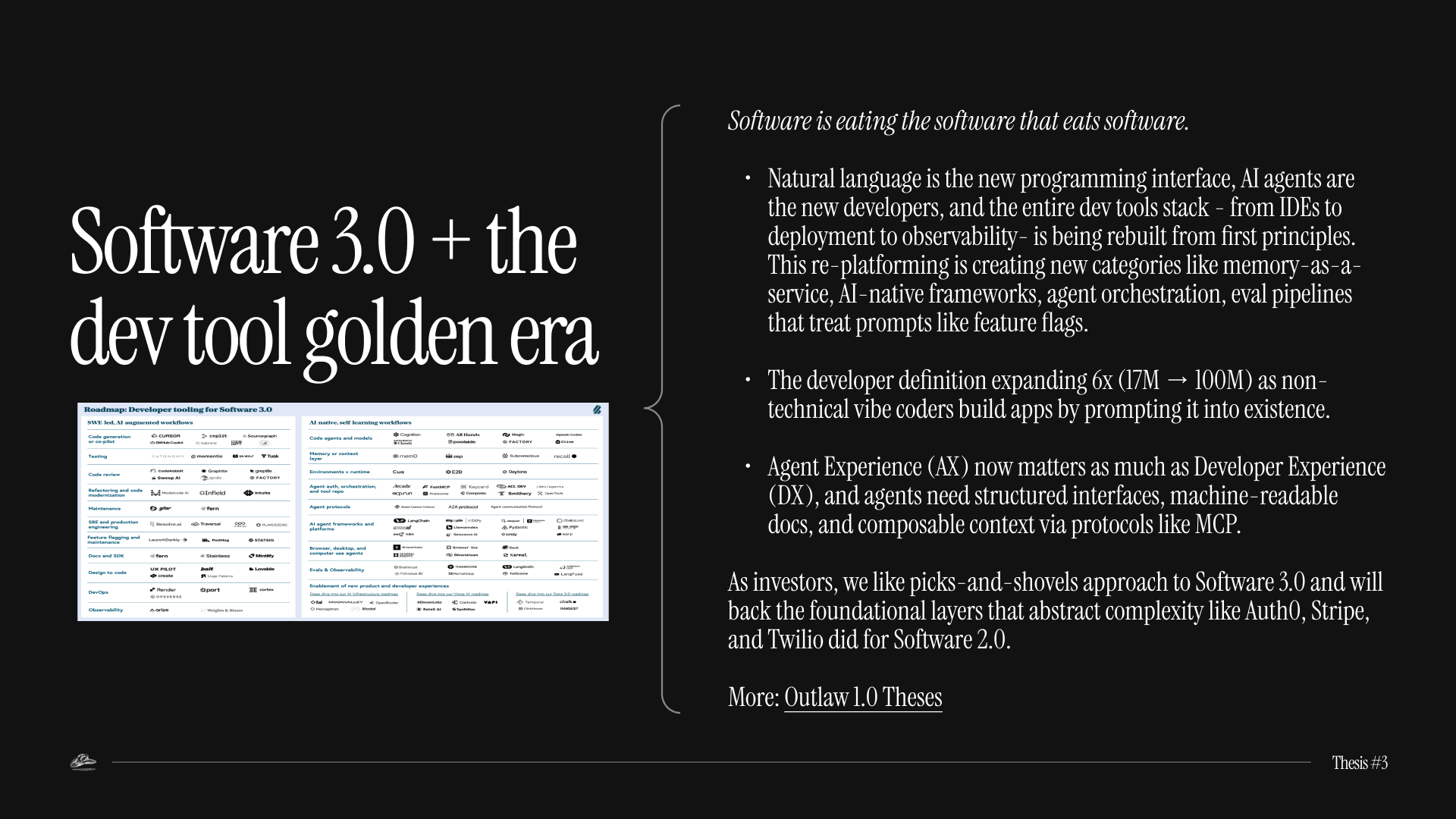

3. Software 3.0 + the dev tool golden era

"Software is eating the software that eats software."

We are in the middle of a generational re-platforming of the dev tools stack.

Software 1.0 was handcrafted logic.

Software 2.0 was earned systems - neural networks trained on data, emergent logic that scales with compute rather than humans.

Software 3.0 is generative and self-improving - LLMs produce code, design models, and orchestrate systems with minimal human intervention.

The entire dev tools stack is being rebuilt from first principles.

Like Auth0 eliminated months of authentication work and Stripe abstracted payment complexity, Software 3.0 needs equivalent foundational layers for AI-native development. The definition of "developer" is expanding dramatically - from 17m JavaScript developers today to a projected 100m in the next decade.

We like the picks-and-shovels approach: the platforms and tooling that enable this new generation of builders to create without writing code.

4. Modernization of the private investment firm

"Private markets are having their Bloomberg Terminal moment."

The private markets in 2026 are at a similar inflection point as traditional finance was in 1984, when Bloomberg arrived to provide real-time data, instant calculations, and all bond info in one place.

If you look under the hood at different funds today, you will see a massive gap in the sophistication of their workflows. The best funds operate more like software firms than financial services businesses, and there is a high correlation between firms who have rebuilt modern workflows and firms who have distributed capital and been able to raise fresh funds.

We think the companies building the infrastructure for this transformation - the AI-native tools for deal sourcing, portfolio monitoring, LP reporting, and fund operations — will capture an enormous market.

These theses inform sourcing (content attracts founders building in these areas) and selection (pattern recognition for quality founders in these domains), but they don't constrain opportunistic investing outside these areas when exceptional founders appear.

For a deeper breakdown of each thesis, including the companies we are studying in each category, read the full investment theses essay.

Fund updates

Thanks for following along as I document how I think about early-stage investing and the frameworks that have lead me through firm building.

For those of you curious about Outlaw, I have included more below.

Thesis

Chief capitalist to out-of-distribution individuals.

We are pursuing 1.5% of a $5b business. Every decision centers around the pursuit of finding the founders capable of this type of scale, owning as much of their company as we can, and building a scalable investment product that acts as an extension of their business.

We believe in the art of finding under-discovered talent. The most talented people in the world were once unknown names. We believe the most upside belongs to those willing to do the work identifying talent before it becomes obvious in hindsight.

We believe in building the infrastructure for pre-seed bottlenecks. The firm is built on top of a larger media business that creates a scalable asset to be used by founders to build distribution, close hard-to-win talent, and find long-term capital partners.

For those of you looking to get more involved, I’m happy to chat.

My calendar is linked.

Thanks for reading this far and giving us a little bit of your attention this week. Feel free to unsubscribe whenever this stops becoming valuable to you.